Canary Capital files S-1 for staked Cronos ETF as SEC softens stance on staking

In addition to tracking the price of CRO, the fund aims to earn extra tokens through on-chain staking.

Asset manager Canary Capital has filed a Form S-1 registration statement with the SEC to launch the Canary Staked CRO ETF, a new investment product designed to track the spot price of Cronos (CRO) while earning additional CRO through staking.

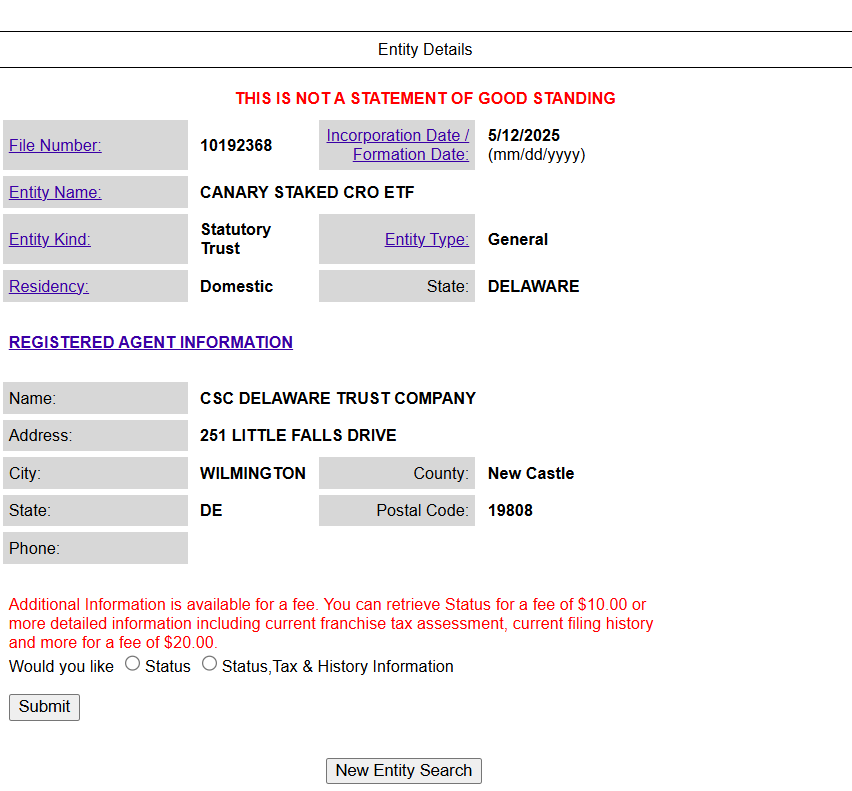

The official SEC filing follows Canary Capital’s registration of a trust entity in Delaware earlier this month, a step that typically signals an imminent formal submission to the SEC.

CRO held by the Trust will be custodied by Foris DAX Trust Company, doing business as Crypto.com Custody Trust Company, while all staking activities will be performed through validated infrastructure providers, as noted in the filing. Any staked CRO will be subject to a 28-day mandatory unbonding period during which it cannot be transferred or withdrawn.

The firm will charge an annual unified fee, though the percentage remains undisclosed. The fund’s ticker symbol is also currently unavailable.

“ETFs have been an effective means for broadening investor participation in crypto and further integrating digital and traditional finance capabilities,” said Eric Anziani, President and COO of Crypto.com, in a Friday statement. “We are tremendously excited to see this important step being taken in building towards all investors in the U.S. having the opportunity to engage with CRO through an ETF with Canary Capital.”

Launching a Cronos ETF is part of Crypto.com’s strategy to expand its platform offerings in 2025, which also includes plans to introduce a stablecoin. The exchange is targeting both retail and institutional investors, reflecting the growing mainstream acceptance of crypto ETFs, particularly in the US.

Last month, Crypto.com and Trump Media & Technology Group announced a partnership to launch “America-first” ETFs linked to digital assets such as Bitcoin and Cronos, with Foris Capital US reportedly responsible for distributing the funds.

If approved, Canary Capital’s proposed fund would become the first-ever spot Cronos ETF in the US.

In addition to the proposed Cronos ETF, Canary Capital is pursuing SEC approval for several staking-enabled crypto ETFs, including the Canary Staked TRX ETF, which follows TRON’s price, and the Staked SEI ETF, which provides direct exposure to SEI tokens from the Sei Network.

SEC staff on Thursday issued a statement clarifying that most crypto staking activities on proof-of-stake blockchains do not fall under US securities laws.

The guidance outlines staking rewards as compensation for services provided by node operators rather than profits from entrepreneurs, and it states that custodial and ancillary services related to staking are not securities offerings.