US Bitcoin ETFs net over $500M in a single week as Grayscale’s outflows slow down

BlackRock's IBIT was the top performer, attracting over $310 million in inflows last week.

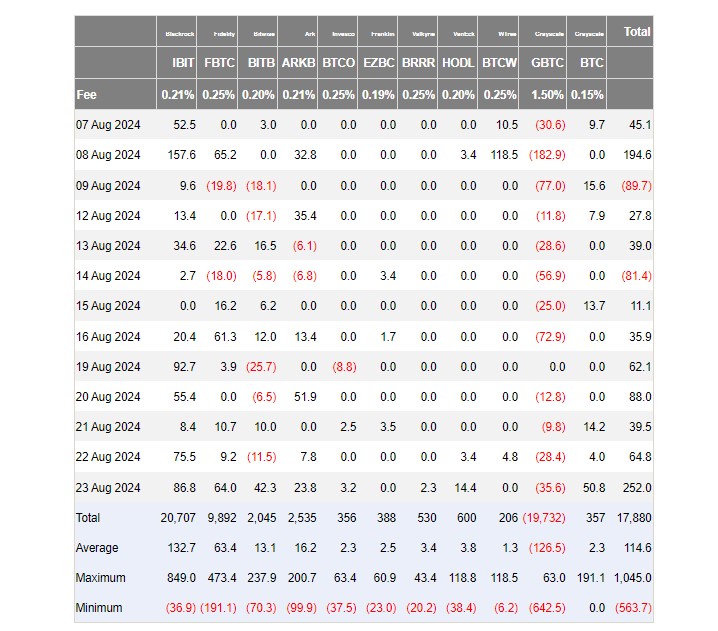

Investors poured over $500 million into ten exchange-traded funds (ETFs) that track the spot price of Bitcoin last week, data from Farside Investors showed. The positive performance was mainly driven by a slowdown in Grayscale’s GBTC outflows and steady inflows into rival funds, with BlackRock’s IBIT taking the lead.

US spot Bitcoin ETFs recorded a seventh consecutive day of net inflows after collectively taking in over $250 million on Friday, the highest mark since July 23, data revealed.

BlackRock’s IBIT led the pack with over $310 million in weekly inflows. Fidelity’s FBTC took the second spot with approximately $88 million. With last week’s gains, FBTC is on track to hit $10 billion in net inflows.

ARK Invest/21Shares’ ARKB, Grayscale’s BTC, and Bitwise’s BITB also reported large inflows, while other funds issued by Invesco/Galaxy, Franklin Templeton, Valkyrie, VanEck, and WisdomTree registered smaller gains.

Despite a reduction in the rate of withdrawals, Grayscale’s GBTC still experienced about $86 million in outflows. Around $19.7 billion has been withdrawn from GBTC since it was converted into an ETF.

As reported by Crypto Briefing, the State of Wisconsin Investment Board, which previously held 1,013,000 shares of GBTC, completely exited its position as of June 30. The Board, however, increased its stake in BlackRock’s IBIT, reporting a total of 2,898,051 shares held.