Strategy launches 5 million perpetual preferred share offering to fund future Bitcoin purchases

The company is aggressively pushing towards increasing its BTC reserve despite market volatility.

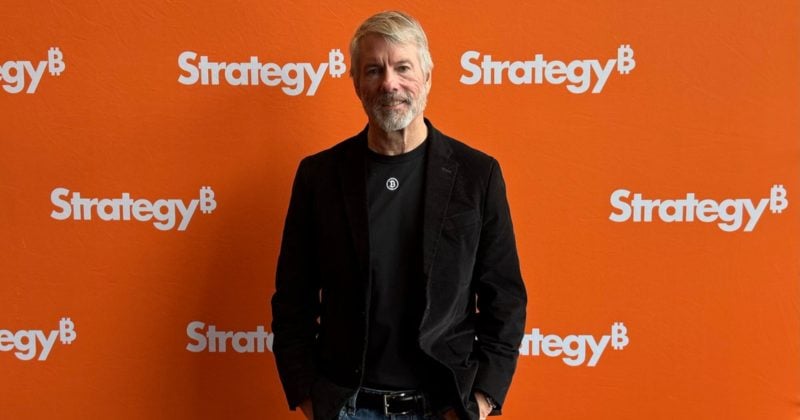

Strategy, the world’s largest corporate holder of Bitcoin, on Tuesday announced the launch of STRF (Strife), a new perpetual preferred stock offering, available to institutional investors and select retail investors.

Strategy today announced the launch of $STRF ("Strife"), a new perpetual preferred stock offering, available to institutional investors and select non-institutional investors. For more information, click here. $MSTRhttps://t.co/YxNmogceGq

— Strategy (@Strategy) March 18, 2025

The company also revealed its plan to offer 5 million shares of Series A Perpetual Strife Preferred Stock in a public offering to raise funds for Bitcoin purchases and working capital.

The preferred stock will carry a 10% annual fixed dividend rate, payable quarterly starting June 30, 2025. If dividends are not paid on schedule, compounded dividends will accumulate at an initial rate of 11% per annum, increasing by 100 basis points each quarter up to a maximum of 18% annually until paid in full.

The initial liquidation preference will be $100 per share, with daily adjustments based on market prices and trading activity. Strategy maintains the right to redeem all shares if the outstanding amount falls below 25% of total shares issued or in case of certain tax events.

Morgan Stanley, Barclays Capital, Citigroup Global Markets and Moelis & Company are serving as joint book-running managers for the offering, which will be made through an effective shelf registration statement filed with the SEC.

Strategy said Monday it had purchased 130 Bitcoin at an average price of $82,981 per token between March 10 and 16.

The latest purchase, reported in an SEC filing, brings Strategy’s total Bitcoin holdings to 499,226 BTC, valued at around $41.6 billion.

The acquisition was financed through the sale of 123,000 shares of its 8.00% series A perpetual strike preferred stock, generating about $10.7 million. As of the latest update, Strategy holds over 2% of the entire Bitcoin supply.

Earn with Nexo

Earn with Nexo