Bitcoin spot ETFs could hit longest outflow streak on record

Bitcoin is struggling to recover amid strong outflows and selling pressure from upcoming repayments by Mt. Gox.

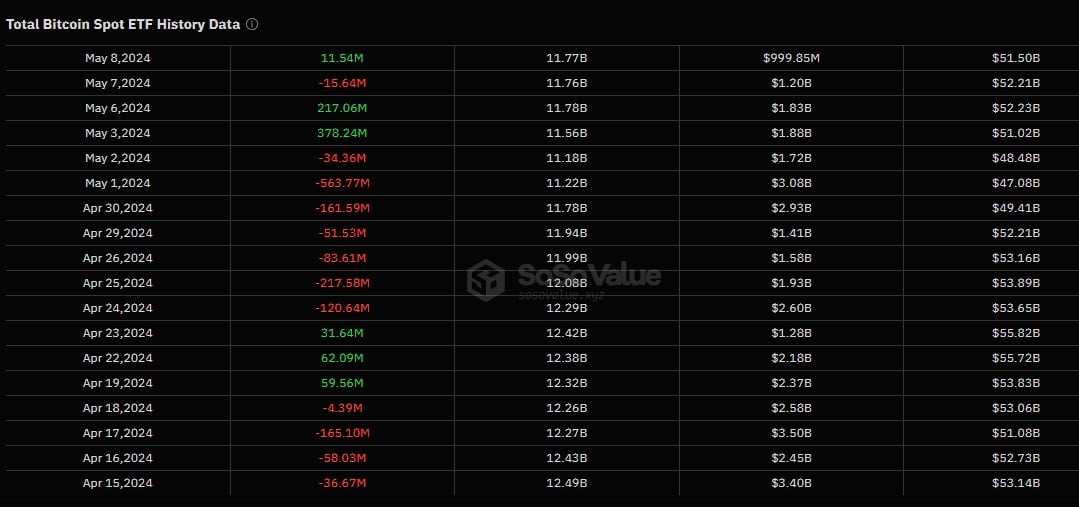

US spot Bitcoin exchange-traded funds (ETFs) are on track to notch their longest-selling stretch after recording an outflow of $174 million on Monday, the seventh in a row, according to data from SoSoValue.

On Monday, Grayscale’s GBTC recorded $90 million in withdrawals, while Fidelity’s FBTC experienced $35 million in outflows.

Franklin Templeton’s EZBC saw its first net outflow since May 2, with $20.8 million withdrawn yesterday. Other funds also reported outflows yesterday, including VanEck’s HODL ($10 million), Bitwise’s BITB ($8 million), Ark Invest/21Shares’ ARKB ($7 million), and Galaxy Digital’s BTCO ($2 million).

BlackRock’s IBIT, along with funds from Valkyrie, WisdomTree, and Hashdex, recorded zero flows.

The downturn follows a 19-day inflow streak that ended on June 11. If the ETFs continue to bleed today, this will mark the longest outflow streak on record.

Spot Bitcoin funds recorded the longest outflow streak on May 2 after these ETFs saw outflows for the seventh consecutive day. On May 3, the outflow streak ended as the funds reported $378 million in inflows.

Bitcoin tumbles

The ETF outflows came amid Bitcoin’s (BTC) price correction. On Monday, BTC dipped below $59,000 following news that Mt. Gox’s trustee will start repaying creditors in July with over $9 billion in Bitcoin and Bitcoin Cash.

According to CoinGecko’s data, BTC is trading close to $61,000 at the time of writing, down 3% over the past 24 hours.

Earn with Nexo

Earn with Nexo