Ready To Stake ETH? How To Make Money On Ethereum 2.0

Ethereum 2.0 will introduce staking rewards in November 2020.

Share this article

Ethereum 2.0 is scheduled to go live in November 2020, and one of the first features that it will introduce is proof-of-stake. This will give Ethereum coinholders a way to earn returns on their ETH investment.

The Basics of Staking

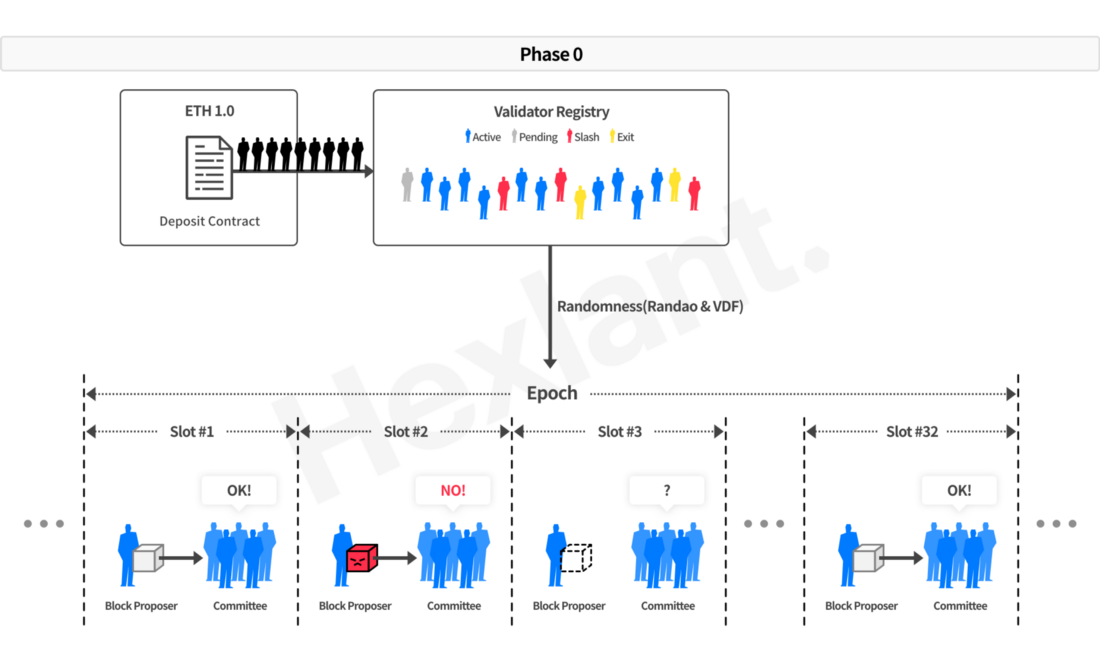

In order to begin staking on Ethereum 2.0, you’ll need to run a validator node and lock up your ETH tokens in a deposit. This will allow you to participate in block creation: validator nodes will be selected to vote on new blocks semi-randomly. Other validators will then agree on the result to reach consensus.

Proof-of-stake will serve the same function that mining currently serves, but it will offer several advantages: it is arguably more secure and decentralized than mining, and it will help the Ethereum blockchain scale up and handle transactions more efficiently.

You will still be able to mine on Ethereum 1.0 after staking goes live, but mining rewards will fall gradually. In fact, this is already happening: 2019’s Constantinople upgrade cut mining rewards significantly. Since then, Drake has suggested that mining rewards (ie. token issuance) be reduced tenfold in the coming years – though this will ultimately depend on the price of ETH.

What You’ll Need To Start Staking

You’ll need at least 32 ETH if you want to stake on Ethereum 2.0. That amount is worth about $12,000 as of August 2020; small investors should join a staking pool instead.

You do not need a powerful computer to stake ETH, and ASIC devices provide no advantage. Most consumer-grade laptops, or even a Raspberry Pi, will be able to support at least one validator slot.

You will, however, need to stay online consistently and be available to validate blocks. You will need some technical knowledge in order to run Ethereum’s node software. Somer Esat provides step-by-step instructions on how to run a testnet node on this page.

Validators will need to wait at least 18 hours to withdraw their ETH, assuming there is no queue. Naturally, most validators will stake their ETH for much longer than than that.

Ethereum 2.0 will use disincentives in order to maintain integrity and security. Small “penalties” will incentivize validators to stay online. “Slashing,” meanwhile, is a separate process that will take away a portion of a validator’s stake and force them off of the network – but this is directed towards malicious validators.

How Much Can You Earn By Staking?

It is not yet clear how much investors will be able to earn by staking.

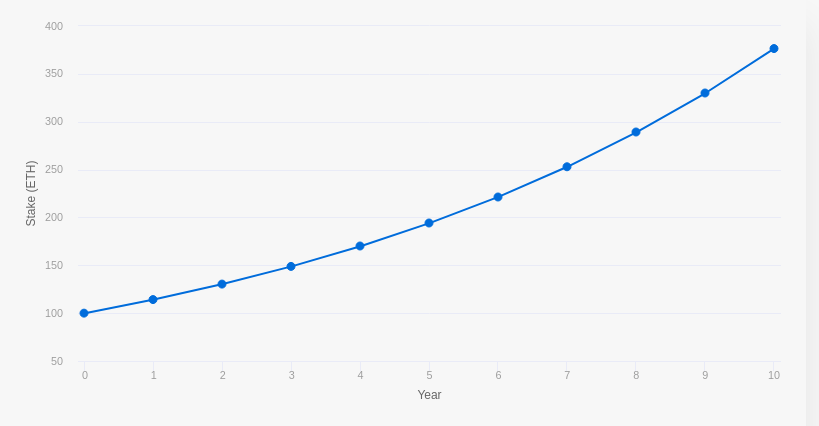

Ethereum creator Vitalik Buterin recently proposed setting annual returns between 1.5% and 18%, depending on how much ETH is staked across the entire network. Justin Drake, a lead developer, suggests aiming for a 5% return rate for validators. He also notes that annual returns will include gas returns as well as inflation.

Market prices will influence profitability as well: validators may earn a certain amount of ETH, but that ETH could be worth much more or much less than expected depending on market conditions.

Whatever interest rate staking ultimately produces, those interest rates will increase if you stake ETH for a longer period of time.

Simple Staking for General Users

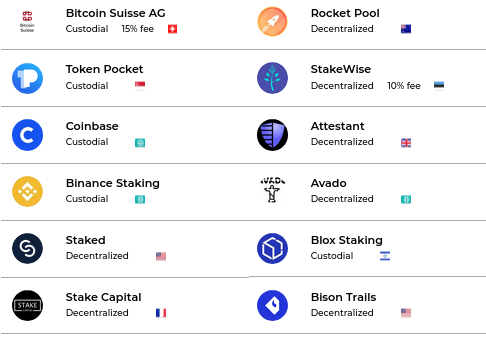

If you don’t want to go to the trouble of running a validator node, you can stake with a stake pool such as RocketPool, which will manage staking on your behalf. For a small fee, you won’t need to run software or stay online, and you can stake as little as 0.01 ETH (~$5).

You can even stake your ETH with RocketPool before Ethereum 2.0 goes live. Right now, you will earn placeholder tokens (rETH), which can be sold or traded for other coins. When Ethereum 2.0 goes live, you will be able to “burn” the token for standard ETH.

Several other staking pools or staking services also exist; decentralized options give you more control over your cryptocurrency.

Other types of investing such as yield farming and crypto lending provide alternative ways to earn interest on your Ethereum holdings. These are unrelated to Ethereum 2.0’s proof-of-stake system, but you will nevertheless need to “stake” your crypto in a contract.

When You’ll Be Able To Start Staking

You’ll be able to begin staking ETH in November 2020. That’s when Ethereum 2.0’s beacon chain, aka “phase 0,” will go live. If you want to use “play money” (valueless testnet ETH) you can already take staking for a test drive on the Medalla testnet.

Initially, Ethereum 1.0 and 2.0 will work in parallel. During phase 0, you’ll be able to migrate ETH tokens to the Ethereum 2.0 “beacon chain,” which will handle staking exclusively. During phase 0, Ethereum 1.0 will handle non-staking activity, including transaction activity and smart contract activity.

Ethereum 2.0 is a multi-year project. But even as staking is introduced, it will not replace the old system entirely. “Mining will likely end at some point,” Drake tells Crypto Briefing. “Eth1 will likely never be discontinued, unless the community clearly favors that.”

Share this article