US Bitcoin spot ETFs end 19-day inflow streak ahead of CPI report and FOMC meeting

Bitcoin funds face a shift as US ETFs report first outflows in nearly three weeks.

US spot Bitcoin exchange-traded funds (ETFs) have seen their first outflows after a 19-day streak of inflows, according to data from HODL15Capital.

On Monday, the ETFs experienced approximately $65 million in outflows, with Grayscale Bitcoin Trust (GBTC) reporting nearly $40 million in withdrawals.

Fidelity Wise Origin Bitcoin Fund (FBTC) faced outflows of $3 million. Invesco Galaxy Bitcoin ETF (BTCO) saw a substantial $20.5 million leave its fund. Valkyrie Bitcoin Fund (BRRR) reported nearly $16 million in outflows.

In contrast, Bitwise Bitcoin ETF (BITB) saw almost $8 million in net inflows while BlackRock’s iShares Bitcoin Trust (IBIT) recorded around $6 million in inflows.

Other funds, including ARK 21Shares Bitcoin ETF (ARKB), Franklin Templeton Bitcoin ETF (EZBC), VanEck Bitcoin Trust (HODL), and WisdomTree Physical Bitcoin (BTCW), reported no activity in terms of inflows or outflows during the day’s trading session.

US Bitcoin funds have been active buyers, accumulating approximately 25,700 BTC in the first week of June alone. IBIT remains the largest Bitcoin ETF globally, with over 304,000 BTC under management, while GBTC holds the second position with over 284,000 BTC, valued at $19.7 billion.

US economic sentiment and anticipation of the Federal Reserve’s (Fed) monetary policy may have influenced Monday’s ETF flows.

All eyes are on the Consumer Price Index (CPI) report and the Federal Open Market Committee (FOMC) meeting, both scheduled for Wednesday, June 12. CPI inflation is estimated at 3.4% and core CPI at 3.5%.

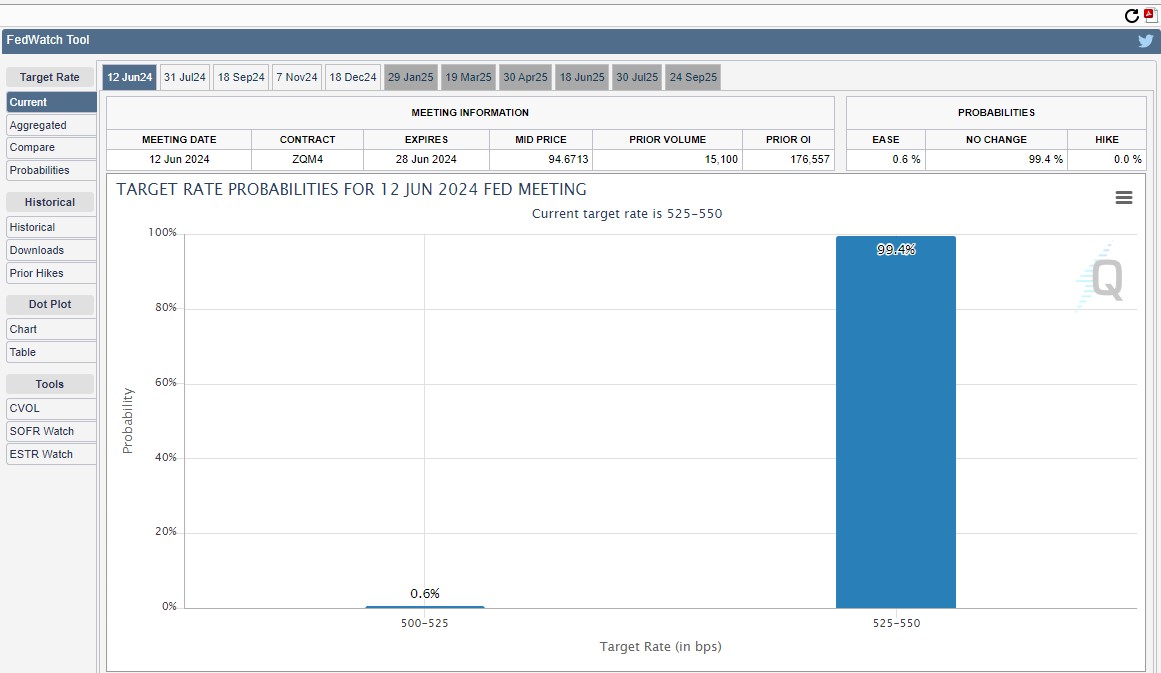

Investors also closely monitor the Fed’s interest rate decision. The CME FedWatch Tool indicates that the market highly expects the Fed to maintain rates between 525 and 550 basis points.

Upcoming economic events could also impact Bitcoin’s price dynamics. As reported by Crypto Briefing, Bitcoin’s perpetual futures markets have seen elevated funding rates, indicating a premium for long positions and a potential correction for spot prices following the FOMC meeting.

According to CoinGecko’s data, Bitcoin is trading at around $68,300 at press time, down almost 2% over the past 24 hours.