Saylor says Strategy engages MSCI as index shakeup threatens major outflows

Possible exclusion from major indices highlights volatility risks for stockpilers of digital assets and could reshape passive investment flows.

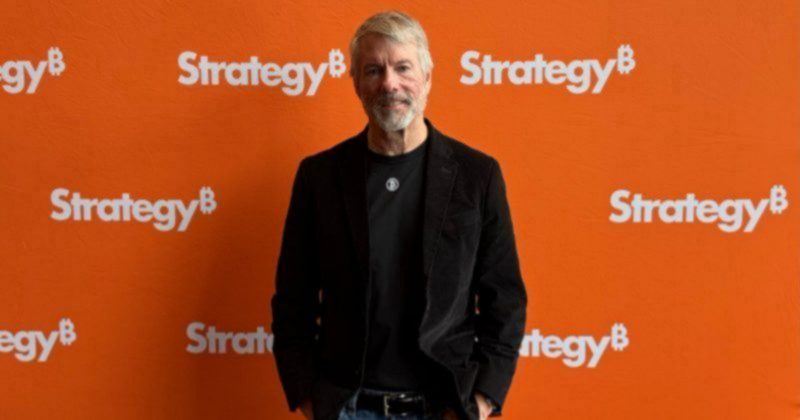

Strategy is discussing with MSCI the possibility of being excluded from its indices as the index provider is expected to decide whether to expel the Bitcoin-heavy company from its major benchmarks on January 15, Michael Saylor told Reuters.

Analysts at JPMorgan estimate that such exclusion could trigger massive investment outflows, potentially amounting to $8.8 billion. Strategy’s inclusion in the MSCI USA and MSCI World indices has been a key source of investor demand through ETFs and other benchmark-tracking products.

Removal would also affect the company’s future ability to raise funds.

Despite confirming the dialogue with MSCI, Saylor questioned the scale of potential outflows projected by JPMorgan.

Strategy stock (MSTR) has been highly volatile amid market instability and a sharp downturn in Bitcoin. The cryptocurrency was hovering around $93,000 at press time, down 26% from its all-time high, according to CoinGecko.

Shares of Strategy jumped nearly 6% on Tuesday as Bitcoin rebounded, with the rally extending into pre-market trading on Wednesday.

The stock is still down 33% over the past month, with worries over potential MSCI index removal dragging on sentiment.