2024 is the year for Bitcoin, gold, and silver, Bitfinex’s Head of Derivatives predicts

Macro movements, such as modest earnings growth and geopolitical risks, might pose some challenges for stock markets, benefiting safe-haven assets.

2024 will likely be a “decent year for safe-haven assets”, such as Bitcoin, gold, and silver, according to Jag Kooner, Head of Derivatives at Bitfinex. In a commentary sent to Crypto Briefing, Kooner shares his belief that the persistent inflation levels, remaining above the comfort zones of central banks around the world, are anticipated to result in a prolonged period of higher interest rates.

This could result in a delay in easing of monetary policies in developed markets, which may lead to some disappointment among investors. Moreover, Kooner points out that stock markets might face some challenges over the next months.

“Factors such as modest earnings growth and various geopolitical risks are expected to exert downward pressure on stock markets. Some research suggests modest earnings growth for the S&P 500, in the range of 2–3% and a target of 4,200 for the index, with a downside bias. This aligns with our view and we believe will result in more demand for commodities and Bitcoin.”

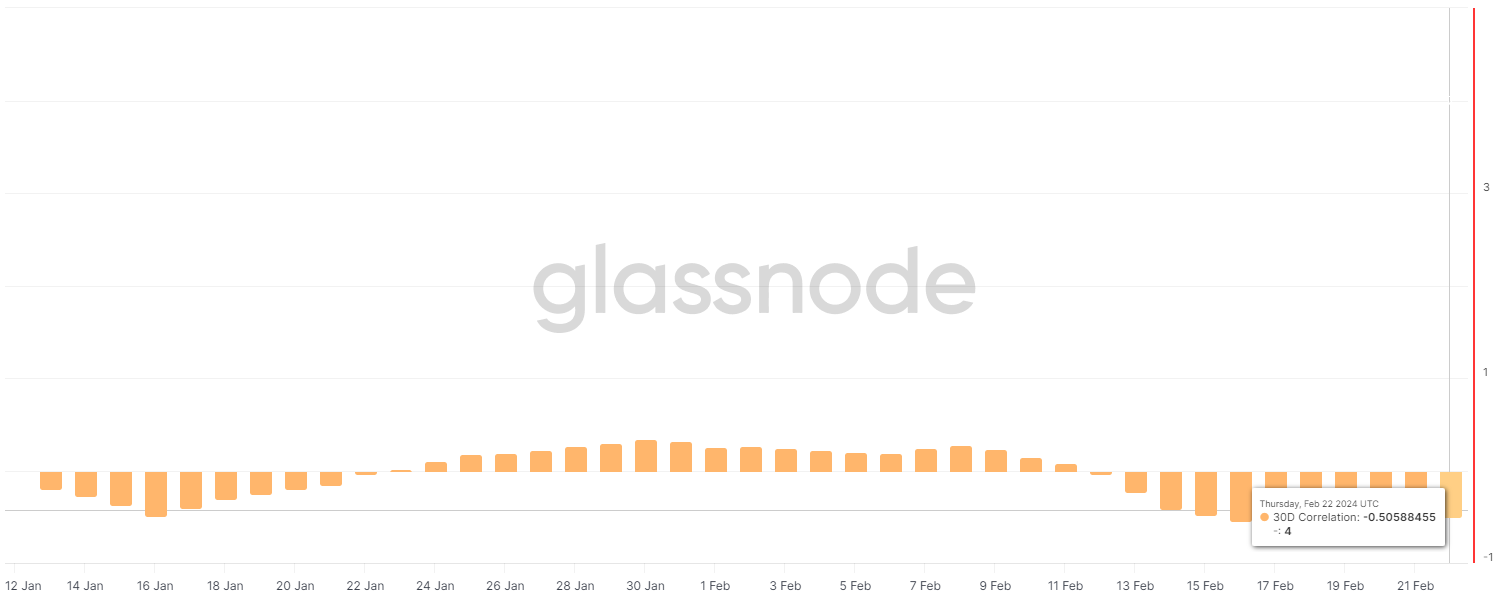

However, the correlation between Bitcoin and gold has been negative in the last 30 days, according to on-chain data platform Glassnode. On Feb. 22, the pair shared a negative correlation of 0.5, where 1 is fully correlated and -1 is the absence of any correlation.

If Kooner’s prediction comes true, the data corroborating it might start showing over the next weeks.