Bitcoin miners unload their reserves at fastest pace in over one year, data shows

Despite a broad crypto downturn, 87% of Bitcoin holders maintain profits.

Bitcoin (BTC) miners have offloaded over 30,000 BTC in June so far, roughly equivalent to $2 billion, according to IntoTheBlock’s “On-chain Insights” newsletter. This is the fastest pace of miners’ sell-off in over one year.

The halving is believed to be a significant factor in this trend, as it has led to reduced profit margins for miners and prompted them to increase their sales. Additionally, a noticeable decrease in Bitcoin’s hash rate was witnessed, dropping by about 15% over the last month, highlighted the analysts at IntoTheBlock.

In a parallel development, the German government has begun to liquidate Bitcoin previously seized from a piracy website. A Bitcoin address linked to the German government has recently moved 6,500 BTC, valued at around $420 million, to centralized exchanges, indicating a probable sale of these assets.

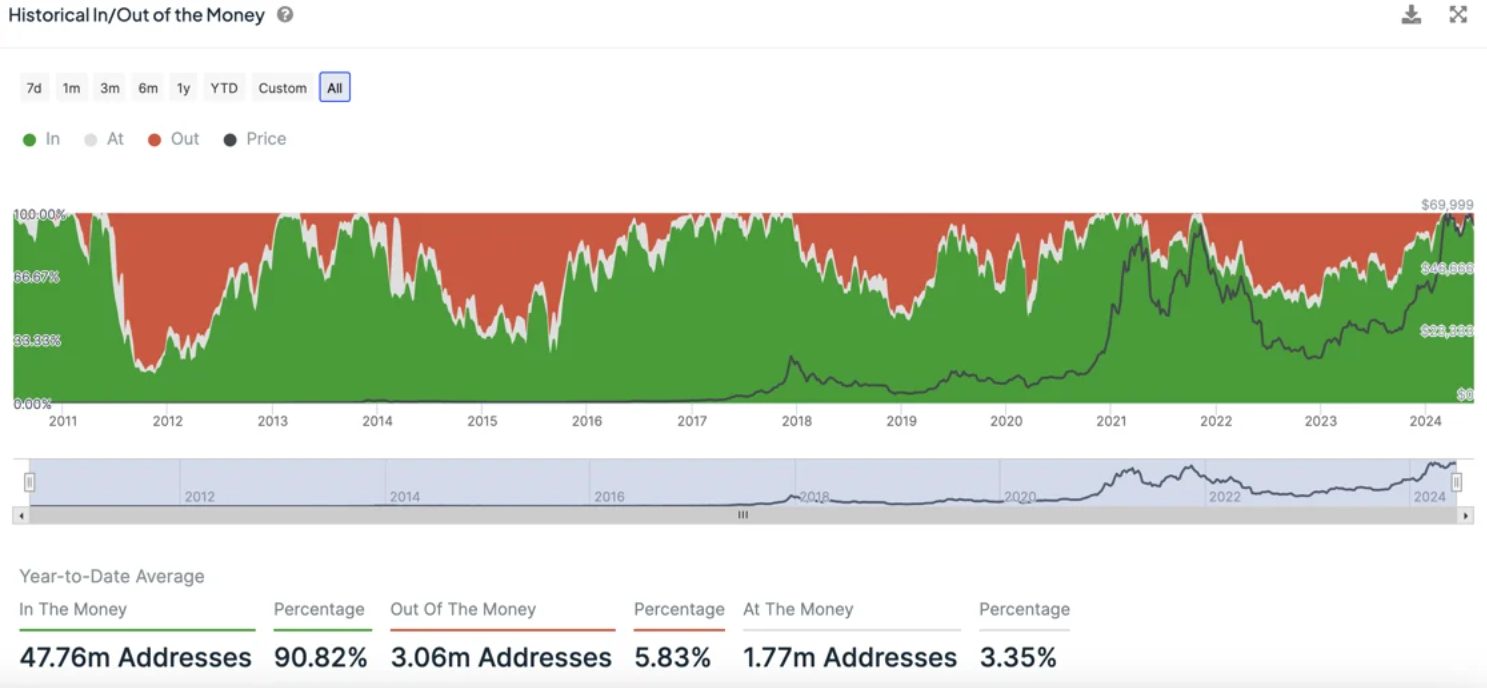

Notably, despite the recent market movements and sell-offs, the majority of Bitcoin holders are still seeing profits, with 87% of them remaining in the green. Furthermore, Bitcoin has strengthened its position, achieving a three-year high in market dominance while other crypto have fallen more sharply in value.

The sentiment in the crypto market has taken a downturn, with many crypto assets languishing well below their all-time highs.

Nevertheless, while summer typically sees reduced activity in the crypto space, the anticipation surrounding the launch of Ethereum ETFs may introduce a new dynamic to the market, conclude IntoTheBlock analysts.

Earn with Nexo

Earn with Nexo