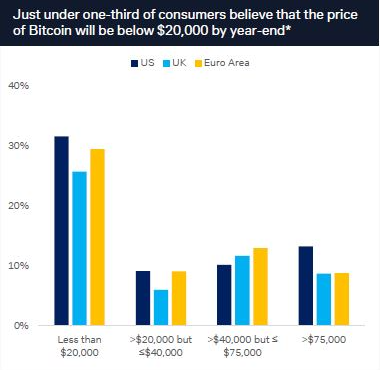

Deutsche Bank customers see Bitcoin under $20,000 by year-end, survey shows

Survey shows deep divide on Bitcoin's value, with 38% predicting its demise.

A recent Deutsche Bank survey indicates that around 30% of its consumers see Bitcoin (BTC) closing 2024 below $20,000, as reported by Bloomberg. The survey captured insights from the bank’s customers located in the UK, Euro area, and the US, where the percentage of customers predicting a bitter end for BTC this year is over 30%.

However, around 15% of Deutsche Bank’s US customers believe that Bitcoin might have a yearly closure above $75,000, also the largest percentage on this prediction. This might be seen as a polarized view by US investors, where the landscape was shaken by the approval of spot BTC exchange-traded funds (ETFs) in January.

According to asset management firm CoinShares’ latest report on crypto funds’ weekly flows, the US is the region with the most investments in these investment products, with over $14 billion allocated to them in 2024 alone. Most of this significant inflow movement can be tied to Bitcoin ETFs.

Moreover, the enthusiasm surrounding spot Bitcoin ETFs is seen as responsible for BTC reaching a new all-time high at $73,737.94, which is 67% up from 2024’s opening price. The upcoming halving might propel Bitcoin prices even further this year.

Despite the skepticism, 40% of respondents maintain confidence in Bitcoin’s longevity, while 38% foresee its disappearance. Notably, less than 1% dismiss crypto as a passing trend.

Earn with Nexo

Earn with Nexo