Bitcoin must hold $60,600 as support for further upside, says trader

While Bitcoin fights to hold key support, spot ETFs see $195 million inflow, led by BlackRock's IBIT with $157.6 million increase.

Bitcoin (BTC) broke $62,000 on Aug. 8 and now needs to hold the $60,600 level as support on the daily chart to try a revisit to $65,000, according to the trader identified as Rekt Capital on X (formerly Twitter).

The upward movement was likely triggered by BTC chasing a CME gap between $59,400 and $62,550. A CME gap is the difference between the closing and opening prices of futures contracts traded on the Chicago Mercantile Exchange.

“Bitcoin has successfully broken above $60600. Dips into $60600, if any at all, would constitute a retest attempt of that level. Generally, continued stability above $60600 and BTC will be able to revisit the $65000 (blue) over time,” stated the trader.

Moreover, Bitcoin has reclaimed its weekly channel between $57,000 and $67,000, while testing the previous all-time high on the monthly timeframe.

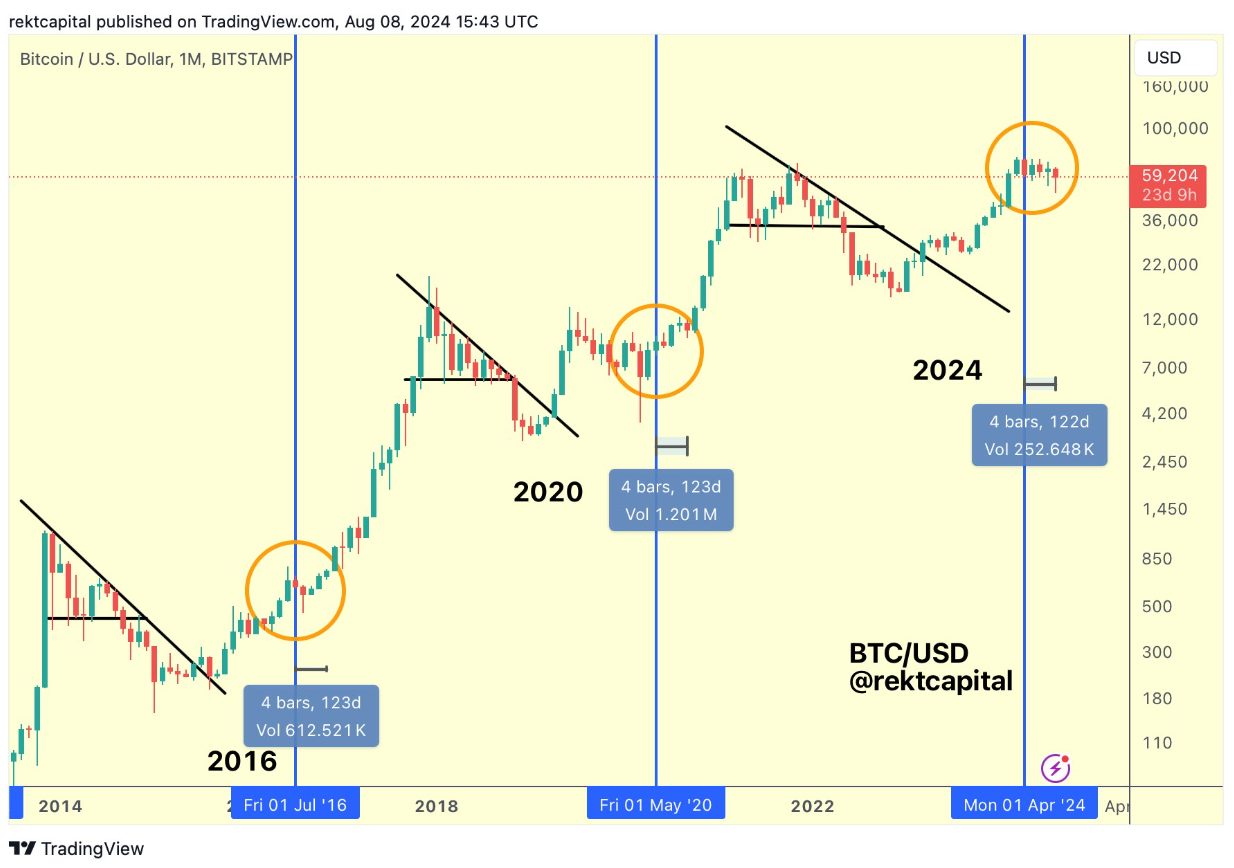

Notably, the “post-halving re-accumulation phase” might be in its final stretch, added Rekt Capital in another post. In an annotated chart, he highlighted that the period is reaching its end.

Nevertheless, the short term still offers a significant challenge for Bitcoin, as it must close above its August downtrend to confirm the end of retesting and the resume of an upward trend.

ETF inflows have resumed

After starting the trading week with two consecutive days of outflows, spot Bitcoin exchange-traded funds (ETFs) registered two consecutive days of inflows.

On Aug. 8, these products had nearly $195 million in cash flowing to them, with BlackRock’s IBIT taking the lead with a $157.6 million leap in assets under management. WisdomTree’s BTCW also saw significant inflows of $118.5 million.

Other ETFs helping bolster assets under management growth were Fidelity’s FBTC, ARK 21Shares’ ARKB, and VanEck’s HODL, which saw inflows of $65.2 million, $32.8 million, and $3.4 million, respectively.

Meanwhile, Grayscale’s GBTC continues to bleed, with $182.9 million leaving the fund yesterday.

Earn with Nexo

Earn with Nexo