Source | Delta Exchange crosses $4 billion valuation in daily trading volumes

Automate your crypto F&O trading with Delta Exchange’s trading bots

Delta Exchange recently crossed $4 billion in daily trading volume, which says a lot about how active the crypto derivatives market is right now. As interest in crypto F&O (futures and options) trading grows, particularly among Indian traders, automated tools like trading bots are playing a major role in shaping strategies and improving trade execution speed.

With seamless webhook integration and real-time automation, Delta is leading this shift by offering traders a more efficient way to participate in the high-volume, high-frequency crypto derivatives market.

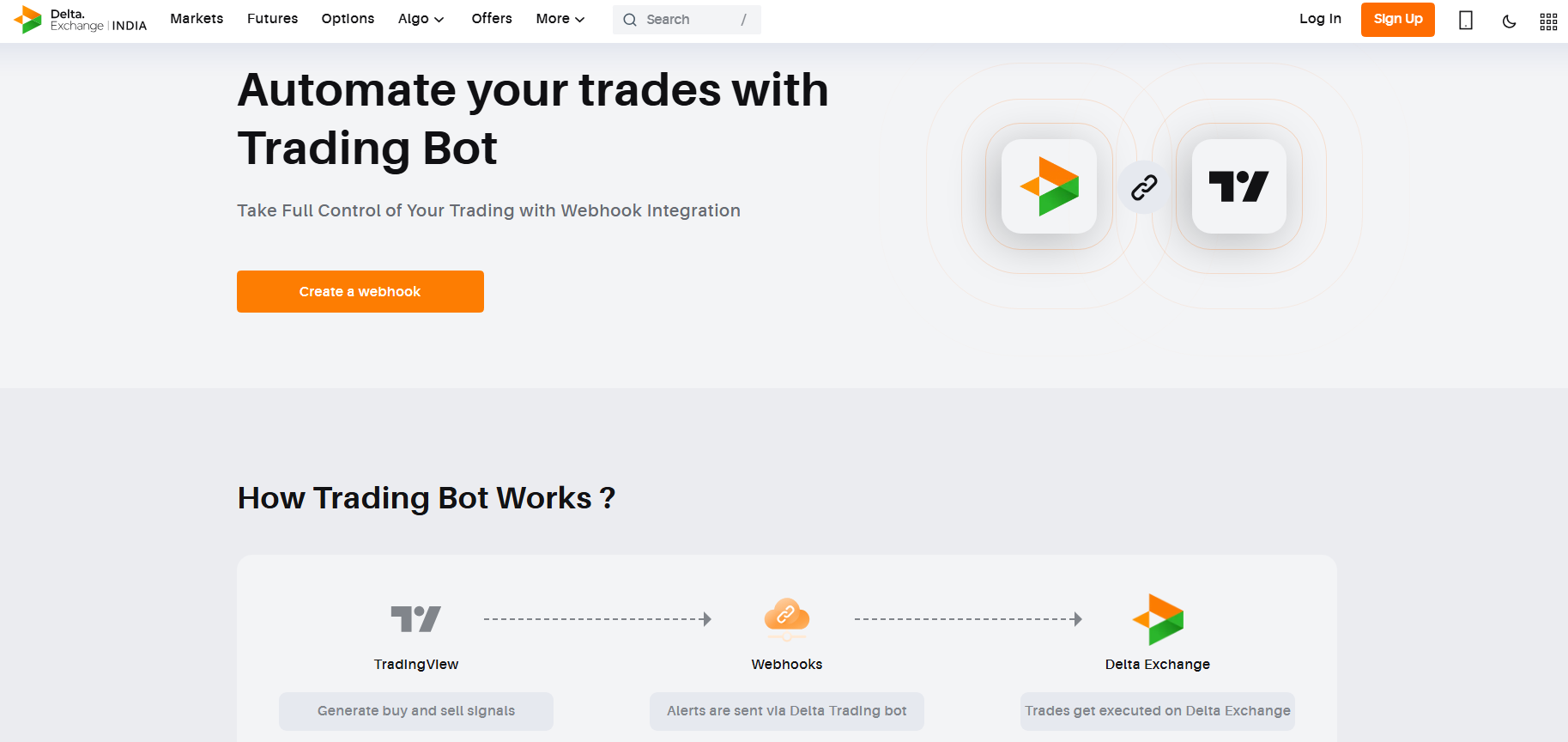

Automated trading bots streamlining crypto F&O strategies

Trading bots on Delta Exchange are making it much easier for traders to automate their crypto F&O strategies. The process is straightforward – traders must set up their buy and sell signals on TradingView, connect those signals to Delta using a webhook, and the bot takes care of the rest. Once everything is linked, trades are executed automatically – no need to keep an eye on the screen all day or worry about missing out on market opportunities.

Some unique features and benefits of Delta’s trading bot include:

- No coding required: Traders can automate complex strategies without writing a single line of code.

- Customizable: Traders can add alerts based on their preferred indicators, strategies, or even trend lines.

- Instant execution: Orders are placed in real time, so there’s minimal delay between the trade signal and the actual trade.

- Supports multiple assets: Whether it’s BTC, ETH, or other altcoin contracts, Delta’s trading bot covers a wide range of crypto assets.

- Security and safety: The webhook URL is heavily encrypted and protected from unauthorized access.

Why are people choosing Delta Exchange?

With the increased crypto F&O trading in India, people are seeking more secure, regulated, and easily accessible platforms like Delta Exchange. With a wide range of crypto F&O in one place, traders can easily navigate and get real-time insights on market fluctuations. The INR settlements make it convenient for traders to participate in the crypto market without the hassle of currency conversions.

Delta makes it convenient to trade on the go with its mobile app, available on both Android and iOS devices.

With advanced and automated trading bots, a daily trading volume of $4 billion, and 24/7 open markets, Delta Exchange is becoming one of the go-to choices for both beginners and experienced crypto traders in India.

For more updates, visit www.delta.exchange. Follow the community on X to know all the latest insights.

Disclaimer: The cryptocurrency or crypto derivatives markets are inherently volatile. Do your own risk assessment and research before crypto F&O trading.