The Bitcoin Whitepaper In Under 1000 Words

Satoshi Nakamoto's ground-breaking Bitcoin whitepaper is explained in 875 pretty easy-to-understand words, and four key concepts.

Ten years ago, on October 31, 2008 an unknown person or entity called Satoshi Nakamoto published the revolutionary whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System” which birthed a $200 billion crypto industry and game-changing blockchain tech and turned the financial world on its head.

The white paper isn’t exactly easy reading, but we’ve digested Nakamoto’s nine-page document into something you can explain to your kids… or your parents. Although it originally had 12 sections, we’ve resolved it into four themes: trusted third parties, the double-spend problem, incentives for miners, and privacy.

Trusted Third Parties

Satoshi Nakamoto explains that the web relies on trusted third parties (such as banks) to process electronic payments. But this approach leads to problems such as reversibility of transactions and high transaction fees. Moreover, the system accepts fraud as inevitable and this imposes costs on everyone.

He argues that there’s a better approach that lets parties transact directly with each other. This can be accomplished by creating a peer-to-peer network where trust is replaced by verification. Transactions would also be irreversible. To secure the network, decentralized computers (i.e., nodes or miners) would provide computational proof of the chronological order of the transactions.

All transactions would be broadcast to the entire network, and everyone would adhere to the same timeline of transactions. This single version of reality (or database) would give users confidence that the electronic records, namely the blockchain, are accurate and valid.

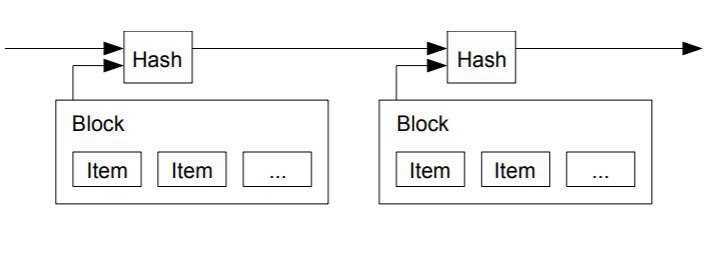

It’s crucial that everyone agrees to the same timeline of events. Thus, a timestamp server would chronologically order the transactions.

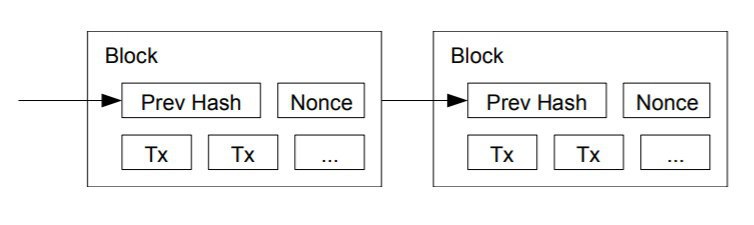

A proof-of-work system would require computing nodes to solve math puzzles, preventing any one party from flooding the system. Nakamoto says it’d be difficult for a hacker to succeed because computers will always look for longer chains (that have already completed proof-of-work) as the valid record. This sequence of block chains makes Bitcoin transactions irreversible.

Double-Spend Problem

Prior to Bitcoin, the double-spend problem prevented organizations from creating electronic currency or e-cash. The problem refers to the possibility of a user spending the same digital token more than once. It would harm a virtual economy if one token can be spent several times because the coin wouldn’t be reliable.

Satoshi Nakamoto proposed ground-breaking solutions that have since revolutionized the digital economy.

First, all transactions must be made public.

Second, everyone in the network must agree to the same timeline — that there be a single version of the order in which transactions are received. For example, sending the same coin to two different merchants wouldn’t work because different timestamps would invalidate the second (double-spend) payment.

In other words, get everyone on the same page whereby each node (miner) can assess that transactions are valid (or not). Everyone should also be on the same timeline so that invalid payments can be prevented and/or discovered by way of unique timestamps.

Nakamoto lists the steps for running the peer-to-peer network: New transactions are broadcast to all computers in the network. Additionally, each computing node processes transactions into a block, forming a blockchain. A block is legitimate only if all transactions in it are valid and not already spent.

Incentives For Miners

Since there is no central authority that distributes bitcoins, incentives for nodes (miners) include rewarding them with bitcoins for maintaining and securing the network. Incentives (new coins) is the mechanism by which bitcoins are brought into circulation.

Satoshi Nakamoto says the above processes add value because of the time and resources expended to make bitcoins possible, similar to gold mining:

The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended ….

“Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.

Bitcoin isn’t free, and it’s also expensive to create. That makes it a usable store of value and medium of exchange over a trustless, peer-to-peer network. Unlike sovereign fiats that are issued by governments and central banks, Bitcoin is inflation-free.

Nakamoto says the network’s reward system encourages nodes to stay honest, and that attackers would have a difficult time tampering with Bitcoin.

[A potential hacker] ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

Privacy

On privacy, the author says that traditional banks achieve privacy by limiting access to information. With Bitcoin, privacy is achieved by keeping public keys anonymous. Outsiders can see sending and receiving amounts between addresses, but transactions are not linked to any identity.

Satoshi Nakamoto ends the whitepaper with a concluding statement.

We have proposed a system for electronic transactions without relying on trust ….

“The network is robust in its unstructured simplicity. Nodes work all at once with little coordination. They do not need to be identified, since messages are not routed to any particular place and only need to be delivered on a best effort basis.

It’s worth repeating this statement because it may reverberate throughout the ages: “The (Bitcoin) network is robust in its unstructured simplicity.”

And that’s under 900 words 🙂

The author holds BTC, which is mentioned in this article.

Earn with Nexo

Earn with Nexo