Bitcoin Poised to Retrace as Whales Go on Selling Spree

The selling pressure behind Bitcoin appears to be accelerating over the past week, suggesting that a retracement will occur before the uptrend resumes.

Bitcoin went through an impressive uptrend over the past week, pushing the price up nearly 11.5%. The pioneer cryptocurrency went from a low of $10,530 on Oct. 8 to recently trade at a high of $11,740.

Now, multiple on-chain and technical indexes suggest that a correction is underway.

Institutional Money Pours in While BTC Whales Dump

Bitcoin’s macro backdrop looks exceptional, and every day it seems to get better.

Another multi-billion dollar company, Stone Ridge, revealed that it had purchased roughly 10,000 Bitcoin, worth more than $100 million. The assets management firm joins over 15 publicly traded companies that are holding cryptocurrencies on their balance sheets.

The rising interest among institutional and retail investors in this new asset class is a positive development for the entire industry. Trading veteran Peter Brandt believes that such a spike in demand will be the catalyst that ignites a new bull market in this sector.

Meanwhile, multinational financial services corporation Fidelity maintains that the capital influx will continue to accelerate as more investors familiarize themselves with crypto via social media platforms.

“As this new wave of retail investors familiarizes themselves with these channels, some of their attention will undoubtedly flow to Bitcoin and other digital assets,” reports Fidelity.

As more market participants turn their attention to crypto, it seems like Bitcoin whales have enjoyed the recent price action to offload some of their holdings.

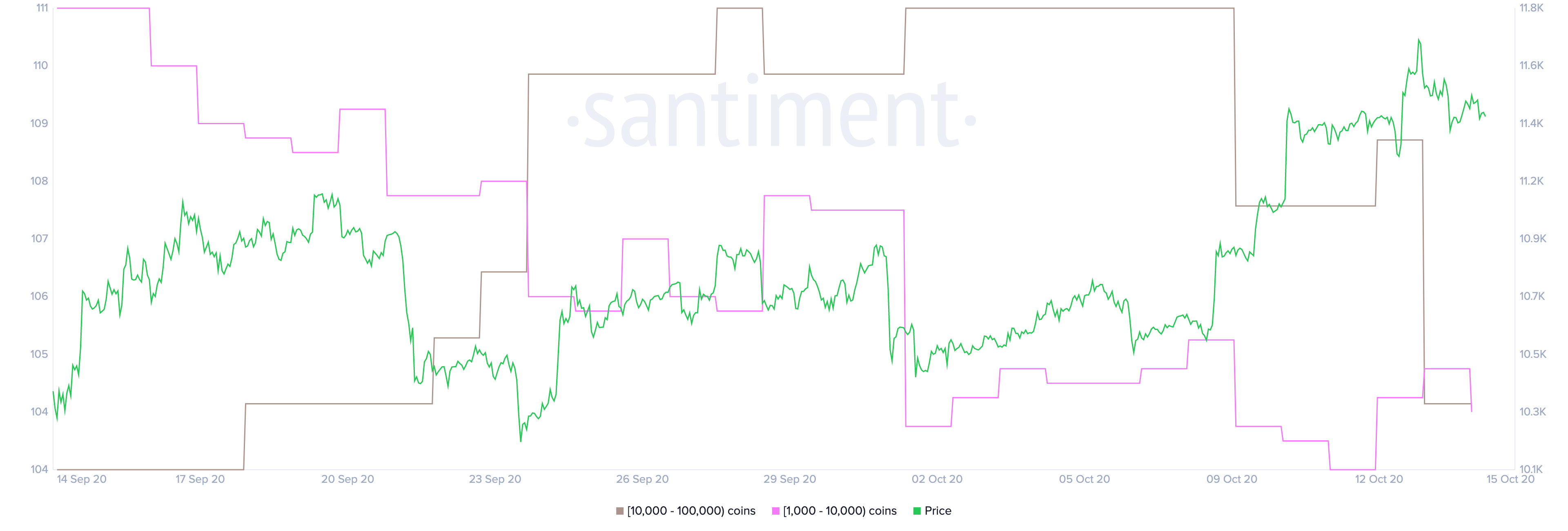

On-chain data reveals that the number of addresses with 1,000 to 100,000 BTC is dropping rapidly while prices trend upward. Since Oct. 8, nearly ten whales have left the network or redistributed their tokens.

This sort of bearish divergence between prices and the number of BTC whales on the network is concerning.

The increasing sell pressure may suggest that the flagship cryptocurrency is poised for a wild downward ride before it returns to new yearly highs.

On the Cusp of a Steep Correction

When looking at the TD sequential indicator, this pessimistic thesis holds.

This technical index recently presented a sell signal on Bitcoin’s 1-day chart. The bearish formation developed in the form of a green nine candlestick.

A further increase in the sell orders by BTC whales may help validate the TD setup scenario. If this were to happen, the bellwether cryptocurrency would likely pull back for one to four daily candlesticks before the uptrend resumes.

Such downswing could see BTC lose most of the gains incurred over the past week.

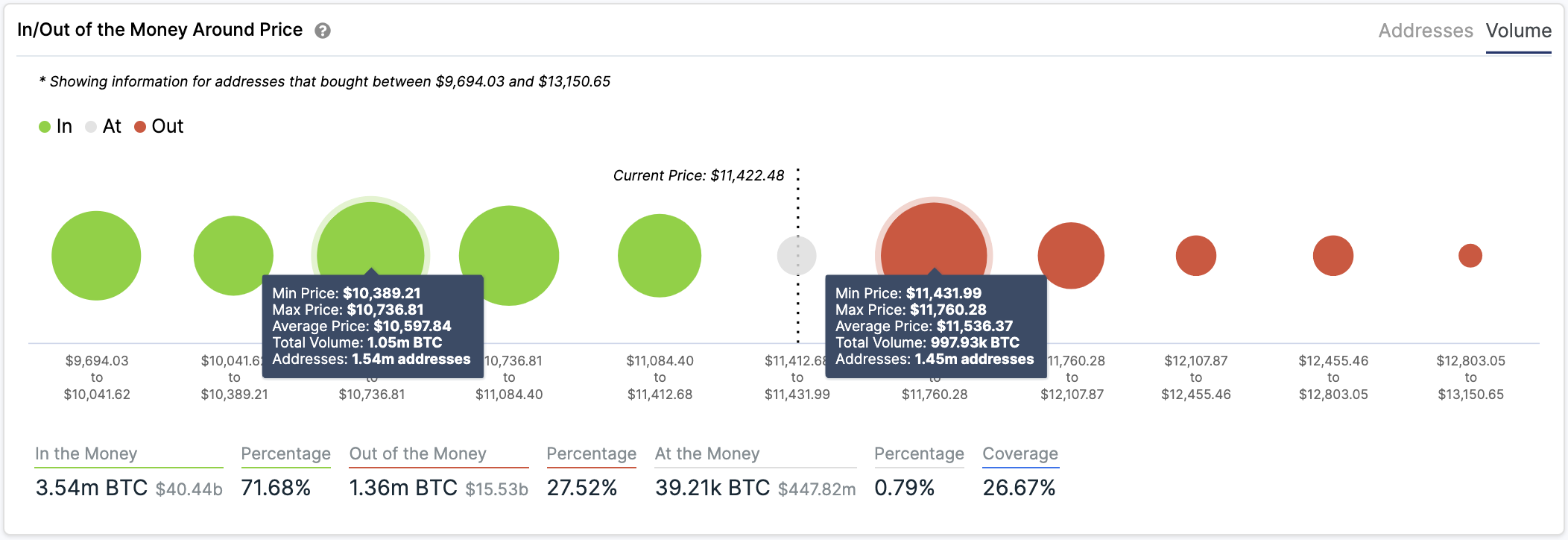

Indeed, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that the most significant support level underneath Bitcoin lies between $10,400 and $10,740.

Here, approximately 1.5 million addresses had previously purchased more than 1 million BTC.

Such an important area of interest may serve as stiff support that keeps falling prices at bay.

Given the high demand seen by institutional and retail investors in the last few weeks, the bullish outlook cannot be taken out of the question.

The IOMAP cohorts show that Bitcoin faces a major supply barrier ahead as 1.5 million addresses hold nearly 1 million tokens between $11,400 and $11,760. If the pioneer cryptocurrency manages to slice through this hurdle, it will jeopardize the bearish thesis previously explained.

There is no significant resistance above this zone that will prevent prices from rising towards new yearly highs.