Bitcoin slides out of top 10 global assets by market value

Institutional investors still see potential in Bitcoin despite its current market cap challenges.

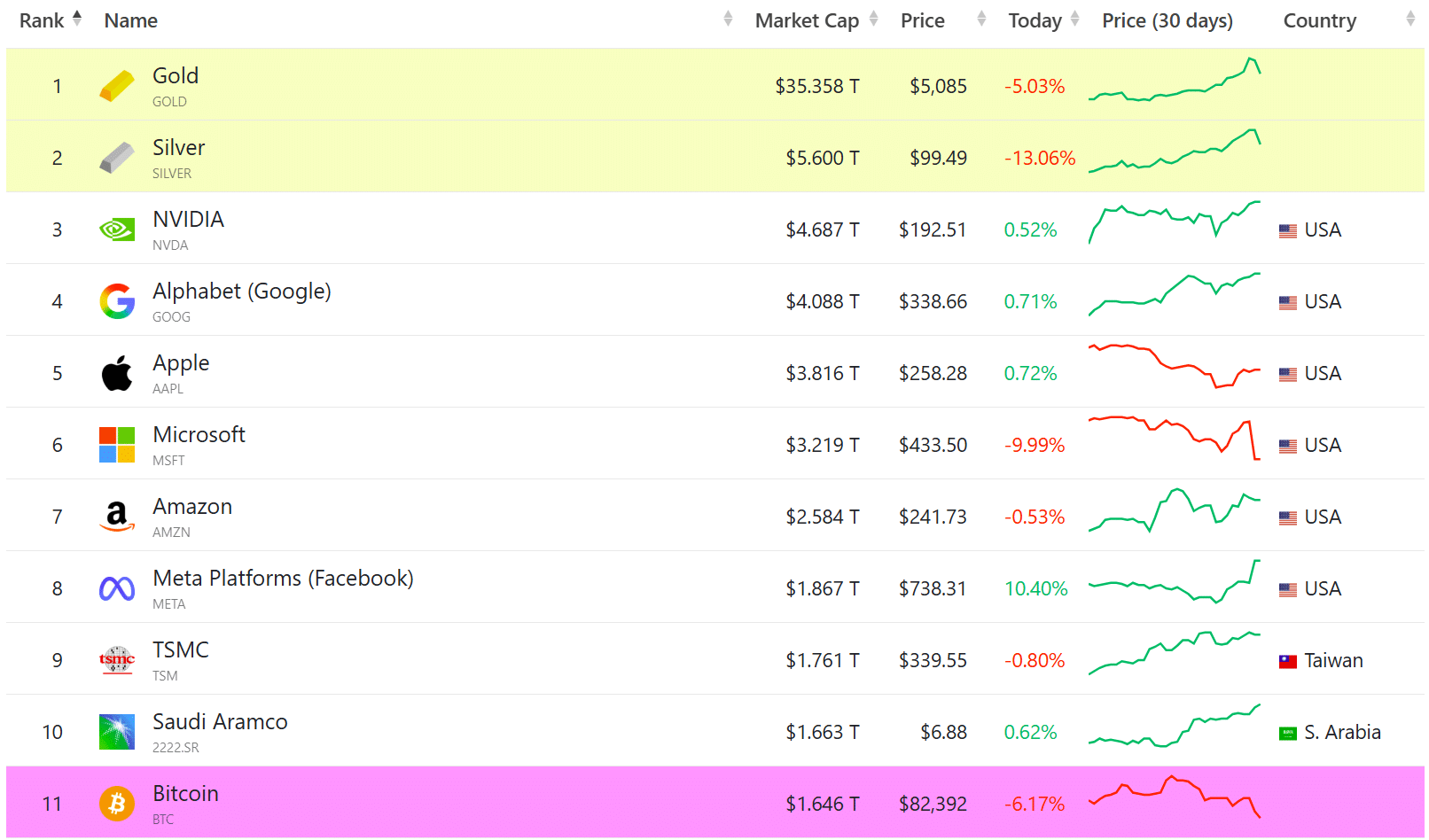

Bitcoin has fallen out of the top 10 global assets by market capitalization, dropping to 11th place amid a major downturn in digital asset markets.

The leading crypto asset’s market cap has declined to approximately $1.67 trillion, placing it behind Meta Platforms at $1.86 trillion, TSMC at $1.76 trillion, and Saudi Aramco at $1.66 trillion, according to CompaniesMarketCap.

Bitcoin was trading at around $87,500 at press time, following a broad risk-off move that hit global markets on Thursday, CoinGecko data shows.

The total crypto market capitalization has fallen to approximately $2.9 trillion, reflecting a 5% loss over 24 hours.

Despite the ranking decline, a recent survey indicates institutional investors view Bitcoin as undervalued at current levels.