BlackRock Bitcoin ETF attracts $205 million inflows amid market stagnation

IBIT dominates as competitors face outflows.

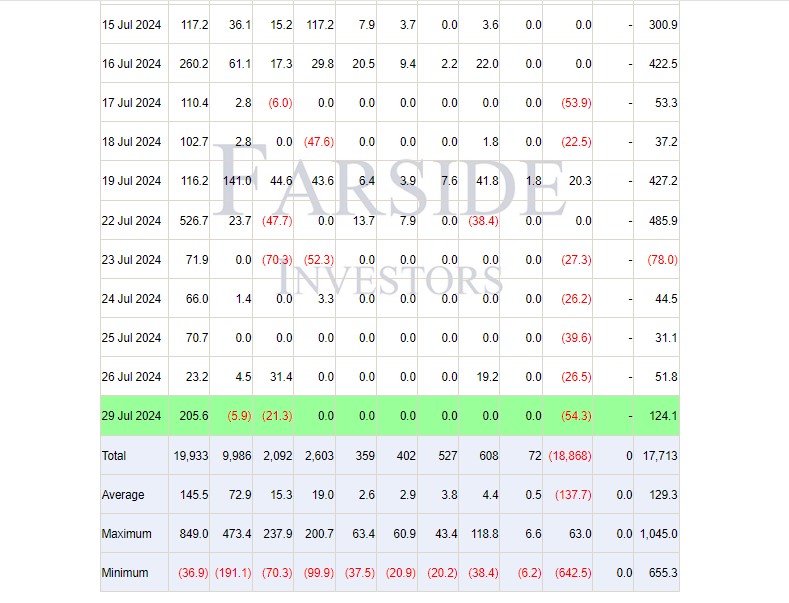

BlackRock’s iShares Bitcoin Trust (IBIT) outperformed its ETF peers on Monday, attracting around $205 million in net inflows while the rest of the market reported either losses or zero net flows, data from Farside Investors shows.

US spot Bitcoin ETFs collectively attracted approximately $124 million in net inflows on Monday, with BlackRock’s IBIT accounting for the entire gain.

In contrast, Grayscale’s GBTC, Bitwise’s BITB, and Fidelity’s FBTC experienced net outflows of $54 million, $21 million, and $6 million, respectively. Other competing funds reported zero inflows.

The Bitcoin ETF market will soon welcome Grayscale’s Bitcoin Mini Trust (BTC), a newly approved mini version of the Grayscale Bitcoin Trust. The spin-off offers a competitive edge with a management fee of 0.15%, significantly lower than the 1.5% charged by GBTC.

Starting July 31, Grayscale will transfer 10% of GBTC’s holdings to the Mini Trust, with GBTC shareholders receiving proportional shares in the new fund. With the new BTC fund, Grayscale aims to provide investors with a lower-cost option to gain exposure to Bitcoin through Grayscale’s investment products.

BTC’s lower fees will position it as a strong competitor in the Bitcoin ETF market. Grayscale’s GBTC, once a dominant player, has lost its edge since being converted to an ETF. As of July 29, GBTC’s assets under management (AUM) were $18.1 billion, outpaced by BlackRock’s IBIT with almost $23 billion in AUM.

BlackRock’s spot Ethereum ETF inflows hit $500 million

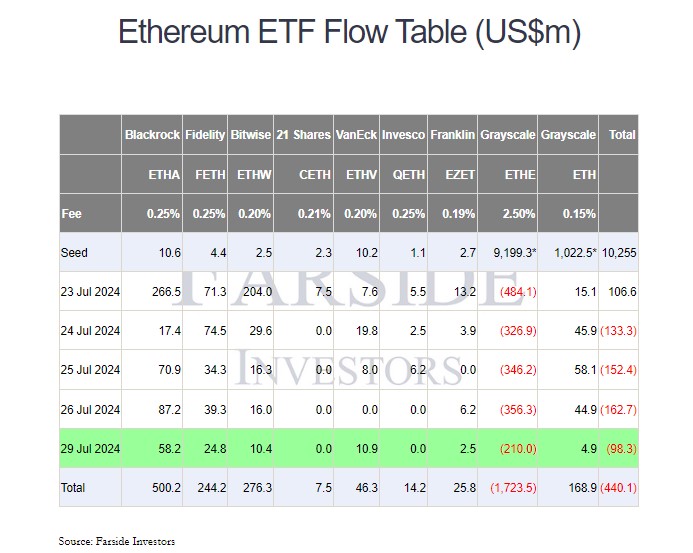

Elsewhere, BlackRock’s iShares Ethereum Trust (ETHA) posted $58 million in net inflows on Monday, bringing the total inflows to $500 million, according to Farside Investors.

After a rough start, US spot Ethereum products have entered their second week of trading as investors prepare for aggressive outflows from Grayscale’s Ethereum ETF (ETHE). With $210 million pulled out of the fund on Monday, ETHE has seen around $1.7 billion drained since it was converted into an ETF.

Apart from BlackRock’s ETHA, the other five Ethereum ETFs that made gains were Fidelity’s FETH, VanEck’s ETHV, Bitwise’s ETHW, Franklin Templeton’s EZET, and Grayscale’s ETH.

Overall, the new Ethereum funds ended Monday with around $98 million in net outflows.