Bitwise files for Aptos ETF via Delaware trust, prepares for SEC registration

Bitwise explores new crypto investment avenues beyond Bitcoin and Ether.

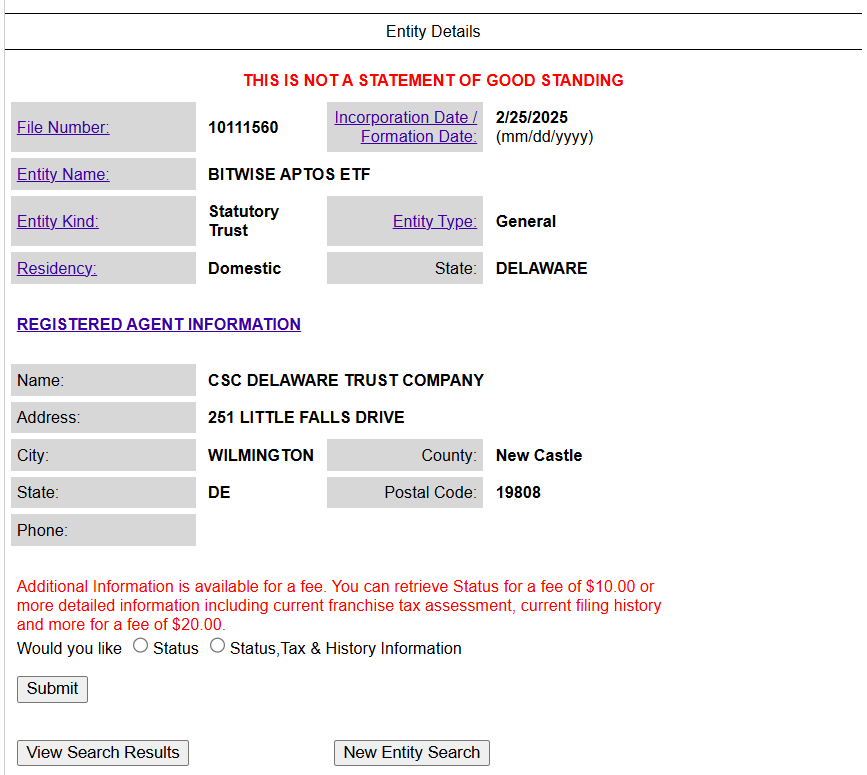

Bitwise Asset Management has filed to establish a Delaware trust entity for a proposed Aptos exchange-traded fund, marking an initial step before formal SEC registration.

The filing positions Bitwise as the first asset manager pursuing an investment product directly holding APT tokens in the US. Aptos currently ranks as the 36th largest crypto asset by market capitalization, according to CoinGecko.

The move comes amid a broader expansion of crypto ETF applications beyond Bitcoin and Ethereum, with asset managers now pursuing funds for XRP, Solana, Dogecoin, Cardano, Litecoin, and HBAR.

This is a developing story.