Trump’s Treasury Secretary Bessent vows to address regulatory roadblocks to blockchain and stablecoin growth

The pro-innovation and deregulatory approach is part of the second Trump administration’s economic policy.

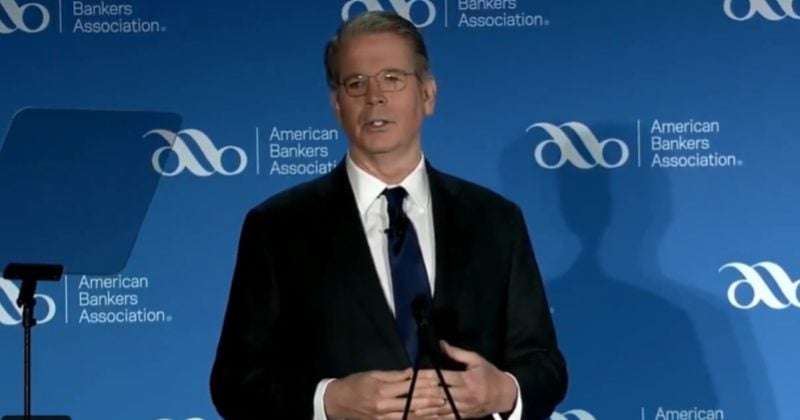

The US Treasury will re-evaluate regulations that may be hindering innovation in blockchain, stablecoins, and emerging payment technologies, said Treasury Secretary Scott Bessent at the American Bankers Association conference on Wednesday.

🇺🇸 JUST IN: Treasury Secretary Scott Bessent says the US government is reviewing “regulatory barriers to blockchain, stablecoins, and emerging payment systems.” pic.twitter.com/G0dctlPSIC

— Crypto Briefing (@Crypto_Briefing) April 9, 2025

The review potentially leads to removal or modification of the current measures as part of the Trump administration’s ongoing efforts to encourage innovation, investment, and competitiveness, especially in fintech and crypto-related areas.

“We will take a close look at regulatory impediments to blockchain, stablecoins, and new payment systems,” Bessent asserted. “And we will consider reforms to unleash the awesome power of the American capital markets.”

One of the key priorities of the current administration is to stimulate economic growth through aggressive deregulation efforts aimed at reducing government oversight and regulatory burdens across industries.

The goal is to create a more balanced regulatory environment that fosters economic growth and benefits “Main Street,” not just Wall Street, according to the Treasury Secretary.

“Americans deserve a financial services industry that works for all Americans, including and especially Main Street,” Bessent added. “Under President Trump’s leadership, the Treasury Department and I will deliver that to you.”

Mark Uyeda, the acting chair of the US SEC, has recently instructed staff to review regulatory statements concerning crypto, including digital asset investment contract analysis and Bitcoin futures under the Investment Company Act.

The move aligns with Executive Order 14192, which aims to reduce regulatory burdens and encourage economic growth by potentially modifying or rescinding certain SEC rules. These reviews could lead to more streamlined regulations for crypto companies.