Shutterstock cover by 3Dsculptor

Bitcoin Tops $55,000 for the First Time in Five Months

Bitcoin continues advancing.

Bitcoin briefly surpassed $55,000 for the first time since mid-May today. On-chain data shows that BTC can post further gains if it holds above a crucial support level.

Bitcoin Turns Bullish

Bitcoin looks unstoppable.

BTC’s price has increased by nearly 8% in the last three hours. The leading cryptocurrency jumped to an almost five-month high above the $55,000 resistance level, putting its market capitalization back over $1 trillion. Currently, BTC is stabilizing above the $54,000 mark; the sudden bullish impulse liquidated more than $200 million worth of short positions in the market.

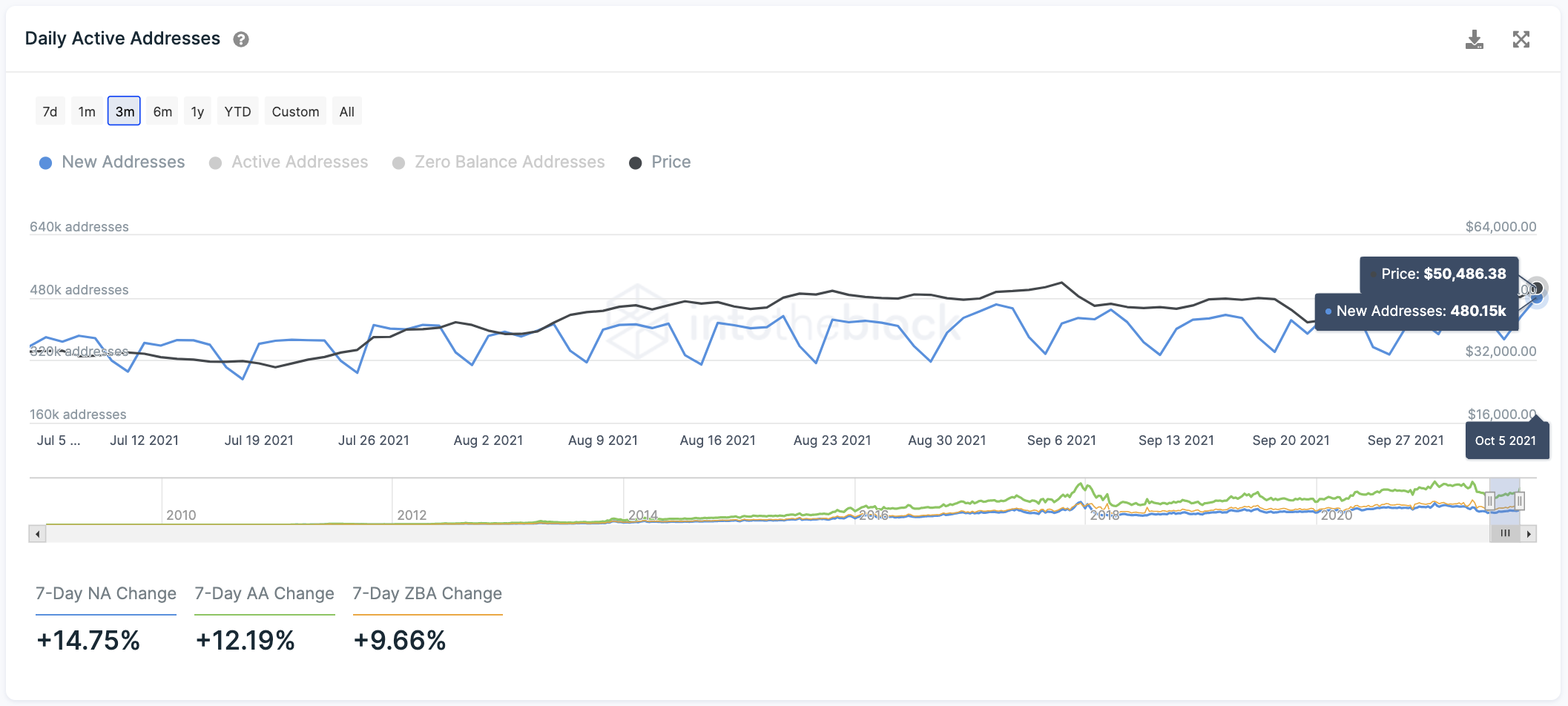

Bitcoin’s recent price action has not gone unnoticed. IntoTheBlock’s “Daily Active Addresses” model reveals that the number of new addresses created on the BTC network is steadily rising. The on-chain metric recently made a higher high of over 480,000 addresses per day calculated on a three-month trailing average.

A continuous increase in the number of new addresses created on the Bitcoin network is often considered one of the most accurate price predictors. Usually, a rising network growth leads to higher prices.

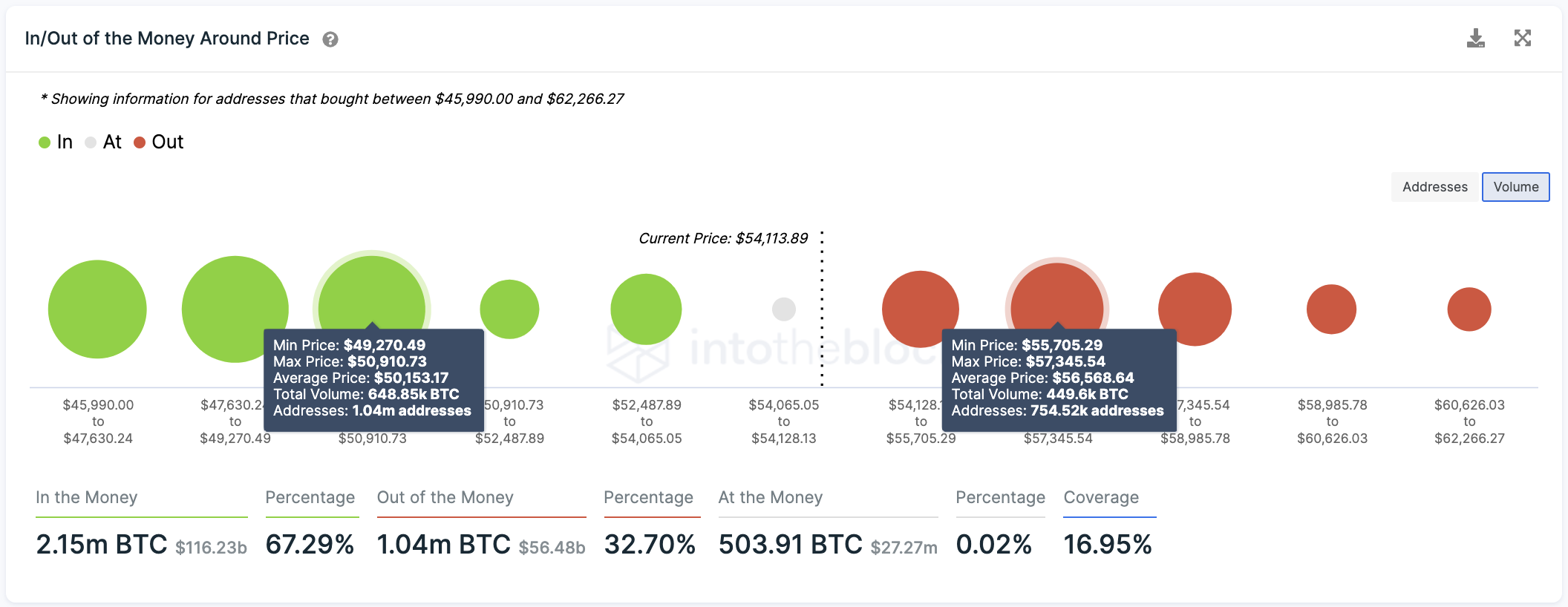

Although the outlook is bullish given the network activity, Bitcoin still faces a major resistance barrier ahead.

Transaction history shows that more than 750,000 addresses have previously purchased nearly 450,000 BTC between $55,700 and $57,350. Due to the significance of this supply barrier, the asset may need a daily candlestick close above this level to retest all-time high at $65,000 or enter price discovery mode.

It is worth noting that Bitcoin appears to be sitting on top of stable support. More than 1 million addresses bought roughly 650,000 BTC at an average price of $50,150. As long as this demand wall holds, the odds will significantly favor the bulls.

Earn with Nexo

Earn with Nexo