An Introduction to Tokenomics

Understanding the design of a project's tokenomics is key to finding out its long-term value.

When investing in crypto, it’s important to understand tokenomics to make informed decisions and avoid getting rekt.

Tokenomics comes from combining the words token and economics and is a field that studies the factors that drive demand for tokens. One has to consider factors such as supply and demand, incentive mechanisms, value accrual, and investor behavior when analyzing a project’s tokenomics.

An Analysis of Supply and Demand

The dynamics between supply and demand are the first things to analyze when a project issues a new token.

An excess of supply can negatively affect an asset’s value. We can find examples in fiat currencies that have suffered from hyperinflation and excessive printing (e.g., the Zimbabwean dollar or the Venezuelan Bolivar).

The same happens in crypto. You wouldn’t feel great if the running supply of the token you’ve just bought is only 30%. That means the supply has yet to increase by another 70%, potentially diluting the price and losing value.

In this context, it’s important to know what Fully Diluted Valuation (FDV) is. FDV is the price of a token multiplied by the total amount that will ever be in existence, including tokens not yet in circulation. The metric is used to measure if the token is overvalued or undervalued.

If a project has a high FDV during its early days, you want to ask yourself who the major token holders are, at what price they bought their bags, and to whom they will sell them.

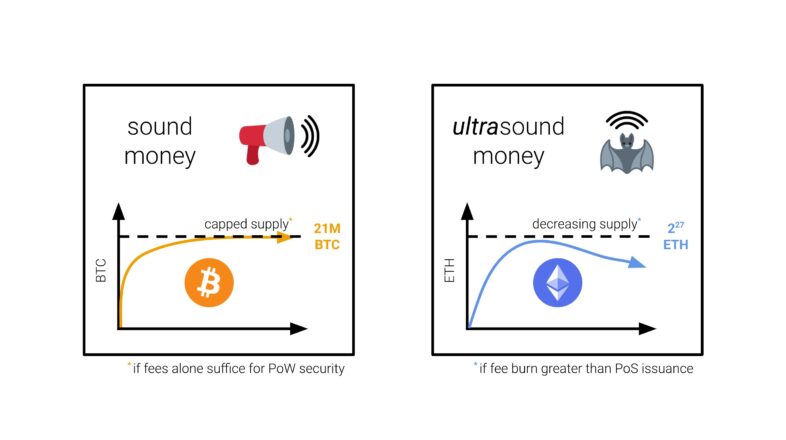

An uncapped supply is not suitable for the value of a token either. Tokens like Bitcoin are hard capped, meaning that once the protocol has issued all its tokens, the value will continue increasing as long as there is demand.

To keep a balance between supply and demand, some tokens feature fee-burning mechanisms that can cause the token to become deflationary depending on how widely the network is used. Ethereum, after the implementation of EIP 1559, is an example of such a mechanism.

Other tokens include buyback and burn mechanisms to designed to regulate supply and demand. Such is the case for the BNB token.

Another important element to analyze is supply relative to market capitalization. If a token has a value of $0.002 and its market cap is around $600,000, have you ever thought what the market cap would be if the price increased to $0.50?

Misperceiving a token’s price relative to its market cap can lead to unit bias. This term describes the belief that holding more units of a less valuable coin will deliver better investment results than holding a fraction of a highly valued coin. This is, in part, why meme coins have been so popular in recent times. Think of holding 10,000 dog coins vs. ⅕ of a BTC—one sounds better than the other, but only if you don’t pay attention to the prices.

On the other side, we have demand. Demand is what drives people to buy a token and how much they pay for it. Demand is generally driven by the token utility, growth in value, and narratives.

Tokens like Ethereum or BNB derive their utility from being used as a currency to execute software on these networks. Whether it’s to approve a listing of an NFT collection or remove your tokens from a liquidity pool, you’ll need the native cryptocurrency of these blockchains to pay for so-called gas (execution) fees.

Another use case that increases token utility is when these assets are used as a means of exchange for products and services in the real world, like a restaurant accepting crypto in exchange for menu items.

Regarding value accrual, staking is a trait of many tokens that fuels demand and helps increase the price. When users stake their crypto looking for rewards, many circulating tokens get locked, decreasing sell pressure.

Protocols aim to find ways to incentivize long-term holding. We see an example in veTokens (ve=vote escrow), a system that gives voting power to long-term holders. DeFi protocols often establish votes to decide which pools get the most rewards in an attempt to attract liquidity. Your vote carries more weight if you hold a large amount of a protocol’s governance tokens.

Some protocols even go as far to penalize unstaking by taking away users’ veTokens to cause less sell pressure.

Lastly, tokens can increase in value thanks to having strong narratives or memes. Think of the dog coin frenzies in October 2021. Many NFT projects came to life as pure speculative memes with utility from their usage as profile pics.

With time, projects like JPEG’d are coming up with new ways to blend the world of NFTs with DeFi expanding their utility.

While understanding tokenomics is fundamental to understanding investment decisions in crypto, it’s not the all-important element. Narratives can also create excitement or apathy towards a token, influencing its price.

Phemex, one of the leading cryptocurrency exchanges in the industry, carefully evaluates each token’s economic model before listing on the platform. For example, the exchange offers high staking rewards from the special features of a list of projects that have undergone deep tokenomics analysis. You can learn more about these projects by visiting the Phemex Launchpool site.

Earn with Nexo

Earn with Nexo