Anchorage’s Maker Voting System To Give Institutions Say On Stability Fees

Custodial solutions designed with voters in mind.

Decentralized governance has faced a series of teething problems: hackers can exploit loopholes in the codebase; community agendas can be hijacked by a vocal minority of trolls and spammers; many on-chain initiatives suffer from rock bottom voter turnouts.

But with the news institutional custodial provider Anchorage is launching its own on-chain voting solution for Maker (MKR) holders, some of the infrastructure required for a stable and long-term decentralized governance is being constructed.

Anchorage Governance will allow institutional clients to fully and securely participate in the on-chain MKR voting mechanism without taking tokens out of cold-storage.

“Until now, institutional investors have lacked a sufficiently secure means of participating in Maker votes,” said Nathan McCauley, Anchorage co-founder and CEO.

Kevin Yedid-Botton, Principal at ParaFi Capital said: “Anchorage is advancing institutional participation across the board, and now offers a seamless user experience for secure on-chain Maker governance.”

Looking forward, the integration means Anchorage clients will now be able to contribute and vote on subsequent executive votes, decisions that will ultimately determine the project’s direction. That will include setting the stability fee, the interest CDP holders pay to the network, as well as the multi-collateral DAI proposal in the middle of November.

Institutional Custody Plus Governance

Anchorage isn’t the only institutional custodial provider offering MKR holders an off-chain voting solution: rival Coinbase Custody unveiled its own Maker governance system earlier this month that allows clients to vote by proxy without taking tokens out of cold storage.

The main difference between the two providers is that Anchorage allows on-chain participation by being integrated directly into the Maker voting contracts. That makes it more secure than Coinbase Custody, where assets are held in a hot wallet until the vote is completed, leaving them vulnerable to a hack.

MakerDAO’s founder, Rune Christensen, said: “Institutional custodians must enable safe and simple participation.” With its secure voting mechanism, “Anchorage has done exactly that”.

By providing another route for token holders to vote, the integration will hopefully ensure quorum is reached for each executive decision. Maker has long-suffered from poor voter engagement. Back in May, a crucial decision on decreasing the stability fee to improve DAI’s peg to USD was temporarily postponed after not enough MKR was staked for the decision to pass.

But Anchorage also believes that by providing a secure voting solution to those with the largest MKR holdings, they are not only improving voter turnout but aligning incentives: those taking future decisions have the most skin in the game. It is in their best interests for the network to succeed and thrive, and they will vote accordingly.

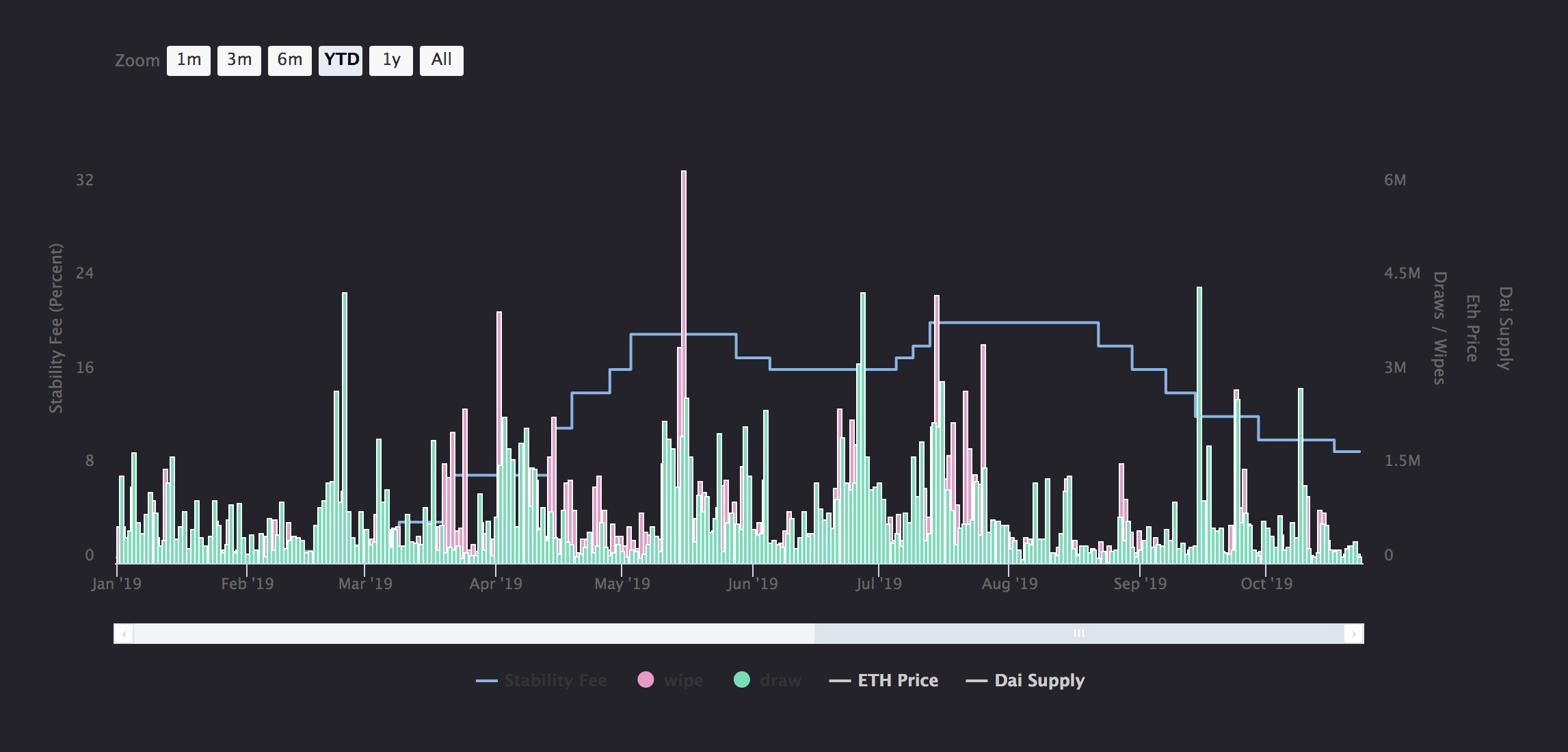

That may mean the stability fee may become a little bit more…stable. As the graph below shows, the fee has already surpassed 20% on two separate occasions as the community attempted to maintain a stable dollar-peg for Dai.

Although the stability fee is now back down to 9.5%, it is still multiples higher than the 0.5% it had stayed at until the start of 2019.

CDP holders can pay fees in MKR, which is subsequently destroyed, meaning that a high stability fee can lead to a rapid drop in circulation which could then affect its market value.

Anchorage believes their new voting mechanism will ensure institutions who hold MKR will have a fiduciary incentive to act in the best interests of the broader network, but it’s unclear what would stop them from maintaining a higher stability fee so as to increase scarcity and improve the MKR price.