Shutterstock photo by AlekseyIvanov

Bitcoin Falls 5% as Fed Confirms Interest Rate Hikes

The overall cryptocurrency market lost nearly 6% of its value over the past 24 hours.

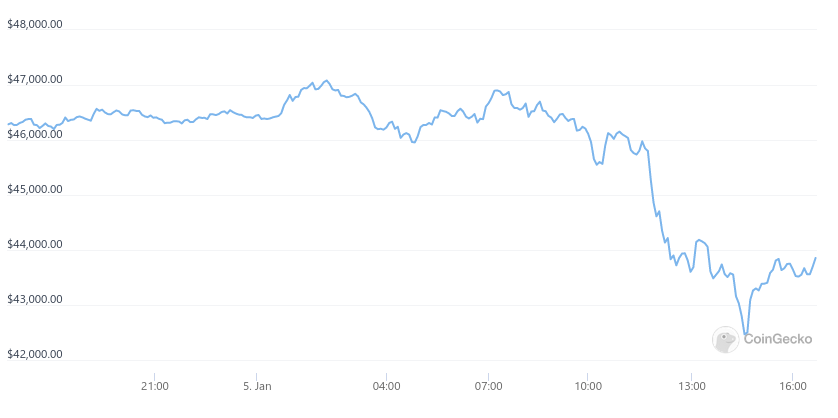

Bitcoin prices fell by roughly 5% today alongside news that the U.S. Federal Reserve will raise interest rates in the coming months.

Bitcoin and Ethereum Are Down

Bitcoin (BTC) prices fell by 5.3% over the past 24 hours, as the asset’s value dropped from $45,800 to $43,500. That amount is the lowest price that the cryptocurrency has seen since September 2021.

Ethereum (ETH)’s value fell by 6.7% over the same period, meanwhile, as prices dropped from $3,780 to $3,545.

Leading cryptocurrencies and altcoins such as Binance Coin (BNB), Cardano (ADA), Ripple (XRP), Avalanche (AVAX), Dogecoin (DOGE), and Shiba Inu (SHIB) all saw similar losses of 5.7% to 6.9%.

Polkadot (DOT), Terra (LUNA), and Solana (SOL) were hit somewhat harder, with losses of 7.3%, 7.9%, and 8.4% respectively.

Losses extended to the rest of the crypto market, which is down 5.9% today, resulting in a total market cap of $2.2 trillion.

Federal Reserve Interest Raise May Be at Play

Reasons for the market slump are uncertain, as there were few if any significant announcements in the crypto industry today.

However, Bitcoin and the stock market are known to correlate often, with a 100-day correlation of 0.33 reported late last year. As such, losses today may be related to similar but milder losses in the stock market. The Nasdaq Composite lost 3.3% over the past 24 hours, while the S&P 500 saw losses of 1.9% in the same period.

Those losses in the stock market have been attributed to the U.S. Federal Reserve confirming that it will begin to raise interest rates in the coming months.

It is believed that this rate hike could take place sooner than expected and as early as March. Such a short time frame may have motivated widespread sell-offs among investors today.

Disclosure: At the time of writing, the author of this piece owned BTC, ETH, and other cryptocurrencies.