Banking giant Barclays to block all crypto transactions on credit cards over debt and fraud concerns

According to a recent SEC filing, the bank is backing BlackRock’s Bitcoin ETF with a $131 million investment.

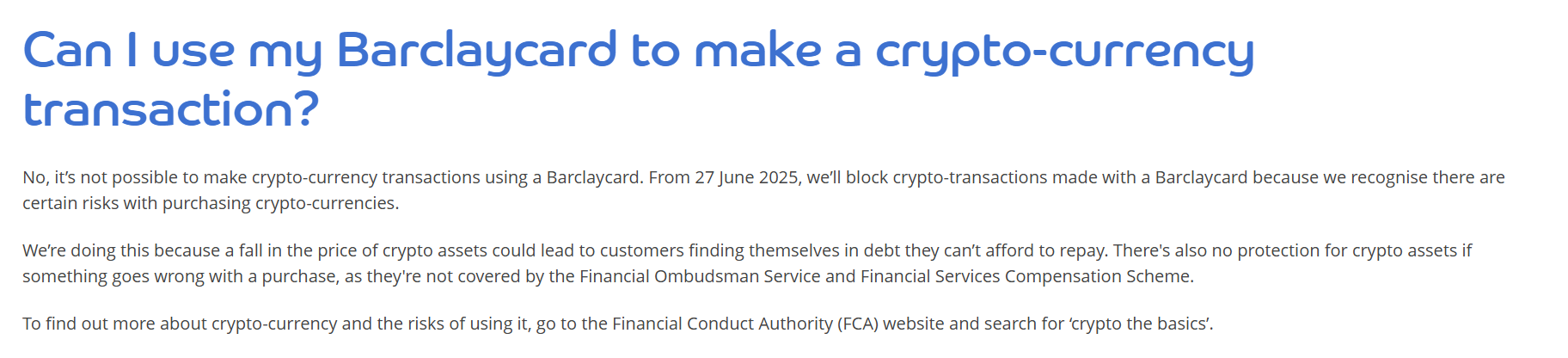

British banking giant Barclays will stop processing crypto transactions on its credit cards starting Friday, June 27, according to a notice published on its official website.

The bank cites concerns over financial risk to customers, warning that falling crypto prices could lead to debt that people can’t repay. It also notes that crypto assets are not protected by the Financial Ombudsman Service or the Financial Services Compensation Scheme.

Barclays is joining other major lenders, including Lloyds, Virgin Money, JPMorgan, and Citigroup, in restricting crypto purchases on credit. The bank said it is reviewing its policy by country.

Barclays is a holder of Bitcoin ETFs. In its latest SEC 13F filing, the bank disclosed that it acquired 2,473,064 shares of BlackRock’s iShares Bitcoin Trust (IBIT), valued at approximately $131 million as of December 31.

Earn with Nexo

Earn with Nexo