Bitcoin faces selling pressure nearing halving event: Bitfinex report

Selling pressure from long-term and short-term holders contributes to bitcoin price fluctuations nearing the next halving event.

Bitcoin (BTC) has shown considerable price volatility recently with fluctuations around the $70,000 level as holders realize profits, according to the latest “Bitfinex Alpha” report. Both short-term (STH) and long-term holders (LTH) are shedding a part of their positions as the next halving event approaches.

“Bitcoin is currently experiencing a consolidation phase, navigating a sideways range between $65,000 (range low) and $71,000 (range high). This movement indicates that the price is beginning to stabilize, even as the price fluctuates,” the report states.

Maintaining the BTC price above critical support zones of approximately $60,000 and $57,000 reduces the chance of major corrections and preserves short-term momentum, as highlighted by Bitfinex’s analysts. The $57,000 support aligns with metrics tracking active Bitcoin addresses and ETF flows.

The current phase presents an opportunity to implement dollar-cost averaging strategies and accumulate Bitcoin at potentially advantageous prices amid uncertainty, the report notes.

More short-term holders

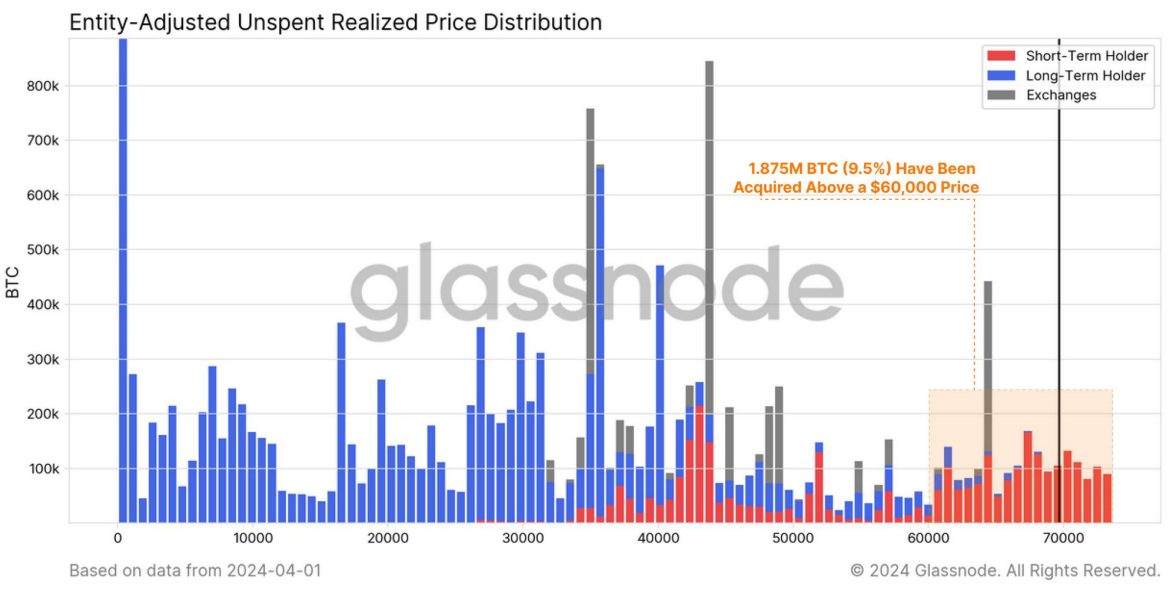

Moreover, the gap between STH and LTH has begun to narrow, as the latter group is selling part of their BTC holdings to secure significant unrealized profits. The peak of 14.9 million BTC held by LTHs was seen in December 2023, and it went down by approximately 900,000 BTC as of last week.

The report points out that the outflows from Grayscale Bitcoin Trust ETF (GBTC) account for about 32% of this reduction, amounting to around 286,000 BTC. Meanwhile, the supply held by STHs has seen an increase of 1.121 million BTC.

“This rise not only offsets the distribution pressure from LTHs but also indicates additional acquisition of about 121,000 BTC from the secondary market, including exchanges,” underscores the report.

The short-term holders encompasse new spot buyers and include approximately 508,000 BTC currently held in spot Bitcoin exchange-traded funds (ETFs), excluding GBTC. This distribution highlights the active engagement of STHs at higher price levels and reflects the evolving dynamics of Bitcoin ownership, particularly in the context of recent market activities and the growing influence of institutional investments through spot ETFs.