Why Is Lightning Network Capacity Decreasing?

There appears to be an inverse correlation between market growth and Lightning capacity.

The Lightning Network is often touted as the solution to Bitcoin’s scaling challenges and has shown tremendous growth with total channel capacity for the off-chain payments network reaching 1100 BTC in early May, just over a year since it began operation.

But capacity began to decline with the latest bull run, recently falling below 940 BTC. The Litecoin Lightning Network also declined to 283 LTC, losing 14% of its channel capacity over the past month.

Why Did Capacity Fall?

Lightning skeptics took the opportunity to roundly decline the “dive” in channel capacity, as evidence that the second-layer solution was throwing sparks.

However, a large part of the diminished capacity came from a single node, which shut down its unused channels.

I closed not-used public channels initiated from my side (age >= 78 days). But I intended to close a maximum up to 1.2 BTC and due to error in the script, all these channels were closed – it's -67 BTC capacity. So capacity of LN will drop 1015-67 948 BTC near hours…

— 🇺🇦⚡LNBϟG⚡️🇺🇦 (@lnbig_com) June 5, 2019

That explains the vast majority of the decline, but it still leaves 9 BTC unaccounted for, not to mention the sizeable decline in the Litecoin Lightning Network. Crypto Briefing got in touch with Blockstream, one of the leading developers for the micropayments network, to hear their take.

Part of the decline might be due to the latest rise in cryptocurrency prices, explained Blockstream engineer Rusty Russell. “I hope this is an indication that people are remembering that Lightning is still beta,” Russell said, “and [are] reducing capacity to control their risk profile as the bitcoin price rises.”

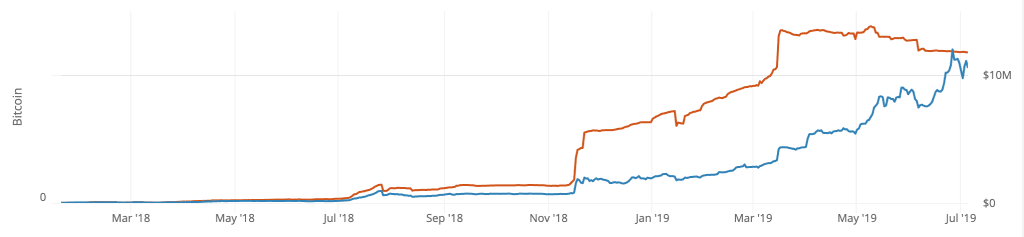

In the latest run-up of cryptocurrency prices, one can observe an inverse correlation between market growth and Lightning capacity, suggesting some nodes may have closed channels in order to sell BTC or LTC at the top. The USD value of the Bitcoin Lightning Network increased significantly in the same time span, from around $6.5 million to exceed $10 million USD.

Compare the changes in BTC value (blue) to USD (orange) in the following chart:

Measured in Bitcoin, the total capacity of the Lightning Network reached a plateau on May 9th, before starting to decline. At the same time, the dollar value of the Network steadily continued to trend upwards, even as bitcoins were removed from payments channels.

Users may be acting cautiously with their funds by removing them from the Lightning network. The technology is still in its early stages of development and losing funds remains a possibility. Alternatively, it might just be that some holders finally decided to secure profits by cashing out.

Russell went on to point out that blips in capacity can happen due to various news events, but that the trend remains net positive. “[T]he network seems to grow in bursts as something attention-getting happens, so it’s a very noisy metric,” he said. “I think I speak for all the developers when I say we’re happy with the upward trend, however.”

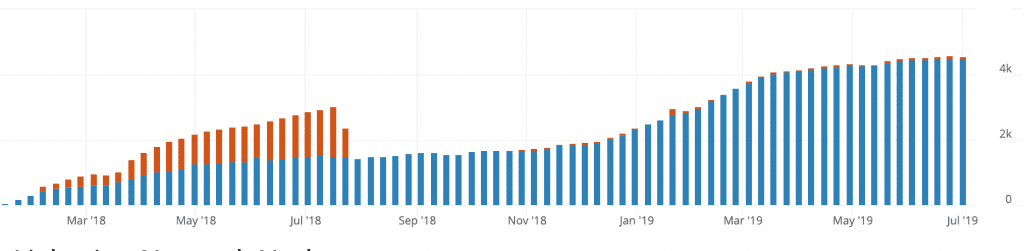

But, if you’re still worried about the network’s progress, other metrics suggest steady growth for the scaling solution. The number of nodes on the BTC network has experienced steady growth, while the number of nodes without channels is now nearly negligible.

The Litecoin version is also seeing growth, with the number of nodes growing 3.5% over the past month.

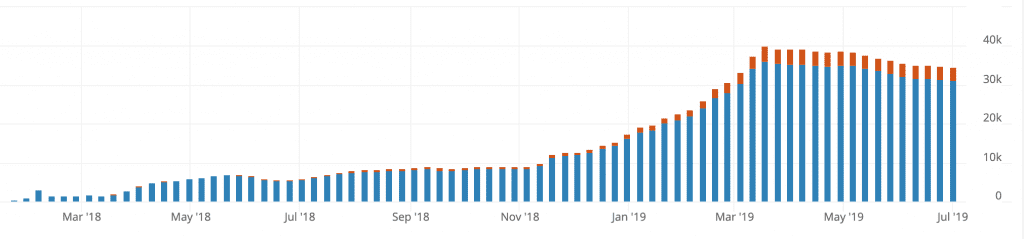

There has been a fall in the number of payments channels, but this decline is far less precipitous than the fall in channel capacity. The number of channels between Lightning nodes fell about 12%, from a maximum of 40,000 in March to slightly less than 35,000 at the time of writing:

Zooming out, the Lightning network is continuing to trend upwards with strong growth as it enters its second year. As the experience becomes more user-friendly and robust, the network is likely to see further growth and adoption.