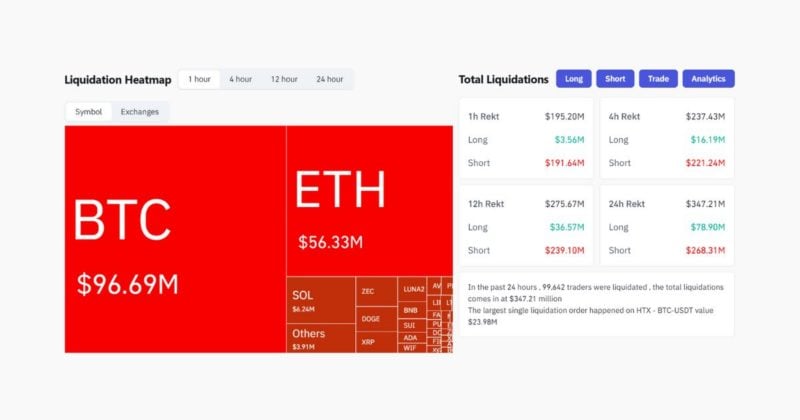

Over $190M in crypto shorts liquidated in last hour amid Bitcoin rally

Leveraged traders face steep losses as rapid market swings amplify volatility and trigger widespread forced closures across major digital assets.

Crypto markets witnessed over $190 million in short position liquidations within a single hour as Bitcoin surged higher, forcing automatic closure of leveraged bets against the leading digital asset.

The liquidation wave struck traders who had positioned themselves against Bitcoin’s price movement, with forced sell-offs triggered when the cryptocurrency’s rally pushed past key technical levels. Short liquidations occur when Bitcoin’s price rises beyond the margin requirements of leveraged positions, automatically closing out the trades.

Crypto markets have shown increased volatility from heavy positioning on both sides, raising the likelihood of liquidation cascades when prices move sharply in either direction. These forced closures of leveraged positions create automatic sell-offs that can amplify market movements across assets like Bitcoin and Ethereum.

Bitcoin is currently trading around $94,000, rising 4% over the past 24 hours, according to CoinGecko.

Earn with Nexo

Earn with Nexo