Shutterstock cover by Rabanser

Bitcoin, Ethereum Uptrend Tempered by Profit-Taking

On-chain analysts are growing concerned as the number of BTC and ETH held on exchanges is drastically increasing.

A significant number of Bitcoin and Ethereum tokens have flooded exchanges in the last 24 hours. Such market behavior suggests that investors are willing to take profits, leading to a steep correction.

Bitcoin Whales Book Profits

Bitcoin and Ethereum holders are selling their assets.

Bitcoin has suffered a significant rejection from the psychological $50,000 resistance level. The flagship cryptocurrency has shed over 3,000 points in market value, representing a 6.7% decline. The sudden downward pressure correlates with a spike in profit-taking among large investors.

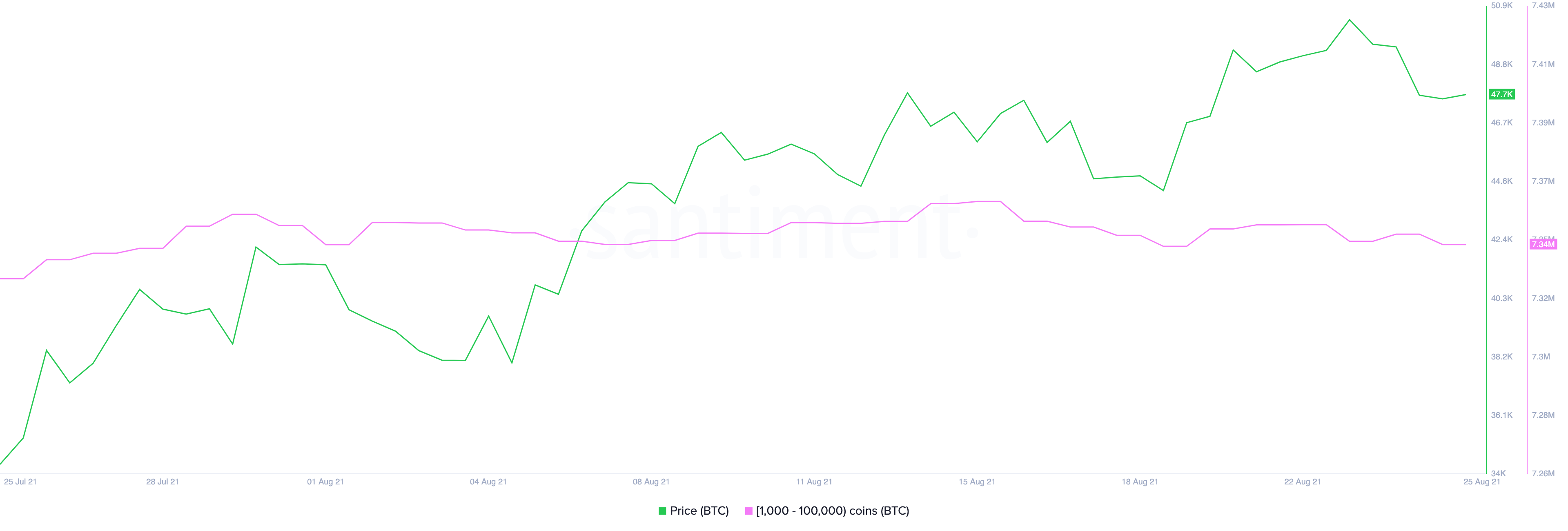

On-chain data and intelligence platform Santiment shows that wallet owners holding millions of dollars in BTC, colloquially known as “whales,” have been trimming their holdings. In the last 24 hours, addresses with 1,000 to 100,000 BTC have sold over 10,000 tokens, worth roughly $500 million.

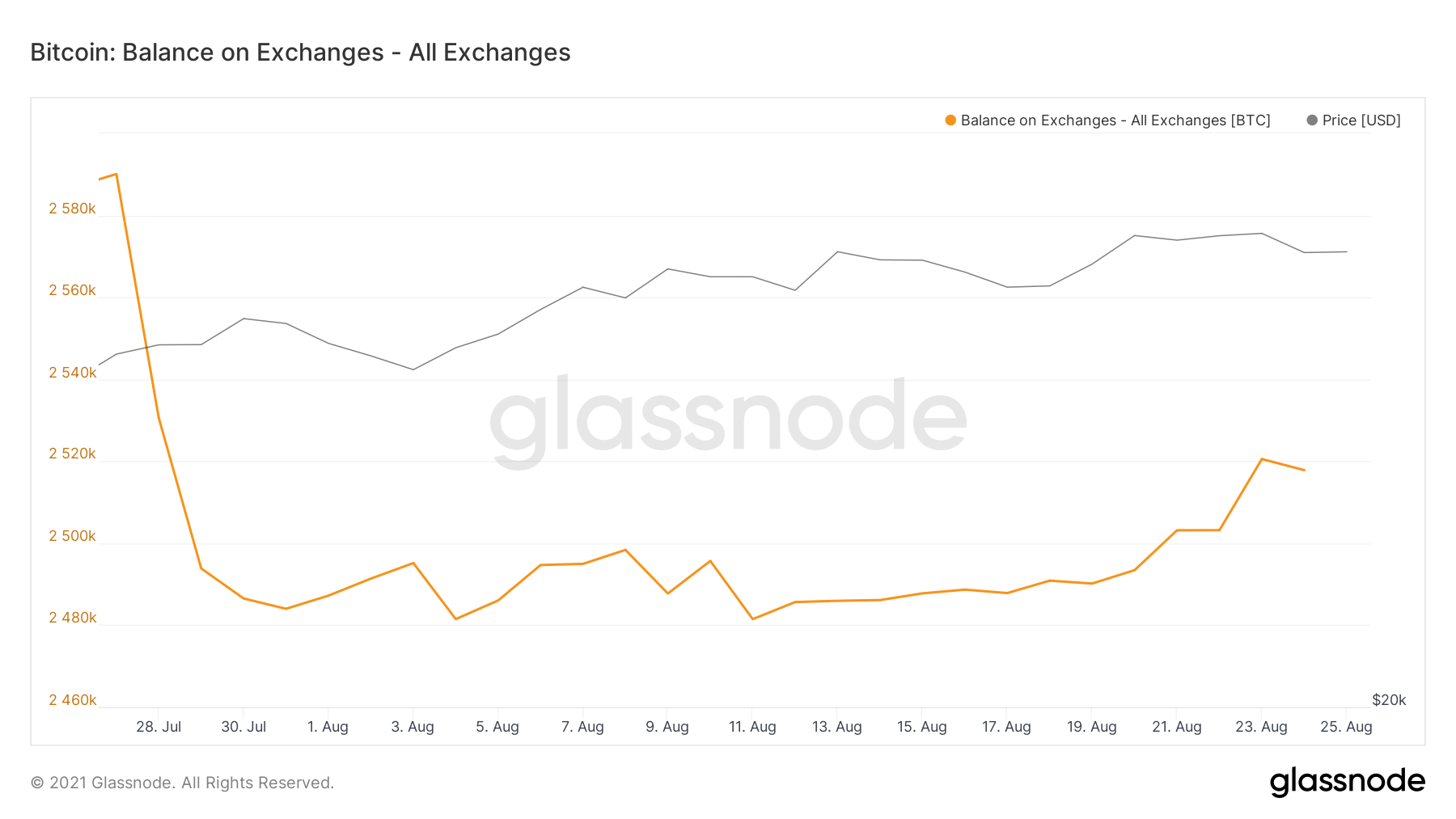

Additionally, a significant number of coins have flooded known cryptocurrency exchange wallets. On-chain analyst Will Clemente maintains that since Aug. 20, more than 27,000 BTC have moved to trading platforms. Many of the inflows went into Binance.

The increasing BTC supply on known cryptocurrency exchange wallets alongside the spike in profit-taking from whales paints a negative picture for Bitcoin’s price action. It technically suggests that the number of tokens available to sell has surged, consequently increasing the downside potential.

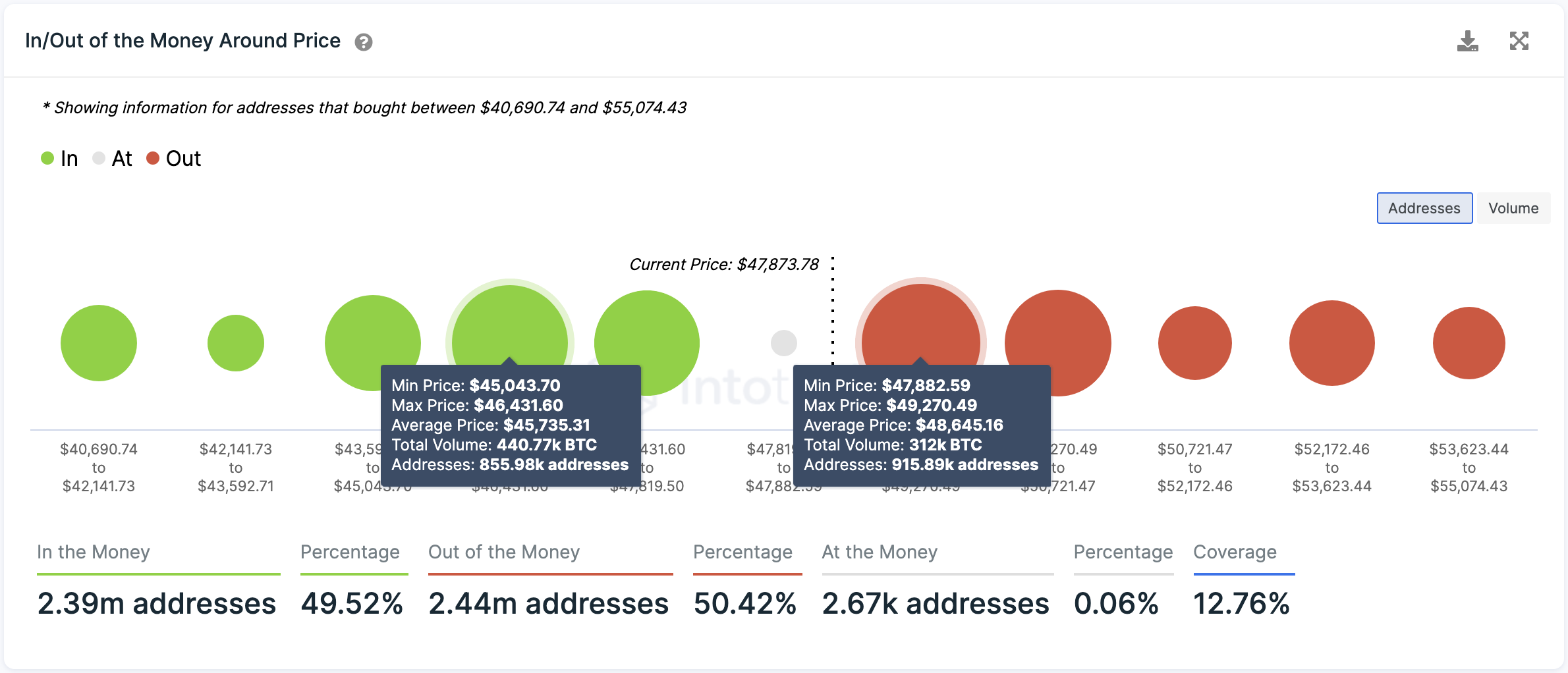

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that if sell orders continue to pile up, Bitcoin could find support at $45,735. Around this price level, nearly 856,000 addresses are holding over 440,000 BTC.

Such a significant demand area may have the ability to absorb some of the recent selling pressure. But if Bitcoin can slice through this hurdle, it could drop to $40,000.

On the other hand, the IOMAP cohorts show a stiff supply barrier ahead of the pioneer cryptocurrency. Rough 915,000 addresses have previously purchased 312,000 BTC between $47880 and $49,270.

Holders who have been underwater around this price level may try to break even on their positions to prevent incurring significant losses, consequently slowing down any potential rebound.

Ethereum Loses Crucial Support

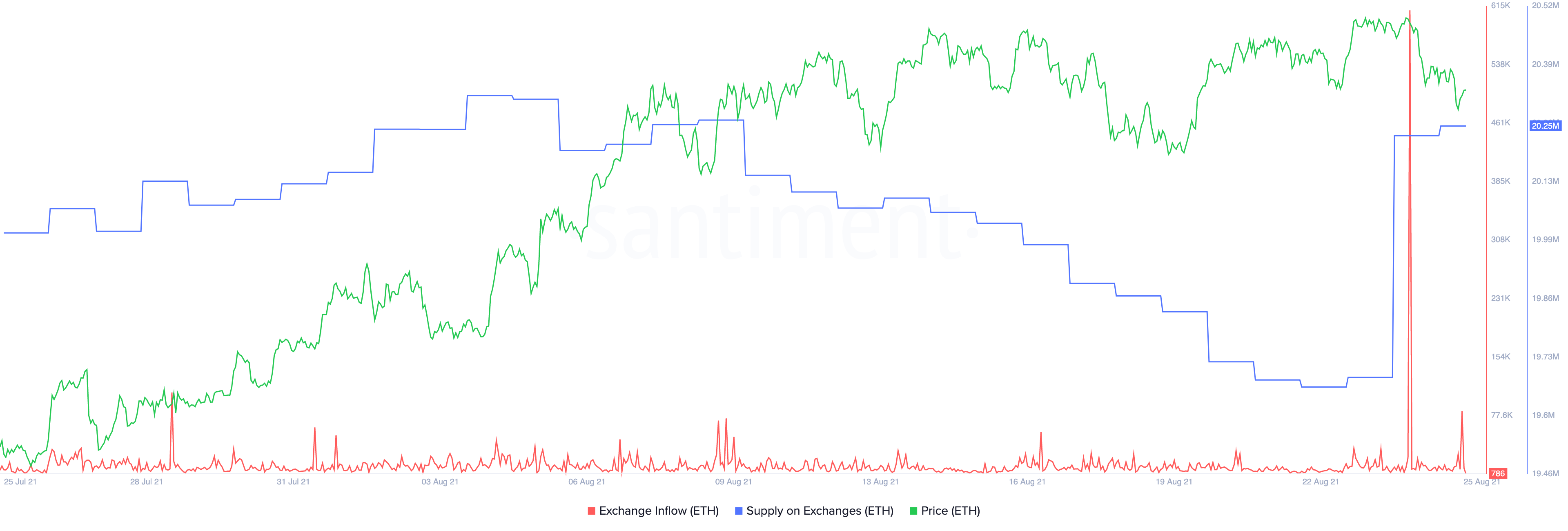

Behavior analytics platform Santiment has also recorded a significant spike in the number of ETH moved to trading platforms. In the last 24 hours alone, approximately $2 billion worth of Ethereum was transferred to Binance.

In an Aug. 25 video, on-chain analyst Dino Ibisbegovic argued that such a big increase in the number of ETH tokens held in exchanges represents a red flag for Ethereum’s future price growth. He said:

“One cannot be 100% sure that all of these tokens are going to be immediately transformed into selling pressure for Ethereum. But, it is certainly a sign that some large addresses may be looking to liquidate their positions and reduce their exposure for the time being.”

The substantial increase in exchange inflow has led to a spike in selling pressure, pushing Ethereum price down by 7.4%. The second-largest cryptocurrency by market cap dropped to $3,080, slicing through a significant support level.

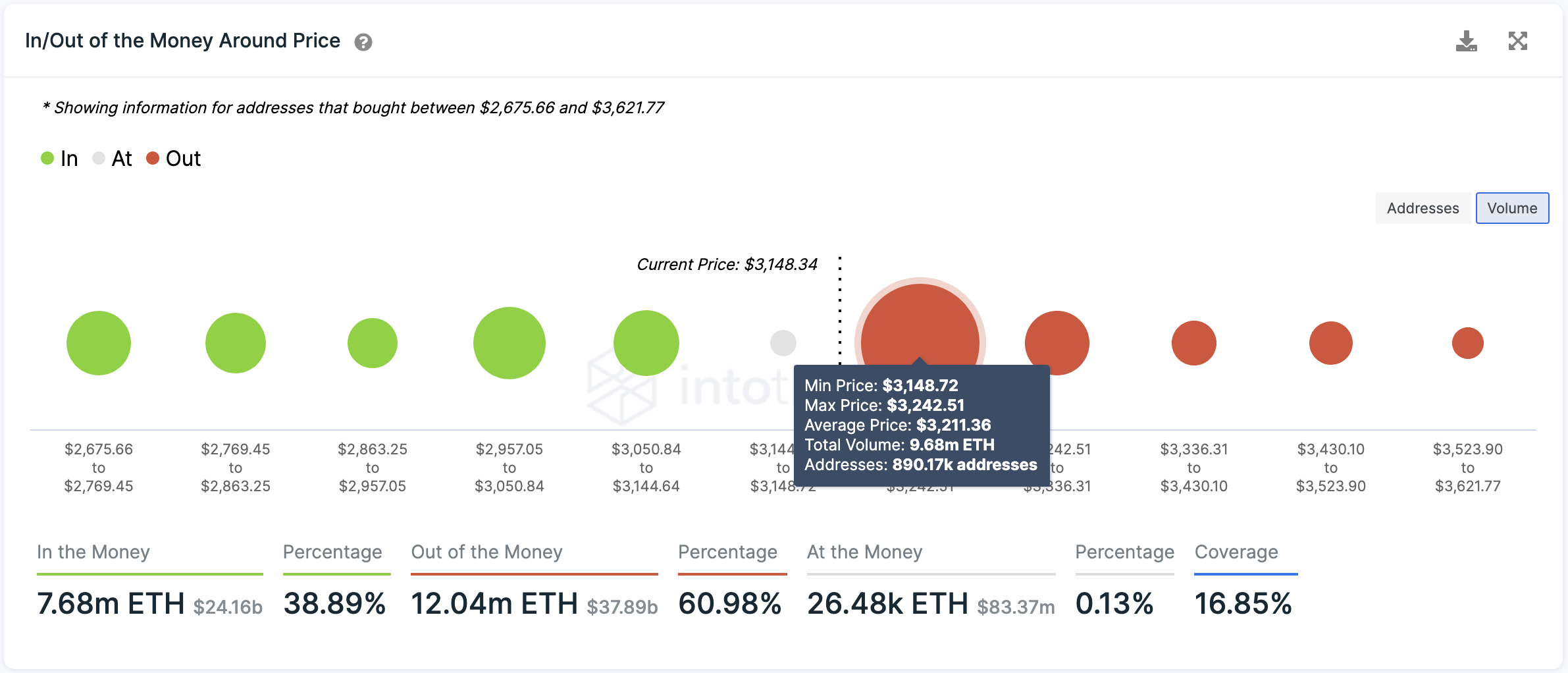

The IOMAP cohorts show that Ethereum must reclaim $3,200 as support as soon as possible to prevent 890,000 addresses from selling the 9.68 million ETH they bought around this price level. Failing to do so could lead to a sell-off that pushes prices towards the next critical demand barrier at $2,400.

It is worth noting that Ethereum would likely resume its uptrend after a decisive close above the $3,200 supply wall. The upswing might encourage market participants to buy, fueling another run-up to $3,700.