Bitcoin Surges Ahead of Halving, Aiming for $10,500

Bitcoin is back in the spotlight after posting $600 in gains today. Now, it seems poised to hit $10,500 based on several different indicators.

Bulls have firm control over Bitcoin’s price action. Indicators show BTC’s trend is expected to continue towards $10,500.

Bitcoin Is Breaking Loose

Bitcoin began surging over the last few hours to hit a high of $9,800 despite bearish market conditions. The upswing allowed it to demolish the massive supply wall that was at $9,600.

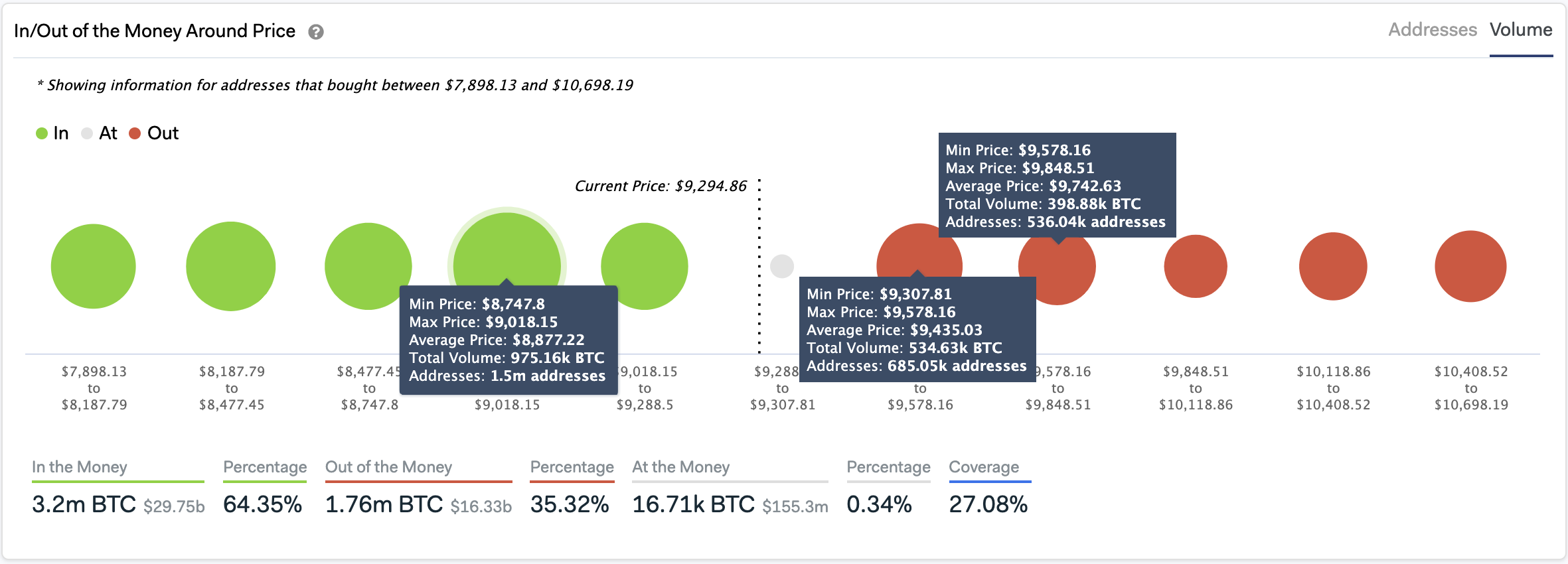

Here, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model estimated that more than 1.2 million addresses were holding over 930,000 BTC.

Now that the flagship cryptocurrency sliced through resistance, there is only one way to go—up.

If the buying pressure behind the bellwether cryptocurrency continues rising, the next barriers to watch out for are the mid-Feb. high and the 127.2% Fibonacci retracement level. These hurdle points sit at $10,500 and $10,900, respectively.

Nonetheless, it is important to remember that the erratic behavior seen recently could be part of a setup. Large holders could be pumping Bitcoin before the halving to then dump their holdings on unaware investors.

Will Whales Dump their BTC?

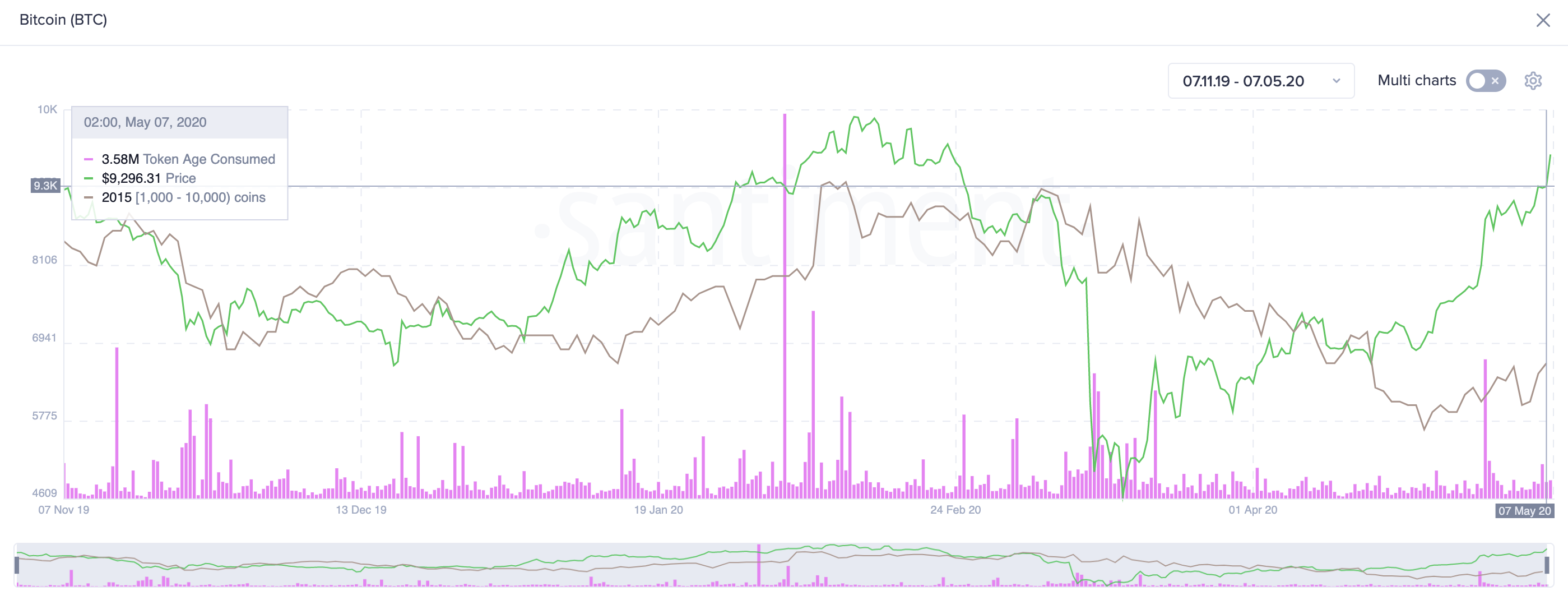

There has been a noticeable change in the way large holders with 1,000 to 10,000 BTC have been behaving. These big players were slowly decreasing their positions, but over the last few days, they started accumulating. The sudden change could signal that market makers are indeed preparing to dump at the top, according to Santiment.

The crypto data insights platform affirmed that a similar behavior appears to be happening with idled coins, which are all of a sudden on the move. The purpose behind it may be “to sell to the newcomers.” Those who get involved in the “halvening rally” might find themselves purchasing BTC from the big whales.

This type of market manipulation strategy has been seen in previous halvings. Therefore, those who panic buy must remain cautious that prices don’t reverse against them.

The $9,440 support level now has a lot of significance to Bitcoin’s rise. This support barrier must rebuff a drop to maintain the continuity of the trend. Otherwise, it would be very likely that the flagship cryptocurrency will reverse and liquidate those who were late to the party.

If this were to happen, the next important support level sits around $8,300.