Strategy stacks 1,955 Bitcoin for $217 million in week eight of nonstop buys

Aggressive digital asset accumulation fuels record holdings as the company leverages equity sales to expand its Bitcoin portfolio.

Strategy, previously known as MicroStrategy, bought 1,955 Bitcoin between September 2-7 for approximately $217 million, marking its eighth straight week of crypto asset purchases, the company reported today.

Strategy has acquired 1,955 BTC for ~$217.4 million at ~$111,196 per bitcoin and has achieved BTC Yield of 25.8% YTD 2025. As of 9/7/2025, we hodl 638,460 $BTC acquired for ~$47.17 billion at ~$73,880 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/QNIuAWRwEW

— Michael Saylor (@saylor) September 8, 2025

The world’s largest corporate Bitcoin holder paid an average of $111,196 per coin during this latest accumulation period, according to an SEC filing. Strategy’s total Bitcoin holdings now stand at 638,460 BTC, acquired for $47 billion at an average price of $73,880 per coin.

The company has generated a BTC Yield of approximately 26% year-to-date.

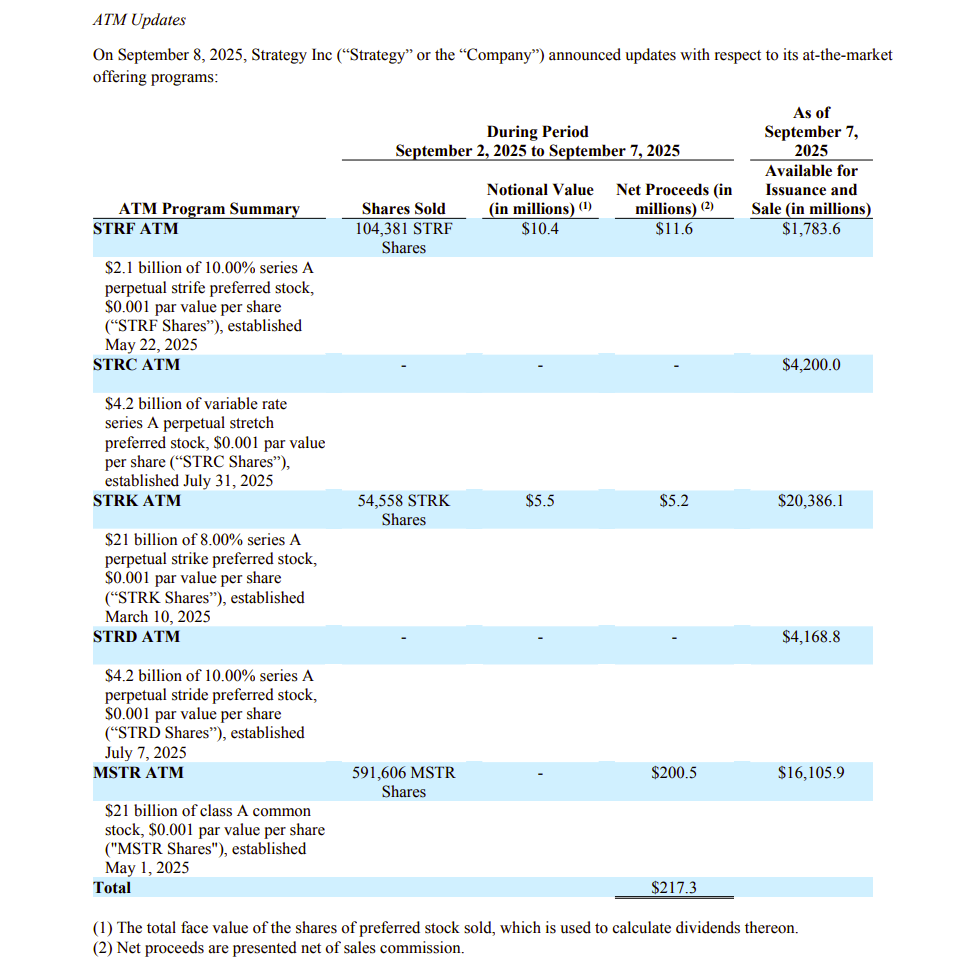

The recent Bitcoin purchases were financed through Strategy’s at-the-market equity programs, including Series A preferred shares and Class A common stock issuances.

The company raised over $217 million through these offerings during the same period, directing the funds to Bitcoin acquisitions.