BlackRock’s $200M Coinbase deposit raises concerns over further liquidations

Institutional moves and global tensions spell uncertainty for crypto investors and market stability amid volatile trends.

Today, BlackRock transferred 18,168 Ethereum ($44 million) and 1,800 Bitcoin ($160 million) to Coinbase amid growing market uncertainty and widespread liquidations in crypto markets.

The deposit comes as Bitcoin fell below $86,000 for the first time since November, while crypto markets experienced $1.6 billion in liquidations over the past 24 hours.

Large entities moving significant amounts of crypto to exchanges are often seen as a signal that they may be preparing to sell.

This trend can lead to further price drops, as other investors may interpret such moves as a sign of weakening confidence or an impending decline.

Market pressure intensified following a $500 million Bitcoin ETF sell-off, coupled with renewed tariff threats from President Donald Trump.

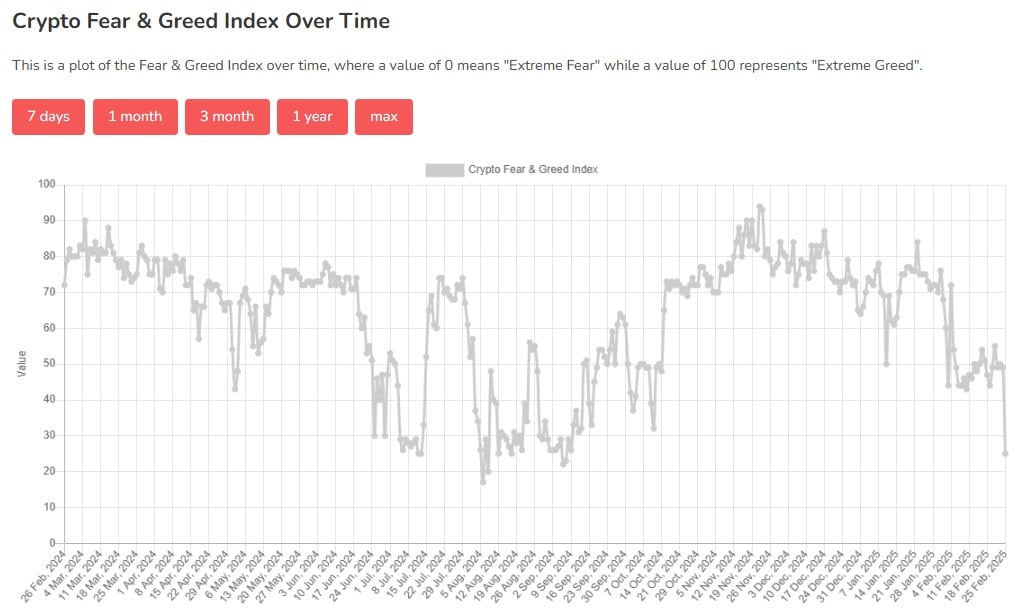

The Crypto Fear and Greed Index dropped to 25, indicating extreme fear and marking its lowest level since September 2024.

Earn with Nexo

Earn with Nexo