Strategy hits 600,000 BTC milestone as accumulation resumes

Robust stock sales fuel company’s record digital asset accumulation as financing capacity remains strong for future purchases.

Michael Saylor’s Strategy has resumed its Bitcoin buying after a brief pause, pushing its total holdings to the 600,000 BTC milestone. The move further cements the company’s position as the largest corporate holder of Bitcoin.

According to a new SEC disclosure, the latest purchase came between July 7 and 13, when the firm added 4,225 BTC for approximately $472 million at an average price of $111,827 per coin, including fees.

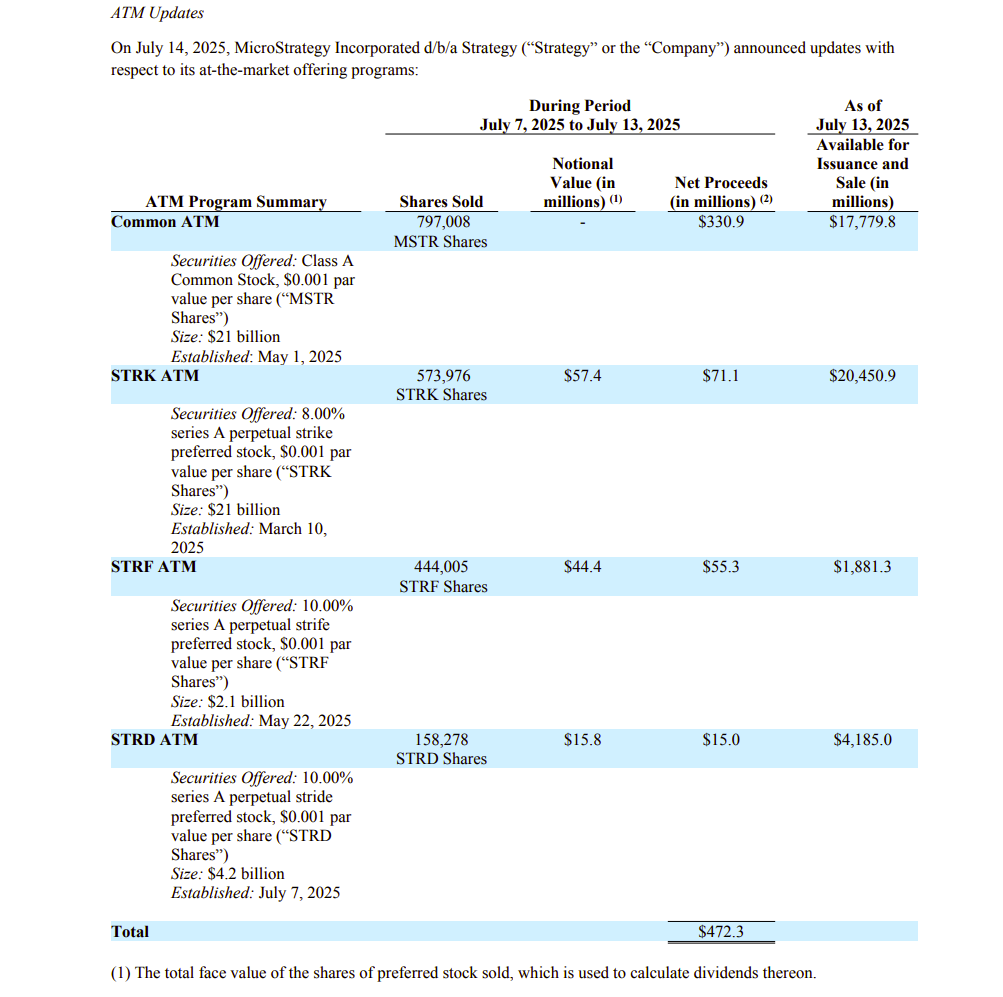

Strategy continues to fund its Bitcoin acquisitions through ongoing stock sales. In the same week, it sold over 797,000 shares of MSTR for nearly $331 million, along with over $141 million in shares of STRK, STRF, and STRD preferred stocks, adding fresh capital to support its Bitcoin strategy.

These sales are part of a broader fundraising program. Under its existing stock issuance plans, the company still has billions of dollars’ worth of shares authorized for sale.

Shares of Strategy (MSTR) closed up 3% last Friday. As of Monday morning, the stock was trading slightly higher in pre-market activity, according to Yahoo Finance.

Earn with Nexo

Earn with Nexo