MicroStrategy stock jumps to record high following $2 billion Bitcoin purchase

Bitcoin also broke the $84,000 mark on Monday.

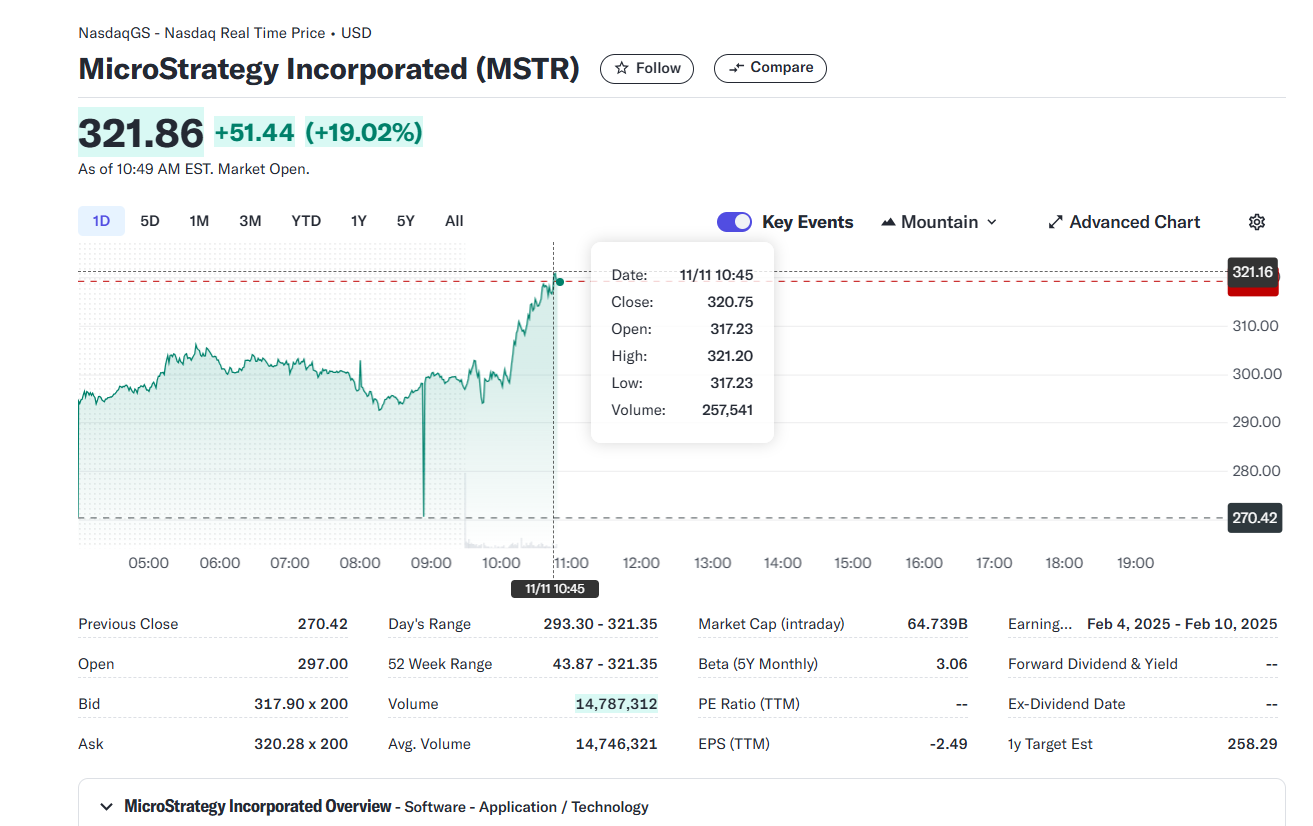

MicroStrategy (MSTR) soared 19% to a record high of above $320 after US markets opened on Monday, following the company’s announcement of a $2 billion Bitcoin purchase, according to data from Yahoo Finance.

The world’s largest corporate Bitcoin holder acquired 27,200 Bitcoin between October 31 and November 10, bringing its total holdings to 279,420 BTC, worth approximately $23 billion at current market prices.

MicroStrategy’s average acquisition cost for its total Bitcoin holdings stands at around $42,800 per BTC, resulting in $11.4 billion in unrealized profits amid Bitcoin’s recent price rally.

The company’s stock performance is heavily influenced by Bitcoin’s performance. Bitcoin also hit a new record of $84,000 on Monday, according to CoinGecko data.

MicroStrategy’s shares have gained over 40% in the past five days and approximately 400% over the last year. Meanwhile, Bitcoin saw year-to-date gains of 124%.

The jump is part of a market-wide rally following Donald Trump’s reelection and the recent interest rate cuts by the US Fed.

Crypto investors are optimistic about the second Trump administration due to his pro-crypto stance.

During his campaign, Trump repeatedly voiced support for the crypto industry, showing intentions to make the US the “crypto capital of the planet” and the “Bitcoin superpower of the world.”

Trump also proposed creating a national Bitcoin reserve and establishing a presidential advisory council focused on crypto. These initiatives are seen as steps toward legitimizing and supporting the crypto market at a governmental level.

Investors hope the new administration will bring much-needed clarity to the murky crypto regulatory landscape, especially given the SEC’s enforcement-heavy approach.