Photo credit

Photo credit

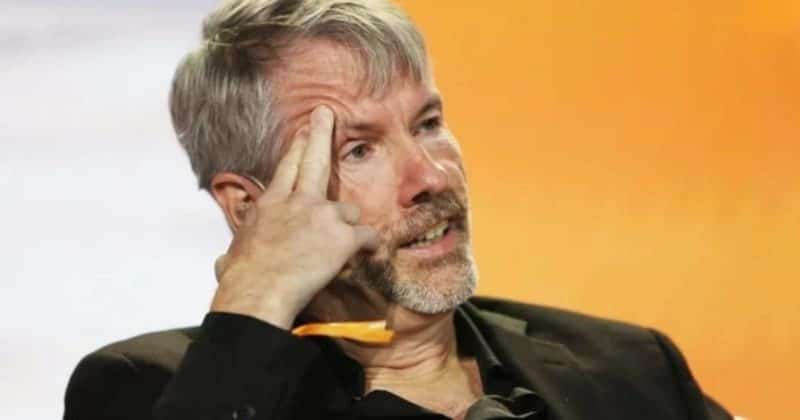

Saylor’s Strategy sees over $9B loss as Bitcoin drops toward $63K

The significant paper loss highlights the volatility and risk associated with large-scale corporate investments in cryptocurrencies.