Shutterstock cover by MJgraphics

Bitcoin Shows Red Flags as Whales Sell En Masse

Bitcoin is threatening to break below support after recording a spike in selling pressure from large whales.

Bitcoin spells trouble as traders continue piling up long positions while a few large whales have left the network. Still, BTC’s future price action depends on its ability to hold above crucial support.

Bitcoin at Vital Support

Bitcoin could be bound for further losses after reaching a pivotal point.

The pioneer cryptocurrency has seen its price decline by nearly 11%, losing over 4,000 points over the past week. The downswing has pushed BTC to a critical area of support that appears to be weakening over time. Still, traders remain hopeful about Bitcoin’s future price action.

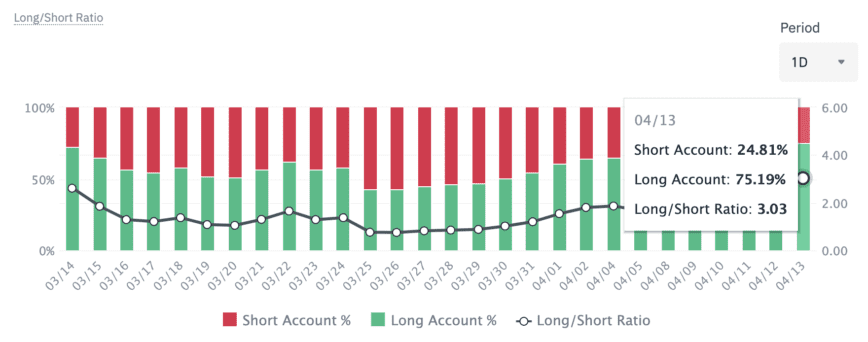

On Binance Futures, the BTC-USDT Long/Short Ratio continues to surge, hitting a 3.03 ratio on Apr. 13. Roughly 75.2% of all accounts on the world’s largest crypto derivatives exchange by trading volume are net-long on Bitcoin.

Optimism among traders remains high because BTC appears to be holding around the lower boundary of a parallel channel that formed on the daily chart in mid-January. Price history shows that each time Bitcoin has reached this support level, a rebound to the channel’s middle or upper trendline tends to occur.

Similar price action could see the flagship cryptocurrency surge toward $45,000 or even $50,000.

Still, the growing confidence among traders can be considered a negative sign. More importantly, as long positions continue piling up, it creates the conditions for a long squeeze.

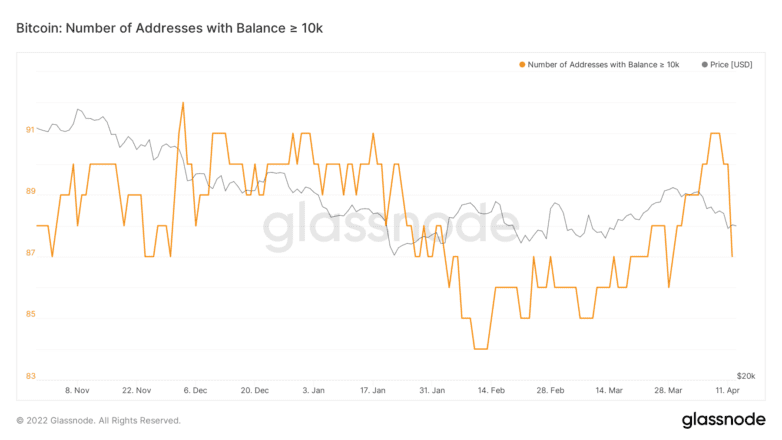

Such a pessimistic outlook is further validated when looking at whales’ behavior. On-chain data shows that the number of addresses on the network holding more than 10,000 BTC has declined by more than 4.60% in the last four days. At least four large whales have sold or redistributed their tokens within this short period.

Even though the spike in downward pressure may seem insignificant at first glance, each of these addresses has gotten rid of more than $400 million worth of Bitcoin.

For this reason, it is imperative to pay close attention to the channel’s lower boundary at $39,400. A decisive daily candlestick close below this vital demand level could create a liquidations cascade that sends Bitcoin further down. BTC would then try to find support at around $35,000 or even $30,000.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.