BlackRock calls Bitcoin one of the biggest investment themes of the year

Major institutional support reflects a growing mainstream acceptance of digital assets among top investors in traditional finance.

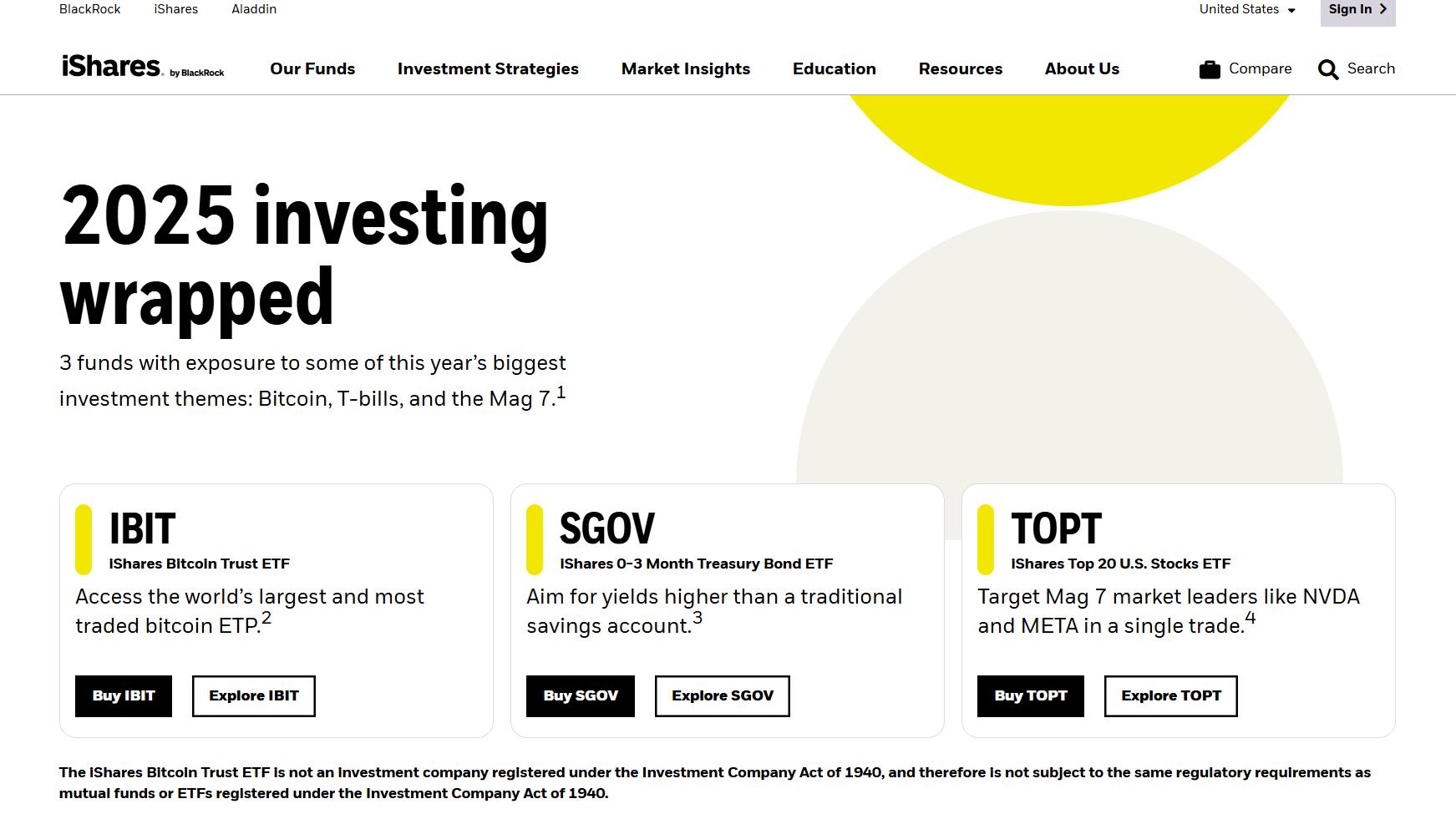

BlackRock has named Bitcoin as one of its top investment themes for 2025. The asset manager has featured the crypto asset alongside T-bills and the Magnificent Seven tech stocks on its iShares page.

The firm has been a major player in the Bitcoin market since launching its iShares Bitcoin Trust ETF last January, which has grown to become the largest spot Bitcoin exchange-traded fund in the US.

BlackRock’s Bitcoin fund has reached $68 billion in assets under management as of the latest data. The ETF has attracted nearly $63 billion in net inflows since its trading debut.

BlackRock CEO Larry Fink has confirmed that sovereign wealth funds are accumulating Bitcoin, signaling a shift from short-term speculation to purpose-driven, long-term investment.