Shutterstock cover by F-Focus by Mati Kose

Bitcoin Is at Risk as Support Weakens

Bitcoin has kicked off the week in bearish mode, signaling that it could drop lower.

Bitcoin has reversed to a critical support level that will determine where it is heading next. Although this demand zone appears to be weakening over time, there is one reason to remain optimistic about the top cryptocurrency.

Bitcoin at a Make-Or-Break Point

Bitcoin has shed most of the gains it made last week, raising questions over its bullish narrative.

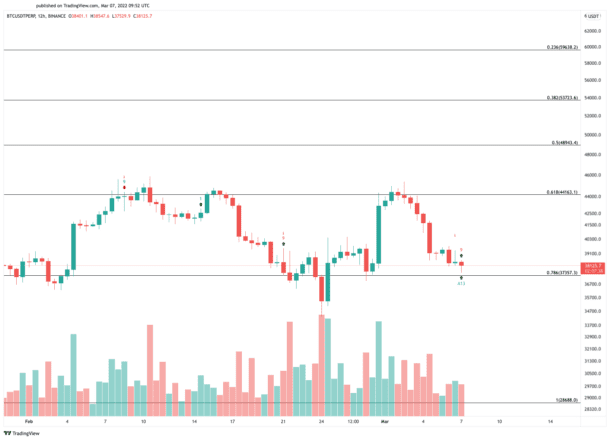

The leading cryptocurrency has retraced by 17.24% since Mar. 2, losing more than 8,000 points in market value. The $37,500 support level now appears to be acting as a strong foothold where prices must hold to avoid a significant crash. The Fibonacci retracement indicator, measured from the low of $28,700 on May 19, 2021 to the all-time high of $69,200 on Nov. 10, 2021, suggests that breaking the interest zone at $37,500 could result in a downswing to $28,700.

Still, there is a reason to remain optimistic about Bitcoin’s growth potential. The Tom DeMark (TD) Sequential indicator is currently presenting a buy signal on Bitcoin’s 12-hour chart. The bullish formation developed as a red 9 candlestick, which is indicative of a one to four 12-hour candlestick upswing or the beginning of a new upward countdown.

A spike in buying pressure around the current price levels could help validate the optimistic outlook, preventing Bitcoin from a catastrophic correction. If buy orders increase, the asset could have the strength to rebound to $40,000 or even break through the $45,000 supply barrier to confirm the beginning of a new uptrend.

Given the importance of the $37,500 support level, a decisive close below it could indicate that Bitcoin is turning bearish.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.