Bitcoin Remains Most Popular Crypto, Says UK Regulator

BTC remains the investors' choice. But Bitcoin awareness, and that of the sector, is still very low; only one in three knew what crypto was.

Bitcoin (BTC) remains the best-known cryptocurrency in the United Kingdom, but that’s not saying much. Just over half of the country’s crypto investors have bought the original digital asset, according to a recent report. But the same report reveals that general awareness about digital assets remains relatively low.

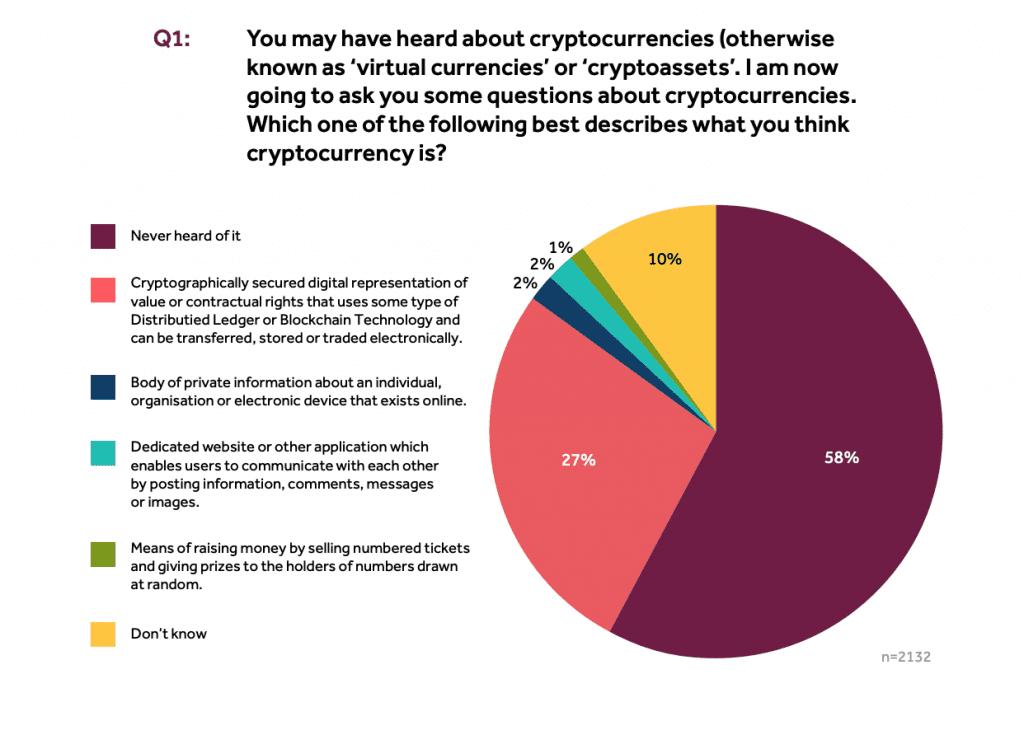

The survey, which was conducted by the U.K.’s Financial Conduct Authority (FCA), looked into changing attitudes towards virtual currencies. Published yesterday, the study found that 51% of all respondents that had ever invested in cryptocurrency had bought Bitcoin.

Out of more than 2,100 investors who participated in the study, 70% said that they either hadn’t heard of cryptocurrency or could not define what it was. Out of the 30% who did know what crypto was, the FCA estimates that 1 in 10 had actually bought some.

Many respondents also said that they saw crypto as a risky investment, with 71% saying it was a risk they were prepared to take. 31% of those who did invest only did so as a gamble, and 30% had bought crypto as part of a wider investment portfolio.

18% of respondents said they thought they expected to make money quickly, with only 4% saying they bought because of FOMO – fear of missing out.

Although Bitcoin was the most popular virtual asset, Ether (ETH) wasn’t far behind. One in three of survey respondents had purchased Ether. Litecoin (LTC), XRP and Bitcoin Cash (BCH) all tied with 20% replying that they had bought these assets.

A slim majority of investors – 57% – said they had only ever bought one digital currency.

Rock bottom Bitcoin awareness

More than a decade old, Bitcoin remains the poster-boy for the crypto world. There are far more searches for ‘Bitcoin, than there are for the broader term, ‘cryptocurrency’, according to Google Trends. Bitcoin dominance, which was more than 90% of the total market cap until as recently as 2017, still hovers above 51%.

Nonetheless, cryptocurrency awareness in the UK remains low, compared with other countries. A study conducted by YouGov last year found that nearly 80% of American citizens knew at least one type of digital asset, with most saying they had heard about Bitcoin.

Even Chile had a better score than the UK. Despite having only one tenth of the UK’s GDP, nearly 40% of Chileans say they have heard about cryptocurrencies, according to a study last October by the country’s financial regulator.

Anthony Broderick, analyst and media editor at CoinSchedule, a cryptocurrency data provider, said the results showed more work to be done.

“If as an industry we can work to educate consumers on the benefits of cryptoassets, relative to legacy systems, and address the issue of trust then there is significant potential to create a new (and inclusive) financial system backed by cyptoassets,” Broderick wrote in an email.

Nick Cowan, managing director and founder of the Gibraltar Stock Exchange (GSX), said raising cryptocurrency awareness should become a priority in the UK. He wrote: “The fact that over 70% of those surveyed haven’t heard of cryptocurrencies or are unable to define cryptocurrencies underlines the urgent need for more accessible education on blockchain and digital assets.”

“Education around blockchain technology and digital assets is intrinsically linked to the sustained growth of the industry globally,” he added.

The author is invested in digital assets, including BTC and ETH which are mentioned in this article.

Earn with Nexo

Earn with Nexo