Canary Capital registers SUI ETF in Delaware

The firm seeks to launch the first investment product that holds SUI.

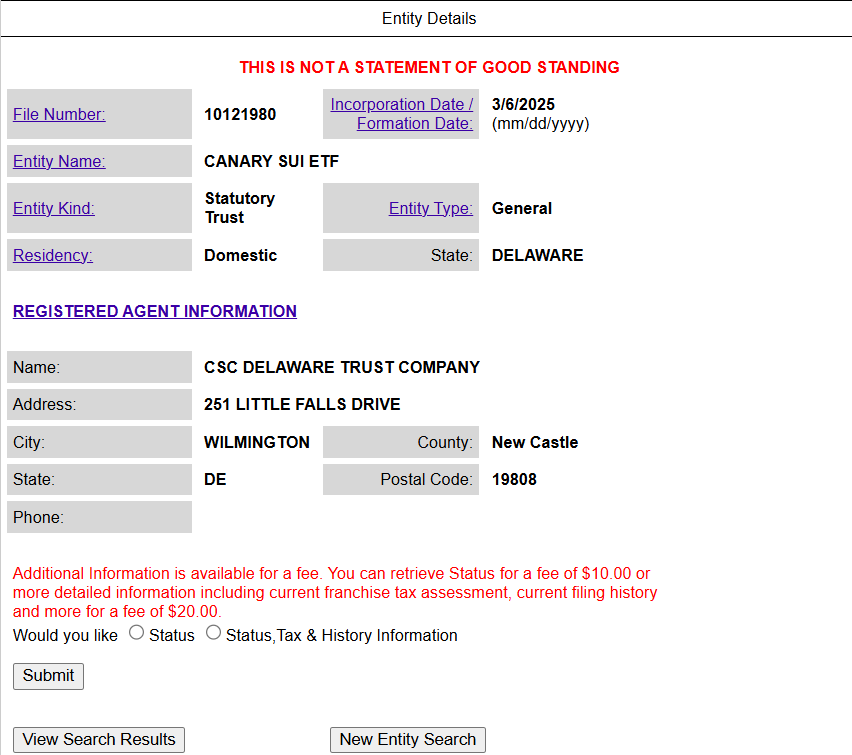

Canary Capital has filed to establish a trust entity in Delaware for its proposed Canary SUI ETF—a move that signals a potential SEC submission for regulatory approval.

The move comes after World Liberty Financial announced its partnership with the Sui blockchain, with plans to add the project’s native crypto asset, SUI, to its strategic reserve fund “Macro Strategy.”

SUI jumped over 10% to $3 following the collaboration announcement. The digital asset, however, did not immediately react to the Canary SUI ETF news.

Canary Capital and Grayscale Investments have emerged as the most active asset managers in the push for altcoin investment vehicles. In addition to SUI-based ETF, Canary also aims for funds that track other digital assets like Litecoin (LTC), XRP, Solana (SOL), and Hedera Hashgraph (HBAR).

On Wednesday, Canary Capital filed an S-1 registration with the SEC for the Canary AXL ETF, which focuses on the AXL token powering the Axelar Network.

Once a SEC filing is confirmed, Canary Capital will officially become the first asset manager to propose a Sui-based ETF in the US.