Shutterstock cover by Peter Galleghan

Bitcoin, Ethereum Look Poised to Rebound

Bitcoin and Ethereum could soon bounce as buy signals are starting to appear.

Bitcoin and Ethereum have reached vital support levels, collecting enough liquidity for potential rebounds. However, from a long-term perspective, a long-squeeze appears to be underway.

Bitcoin, Ethereum on Shaky Ground

Bitcoin and Ethereum could soon rebound, but the level of optimism among traders could spell trouble.

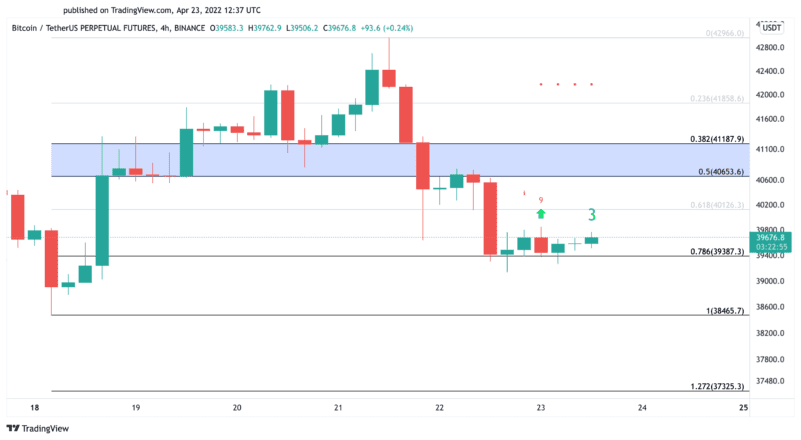

Bitcoin has lost more than 4,000 points in market value over the past 48 hours. The rejection from the $43,000 resistance level on Apr. 21 led to the recent correction. Still, it appears that Bitcoin could be preparing to bounce off the support level.

The Tom DeMark (TD) Sequential indicator has presented a buy signal on Bitcoin’s four-hour chart. The bullish formation developed as a red nine candlestick, which is indicative of a one to four candlesticks upswing. A spike in buying pressure around the current price levels could help validate the optimistic outlook, resulting in an upswing to $40,650 or even $41,200.

It is worth noting that Bitcoin must keep $39,400 as support so the bullish thesis can be validated. Failing to hold above this vital support level could result in a steeper correction as the following vital demand zones sit at $38,500 and $37,300.

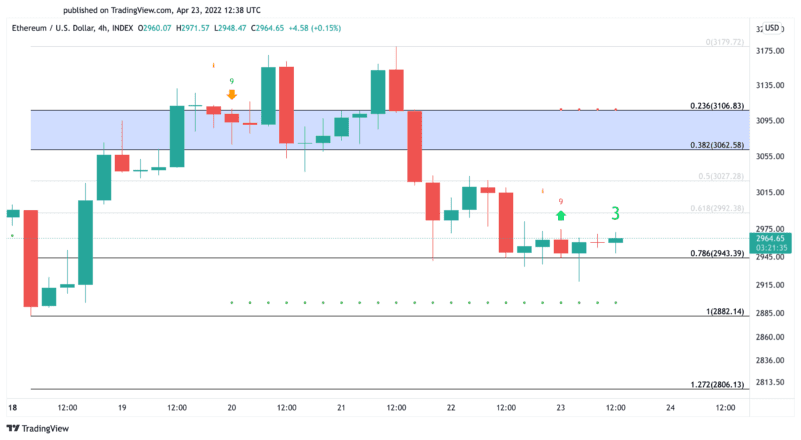

Ethereum also appears to be gathering momentum for a bullish impulse after retracing by more than 8% in the past 48 hours. As long as the asset continues to trade above $2,950, it has a chance of rebounding. The TD Sequential indicator supports the optimistic outlook and has presented a buy signal on Ethereum’s four-hour chart.

If buy orders increase around the current price levels, Ethereum could gain over 150 points in market value. A decisive close above $3,100 could lead to further gains while losing $2,950 as support could see the asset fall to $2,880.

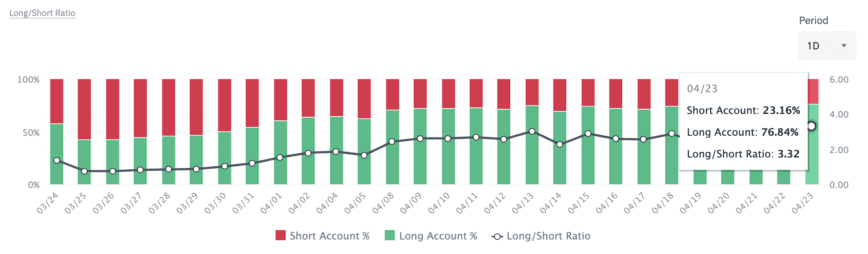

Although the technicals point to a rebound in the short-term future, current optimism levels can be seen as a warning signal.

On Binance, roughly 77% of all accounts with an open position in Bitcoin are long. The BTCUSDT Long/Short Ratio has risen to a 3.32 ratio as of Apr. 23. Most traders on the leading exchange are expecting prices to continue rising, which could create the perfect conditions for a long squeeze.

Disclosure: At the time of writing, the author of this piece owned ETH and BTC.

Earn with Nexo

Earn with Nexo