The 800lb Shitcoin: Why Bitcoin SV Market Cap Is Pure Fantasy

Market cap is the blockchain equivalent of an online horoscope. Besides being a meaningless metric, it puts total shitcoins in the top ten.

Market capitalization is the blockchain equivalent of an online horoscope. It’s total bollocks, but it holds a powerful fascination. And despite repeatedly pointing out the fallacies of the metric, we’re not immune to fixating on it ourselves: every time there’s a drop, we check the charts for the latest flippening.

But new data suggests that cryptocurrency market cap may finally be a metric worth noting. It’s not as intuitive as the method used by Coinmarketcap, but neither does it appear to be utter bunk.

Here’s the problem with market capitalization, at least when it comes to gauging a currency’s value. When CMC calculates the Bitcoin market cap, they do a straightforward multiplication: latest market price times the total number of existing coins.

That means market capitalization is as accurate as exchange prices: in other words, not at all.

If you were John McAfee, or a bet-losing Roger Ver, all you’d need to do is market buy a few satoshis for a hundred dollars each on a big exchange – and hey presto! Your currency has a multi-trillion-dollar market cap!

And this doesn’t even include the vast number of lost, missing, or simply dormant coins that are not impacting the crypto-economy.

The problem is worse for forks: their market capitalization includes all possible coins, even those that have not been claimed. For Bitcoin Cash (BCH) that’s not a huge issue: 9.3 million BCH have been active since Block 478558, when the fork occurred, compared to 9.8 million BTC coins.

But it’s a huge distortion for Bitcoin SV, where the capitalization is calculated on the premise that there are 17 million BSV coins just waiting for the right buyer. Actual data calculated through the Blockchair API show that, of the unspent outputs existing on BSV at the time of the fork, only 4.2 million have actually been activated. BCH didn’t fare much better, with 5.4 million coins being spent.*

That means that one in five BCH hodlers are too lazy to split their wallets, even for free money, if that free money is coming from Craig Wright. Counting the number of active addresses makes the same point in a different way:

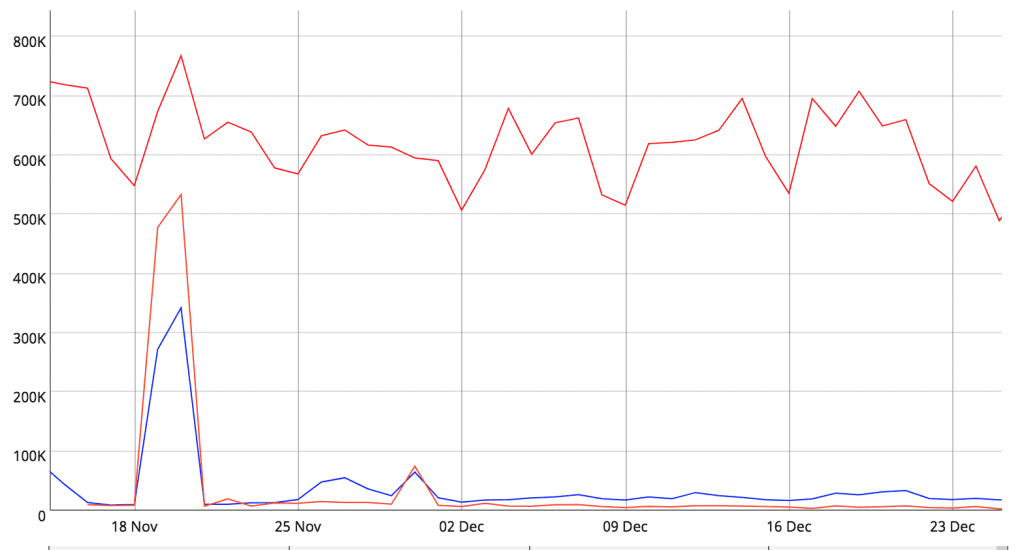

Active addresses for BTC (red), BCH (blue) and BSV (orange).Except for two spikes, the number of active BSV wallets range between a quarter to a half of BCH activity, and both were completely dwarfed by BTC. With less than a quarter of possible coins being activated, BSV’s ‘real’ market cap should lie somewhere between Maker and NEO.

CoinMetrics Realizes The Problem

Luckily, we’re not the only ones who find CMC’s data… incomplete. CoinMetrics, which broke the story of the invisible BTCP Premine, has made a business of accurately measuring blockchain activity, and they’ve invented a new measure for crypto value.

The result is “realized capitalization,” a substitute for market capitalization which places more weight on recent transactions than on on older ones.

Transactions outputs in this measurement are valued according to the market price of their latest movement. According to CoinMetrics, “Its crux is to value different part of the supplies at different prices, instead of using the daily close as market cap does.”

The result looks something like this:

This is still an imperfect metric–the weighting system has been slow to catch up with the latest drops, giving BTC an improbably-high capitalization of $80bn.

So why is that?

The metric gives a historically-weighted capitalization for each Bitcoin transaction based on each coin’s latest movement. For example, Satoshi’s coins are valued at nearly $0, matching the price when when they were mined, but a recent bitcoin movement will be valued at current prices. Realized capitalization does have some distortions from the more traditional metric, but it does inject a measure of actual economic activity into cryptocurrency movements.

According to this metric, the squiggle on the right is Bitcoin SV–with a real value somewhere between Doge and Bitcoin Gold, at around $500M – a far cry from CMC’s suggestion that its market cap is $1.5bn.

Right now it only works for UTXO ledgers, like Bitcoin, but Coinmetrics says that it can be generalized to other blockchains “with some effort” For account-based currencies like XRP or Stellar, the realized capitalization metric would likely omit long-term escrows and unreleased tokens.

As always, caution is in order, especially when dealing with new metrics. Coins on a custodial exchange might change hands several times without changing their blockchain address, and some users might move coins between several wallets without transferring ownership.

All the same, the data appear to confirm what most of the crypto world already knew: that BSV is exactly one letter too long. Despite having a nominally high market cap, any serious metric would put Satoshi’s Vison very far outside the top ten.

The author is invested in Bitcoin, Bitcoin Cash and Bitcoin SV, which are mentioned in this article.

*Special thanks to Blockchair‘s Nikita Zhavoronkov for helping us with the API.