Bitcoin slides below $88K, triggering $135M in crypto long liquidations in the past hour

Volatility returns to the crypto sector as market sentiment shifts to fear, raising stability concerns among traders.

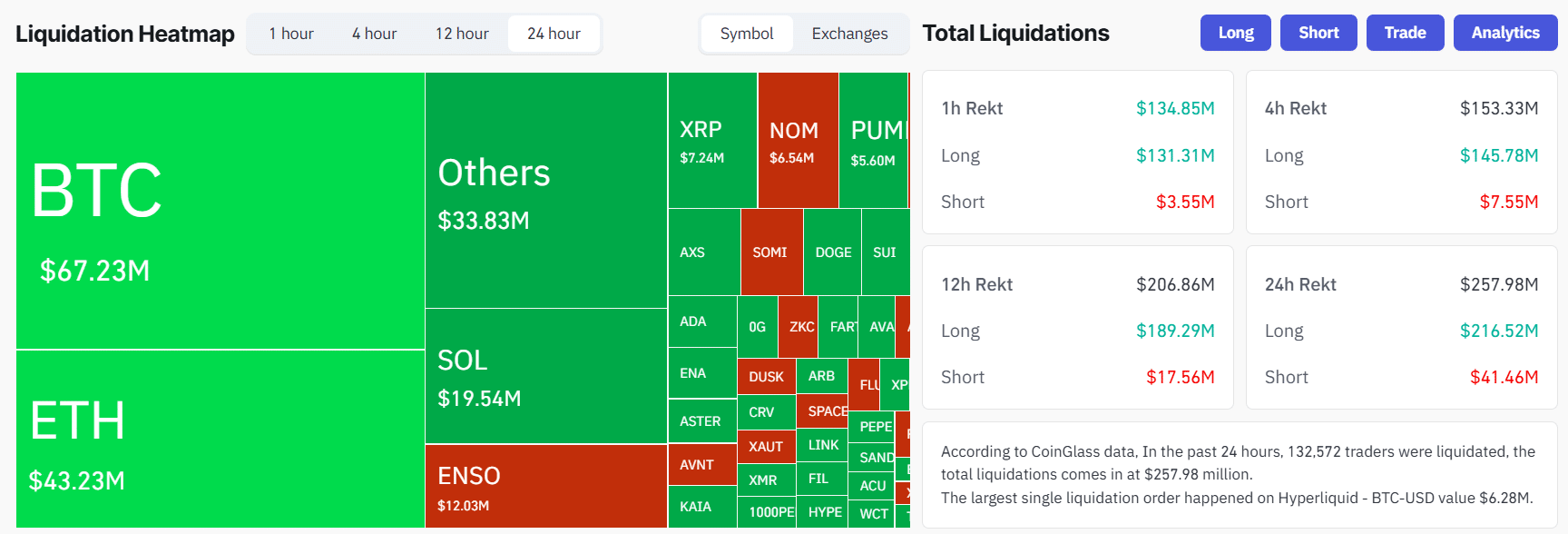

Bitcoin dropped under $88,000 on Sunday, erasing around $135 million in crypto longs in the past hour amid renewed selling pressure across digital asset markets.

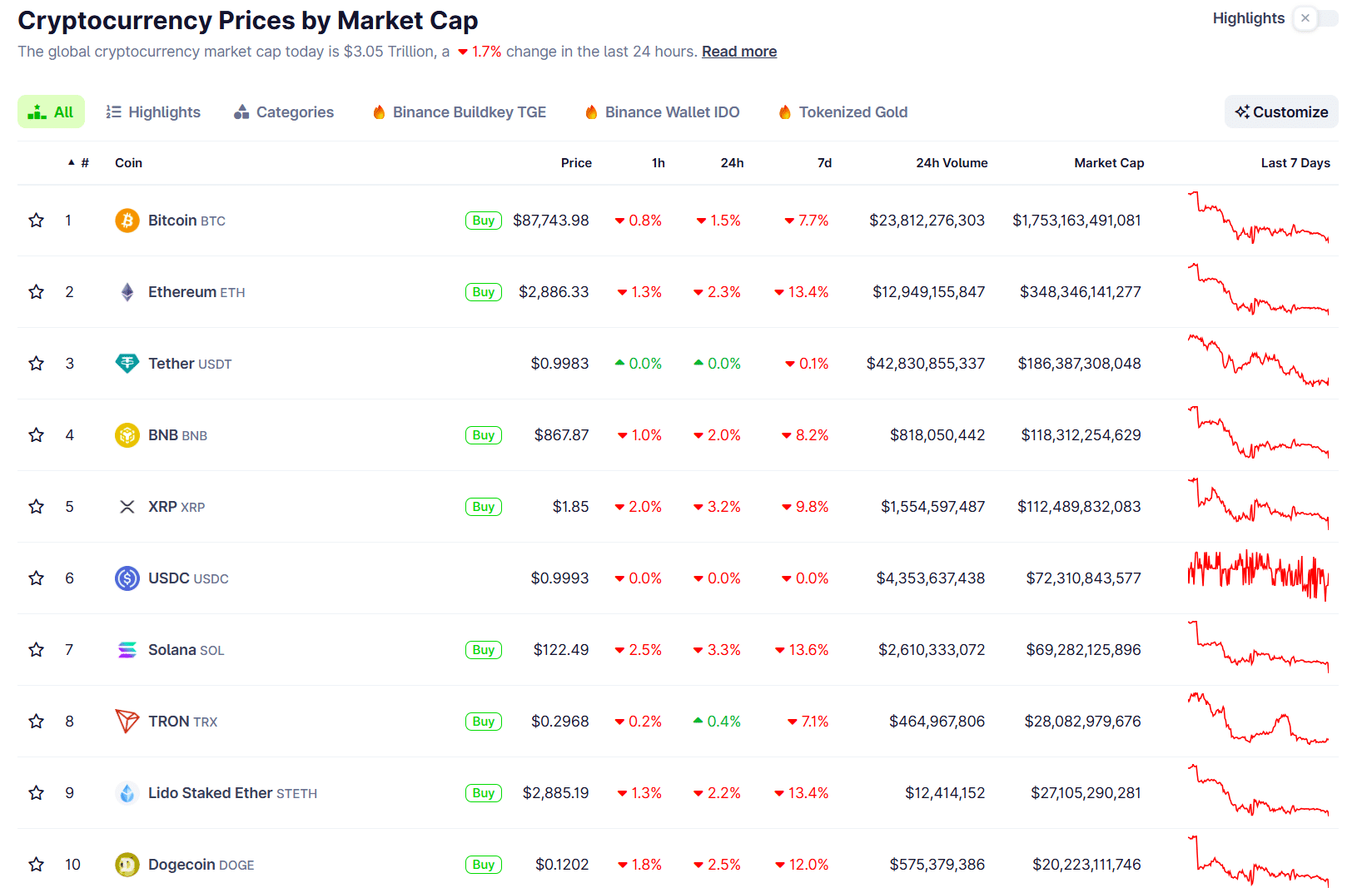

The decline comes after Bitcoin retreated from a weekly high above $92,000 reached on January 19. The leading crypto asset traded at $87,743 at press time, down 1.5% on the day and nearly 8% over the past week, per CoinGecko.

Market sentiment has turned fearful, with the Fear & Greed Index registering a score of 25.

Technical analysts point to a false breakout of the $95,938 resistance level as a catalyst for the current downtrend. Without reversal signals, Bitcoin may test support at $86,561, with some forecasts suggesting a potential slide toward $80,000.

The global crypto market cap has fallen to $3 trillion amid the broader selloff, which has also affected major altcoins such as Ethereum, Solana, and XRP.

Ethereum and BNB declined by more than 2% in the past 24 hours, as XRP and Solana each slid over 3%.

Despite the weekend selloff, crypto bulls showed little sign of pulling back. Michael Saylor, executive chairman of Strategy, the largest corporate holder of Bitcoin, hinted at another potential purchase.

Unstoppable Orange. pic.twitter.com/RUyVxhn38b

— Michael Saylor (@saylor) January 25, 2026

The company currently holds 709,715 BTC valued at more than $62 billion following last week’s acquisition.

Earn with Nexo

Earn with Nexo