Bitcoin miners accumulate as key indicator hints at price rally

Bitcoin nears $70,000 as miners' accumulation suggests market confidence.

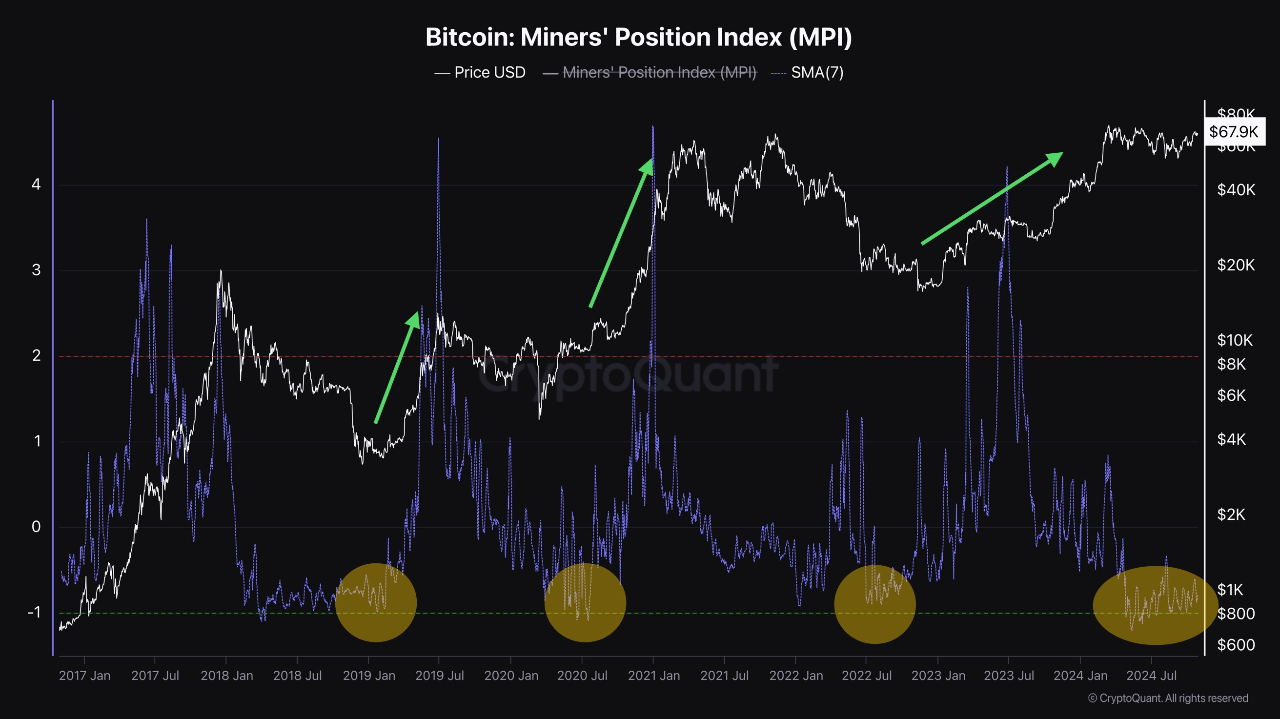

Bitcoin miners hold as the Miner Position Index (MPI) indicator points to a potential price rally. The MPI, which tracks miners’ Bitcoin movements to exchanges, is signaling strong accumulation, according to a CryptoQuant-verified author.

This pattern has been a consistent marker of price rallies in previous cycles, and the current MPI reading shows miners accumulating rather than liquidating. When miners choose to hold rather than sell, it suggests optimism and a potential price surge.

Historically, a low MPI followed by a rebound has often set the stage for substantial Bitcoin price increases. Currently, MPI remains low, indicating that miners are content with holding their positions.

In each cycle, miners generally sell Bitcoin and may pause some operations to cover expenses, particularly as halving nears.

When Bitcoin’s price stagnates, however, they often begin accumulating or holding rather than selling. As the bull run’s latter phase kicks in, they slowly release Bitcoin back into the market, preparing for the next cycle.

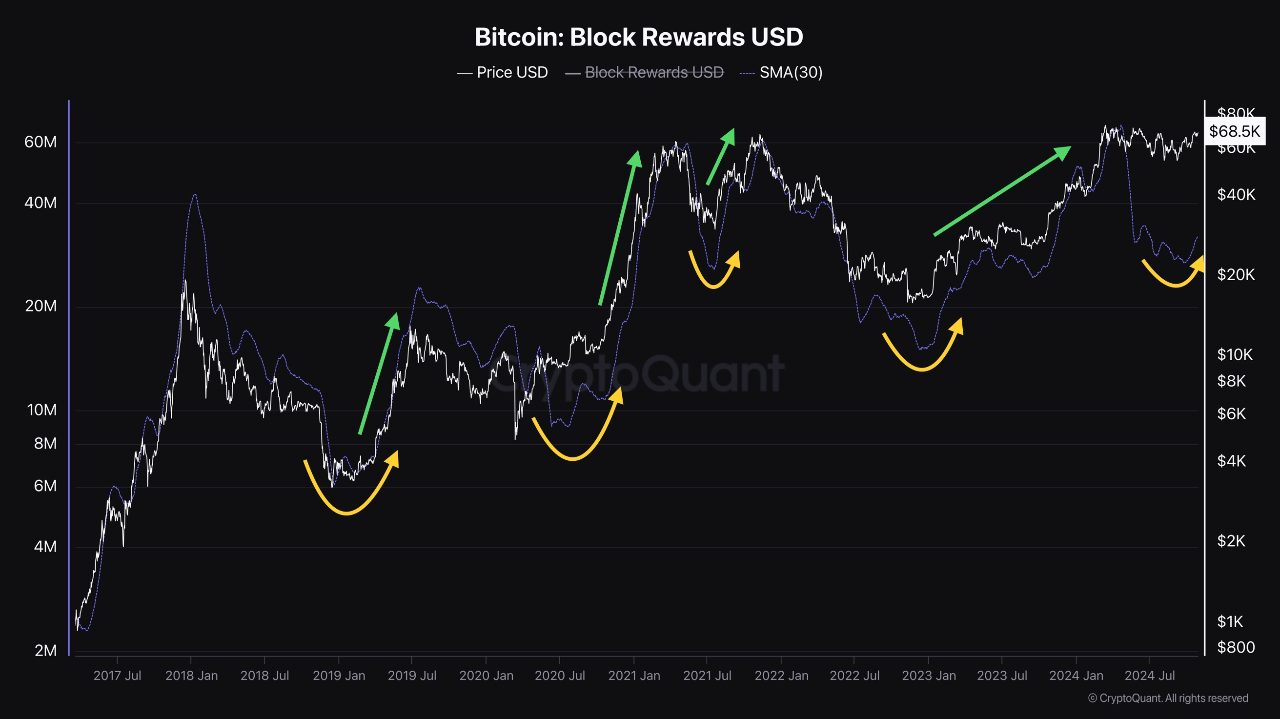

In addition to miners holding BTC, block rewards have shown a steady rebound, indicating a rise in transaction activity on the network.

This is a promising indicator, as heightened network activity often correlates with increased demand and price appreciation. With block rewards ticking up, the data suggests positive miner sentiment and potentially growing market interest.

Bitcoin’s price today reached $69,900, strengthening the bullish outlook as it nears the $70,000 mark. Analysts suggest this could soon become a new support level, with the potential for further gains as the year ends and the November 5 election approaches.