Shutterstock cover by Orla

BNB Targets $520 Following Binance Bridge 2.0 Launch

BNB Chain will host all Ethereum-native tokens with the new Binance Bridge 2.0.

Binance Bridge 2.0 is set to make all Ethereum-native tokens operational on the BNB Chain. The update could increase the utility of the BNB token.

Binance Bridge 2.0 Goes Live

BNB Chain’s utility could see a big expansion following the blockchain’s Binance Bridge 2.0 rollout.

Binance Bridge 2.0 launched on Mar. 29, allowing users to bridge assets from Ethereum to BNB Chain. The cross-chain bridge supports all assets listed on Binance, and those that are unlisted are supported as wrapped BTokens, which can be converted to the original asset at any time. One of the main benefits is that all assets can be stored in Binance without the need for creating third-party wallets.

In launching the update, BNB Chain is hoping to make DeFi activities more accessible by offering access to a faster, cheaper alternative to Ethereum, which is known for its high gas fees. All Ethereum-native tokens can now run on BNB Chain and can be traded at low costs on PancakeSwap.

As the new cross-chain bridge aims to improve BNB Chain’s interoperability, BNB could be positioning itself for a bullish impulse. The token has risen by more than 20% over the past week and appears to have more room to rise.

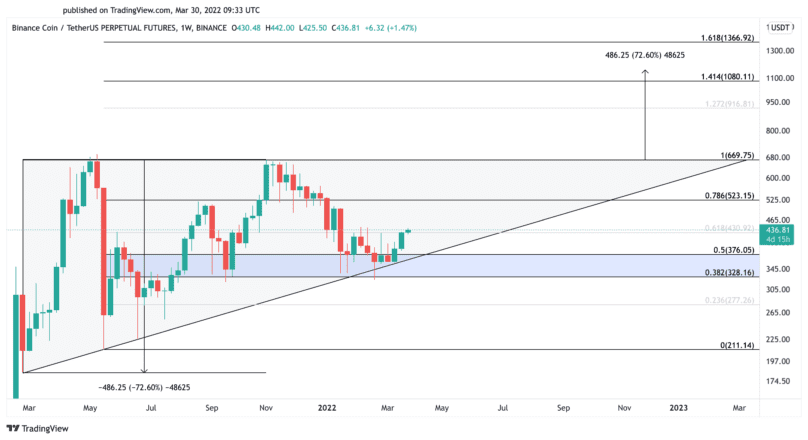

From a technical perspective, BNB appears to have rebounded from the hypotenuse of an ascending triangle that developed on its weekly chart over the past year. Further buying pressure could push prices to the $523 resistance level or the triangle’s X-axis at nearly $670.

If BNB breaks out of the triangle, it could see a 73% upswing to $1,200.

While BNB continues to trade below $670, prices could continue to consolidate within the ascending triangle. Breaching the $376 support level could invalidate the bullish thesis and result in a steep correction to $211.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.