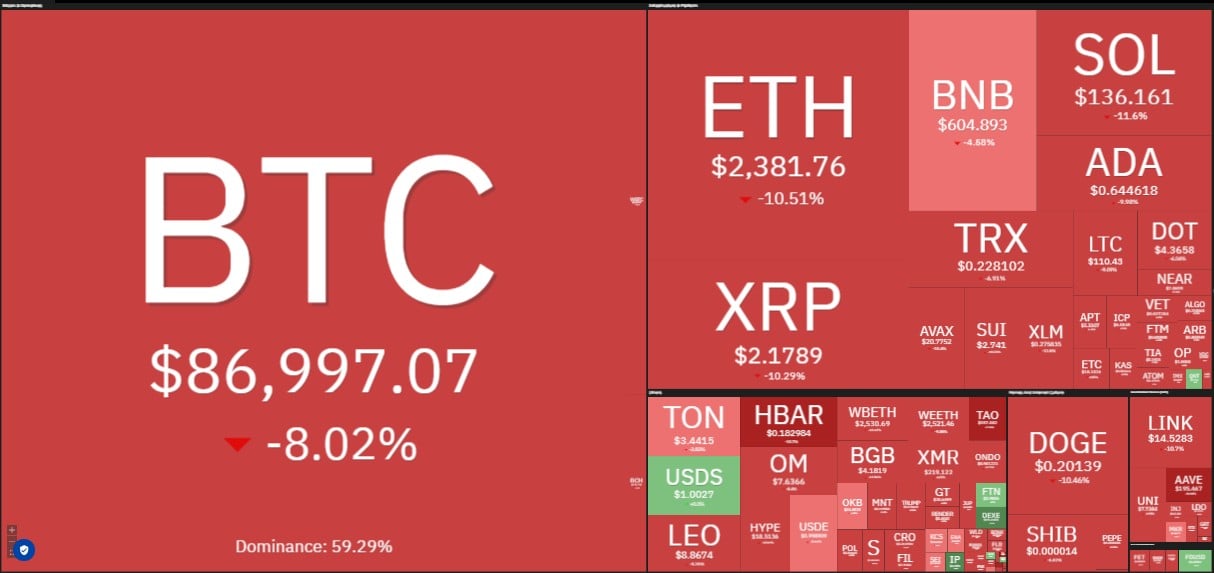

Bitcoin crashes to $86,000, triggers $1.6 billion liquidation in 24 hours

Market volatility spikes as trade policy tensions and ETF selloffs stoke fears among digital asset investors.

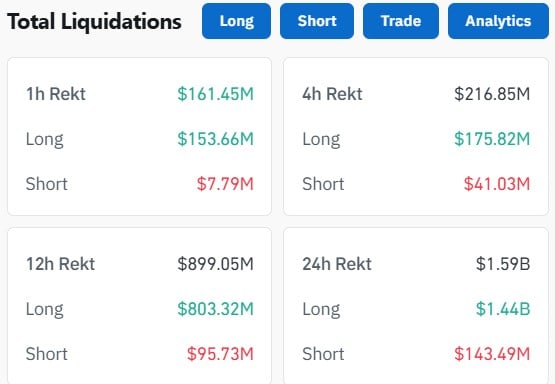

Bitcoin’s drop to $86,000 led to the liquidation of $1.6 billion in trading positions over the past 24 hours, according to Coinglass data.

The drop is attributed to President Donald Trump’s renewed tariff threats against Mexico and Canada and a significant selloff of Bitcoin ETFs.

A $500 million Bitcoin ETF selloff intensified the market downturn, leading to widespread liquidations across major digital assets. The price decline marks Bitcoin’s first drop below $86,000 since November.

Feb 25 Update:

10 #Bitcoin ETFs

NetFlow: -5,474 $BTC(-$485.98M)🔴#Fidelity outflows 2,620 $BTC($232.58M) and currently holds 204,180 $BTC($18.13B).9 #Ethereum ETFs

NetFlow: -4,109 $ETH(-$9.91M)🔴#Bitwise outflows 3,658 $ETH($8.83M) and currently holds 98,642 $ETH($238M).… pic.twitter.com/iNdwSiZIsA— Lookonchain (@lookonchain) February 25, 2025

The liquidation event affected between 286,534 and 367,789 traders, with long positions bearing the majority of losses ranging from $144 million to $1.4 billion.

Bitcoin, Ethereum, and XRP were among the most impacted digital assets.

This event follows a larger liquidation on February 3, 2025, when over $2.2 billion in leveraged positions were wiped out, affecting approximately 729,073 traders.

During that event, Ethereum traders experienced over $600 million in losses, while Bitcoin traders faced $409 million in liquidations.

Trump’s latest statements on trade policy, which revived discussions from his February 3 announcement, have heightened concerns about economic disruptions.

The combination of trade policy uncertainty and institutional investor outflows has contributed to increased volatility across crypto markets.