Someone burned 500 ETH to accuse Chinese hedge fund CEOs of using brain-computer weapons

Allegations of mind control tech spark a crypto donation spree amid intrigue in Chinese finance circles.

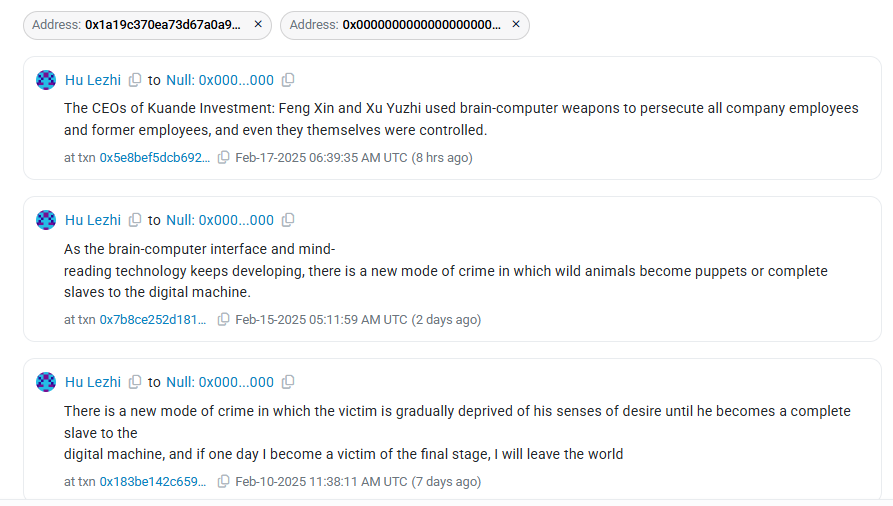

A self-identified Chinese programmer has burned 603 ETH (approximately $1.65 million) and donated 1,950 ETH (approximately $5.35 million) through a series of blockchain transactions, while making allegations against executives of a Chinese hedge fund.

Someone just sent 500 ETH to the burn address with this message (translated):

"The CEOs of Kuande Investment: Feng Xin and Xu Yuzhi used brain-computer weapons to persecute all company employees and former employees, and even they themselves were controlled." pic.twitter.com/5p01PAXXer

— sassal.eth/acc 🦇🔊 (@sassal0x) February 17, 2025

The individual, identifying as Hu Lezhi, sent multiple on-chain messages accusing Kuande Investment CEOs Feng Xin and Xu Yuzhi of using what they termed “brain-computer weapons” against employees and former employees.

Kuande Investment, also known as WizardQuant, is a hedge fund specializing in quantitative trading.

The donations included 711.52 ETH ($1.97 million) to a WikiLeaks donation address and 700 ETH ($1.94 million) to a Ukraine donation address. Additional donations totaling 1,238 ETH ($3.4 million) were sent to various other addresses.

The transactions occurred over several days, with the largest burn of 500 ETH ($1.38 million) taking place today.

The burned ETH was sent to an Ethereum null address, permanently removing the funds from circulation.

The donations were funded through wallets tagged as originating from OKX and Binance.

The company’s CEO, Feng Xin, who holds a PhD in Statistics from Columbia University, serves as Co-Founder and Chief Risk Officer, while Xu Yuzhi, with a background in mathematics from Renmin University of China, serves as Chief Investment Officer.

The incident has sparked community reaction on social media platforms, with crypto users investigating the sender’s wallet activity. Solana-based meme coins emerged in response to the events.