The Freedom of Money: A Fundamental Right

For what is freedom without money in your pocket?

Key Takeaways

- This Independence Day we reflect on the first and most influential right the American Founders fought for—the right to control their own money.

- Having access to money is essential to living freely, and controlling the money supply is the stuff of authoritarianism.

- Crypto proponents believe that blockchain provides the sovereign money we've been hoping for, and with any luck they may be right.

Share this article

For our readers in the States, I hope you’ve enjoyed Independence Day with friends and family. Maybe some of you took time to reflect on the purported ideals of this nation, where we fall short of them, and how we can nurture their virtues while mitigating their shortcomings.

I, for one, was thinking about money.

Hands Off Our Cash

I find myself thinking about crypto today, not because it’s an especially American topic but because its proponents appeal to many of the same ideals that Americans—and the rest of the liberal-democratic world order—hold dear. Among these ideals are self-sovereignty, freedom from the government meddling in our affairs, and the right to personal liberties.

It’s fashionable to talk about freedom in terms of race and gender equality, equal access to justice, and the power to vote. But all that overlooks the more fundamental freedom that had the most profound influence over the founding of this nation—the freedom to have money, and to do what you want with it.

During the Constitutional debates of 1787, it was widely agreed that rights ought to be afforded to “the People,” but a quick glance at the historical record reveals a very different worldview about who ought to be included in that group. In one particular oratory dated Jun. 25 of that year, Mr. Charles Pinckney of South Carolina divided “the People” into three distinct groups and was met with no objection. These were: 1) “Professional men”; 2) “Commercial men”; and 3) “The landed interest” (See Robert Yates, Secret Proceedings and Debates of the Convention Assembled at Philadelphia in 1787).

Nowhere were paupers or women mentioned; enslaved peoples were made to count as three-fifths of a human being, and the indigenous populations were ignored entirely. No, “the People,” in Pinckney’s eyes, were clearly definable. They were folks with money.

That’s because having money is the closest thing to having freedom as any society truly affords. The right to make money—and the right to do what one wants with it—is, historically, more American than any other ideal. The colonial reaction to the insufferable acts of King George and his Parliament regarding taxation, tariffs, shipping rights, and free trade all came back to one thing: keep your hands off our money.

A similar specter haunts the crypto world, as governments grapple with how to regulate non-custodial wallets, how to classify digital assets within traditional frameworks, and of course, how to tax them. Some, notably China, have introduced the outright dystopian concept of a government-controlled central bank digital currency, granting themselves virtually unlimited power over who buys and sells, which transactions are acceptable (and which are not), and to determine who gets to participate in the economy at all. As western nations also explore CBDCs, it’s not surprising that many people are getting nervous.

Authoritarian governments have always relied on either controlling the money or being tight-knit with those who do. Ever since Mesopotamian priests started stockpiling silver reserves in temples to control the money supply, the playbook has been the same: you can have as much power as you want, so long as you can afford it.

Blockchain proponents argue that crypto solves all of that, and while it still has growing pains to get through, its promise to eliminate the need for overlords who control how money works is obvious. That control is clearly centralized at best and, at worst, outright fascist.

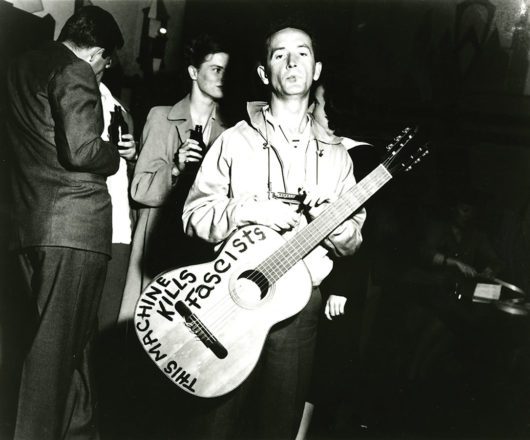

The American folk singer Woody Guthrie, who was among the primary influences on the protest singers of the 1960s and beyond, famously scrawled the words “THIS MACHINE KILLS FASCISTS” across his guitar to make a powerful point. The idea was simple: get a life-changing message in front of as many people as possible, and let their hearts and minds do the rest. Guthrie’s tunes were anthems of freedom and, in many real ways, decentralization of power.

“This machine kills fascists” would have been a worthy epigram for the Bitcoin whitepaper and wouldn’t be out of place in the Ethereum documentation section, either. Like Guthrie’s guitar, cryptocurrency on its own is just a barren tool without a knowledgeable player who knows how to use it: these are not panaceas that are going to solve all our problems simply by existing, but with proper narrativization and a few good users, their potential to persuade people to change the world for the better is apparent.

Controlling the economy is an endgame for fascism: if you control the money, you control the people who rely on it. Crypto changes all of that. Bitcoin broke the mold with the sheer genius of its innovation, and Ethereum took things a step further with its focus on human-usable applications. These innovations, which place money firmly within the control of its owners, are foundational building blocks of the decentralization movement and will likely be absolutely vital to it. For precisely that reason there are still those who would reign the space back in; whether or not that’s even possible, however, remains to be seen.

Happy Fourth, all.

Disclosure: At the time of writing, the author of this piece owned BTC, ETH, and several other cryptocurrencies.

Share this article