Shutterstock cover by Tomas Kotouc

Cardano Faces Critical Resistance After Whale Frenzy

Cardano could soon be ready to break out as market participants add more tokens to their holdings.

Cardano has reached a critical resistance barrier after making significant gains over the last few days. While buying pressure mounts, ADA could be on the brink of a significant breakout.

Cardano Primed to Advance Further

Cardano has rallied by nearly 18% in the last two days after buying pressure spiked.

Large investors appear to be rushing to add more ADA to their portfolios. Santiment’s holder distribution chart shows that a high number of buy orders have been filled over the last 48 hours. The behavioral analytics firm has recorded a significant increase in the holdings of medium-sized Cardano whales.

Addresses holding between 100,000 and 1 million ADA have added more than 16 million tokens to their holdings since Feb. 27. The sudden spike in upward pressure equates to millions of dollars. If the buying spree continues, Cardano may have the ability to advance further and post more significant gains.

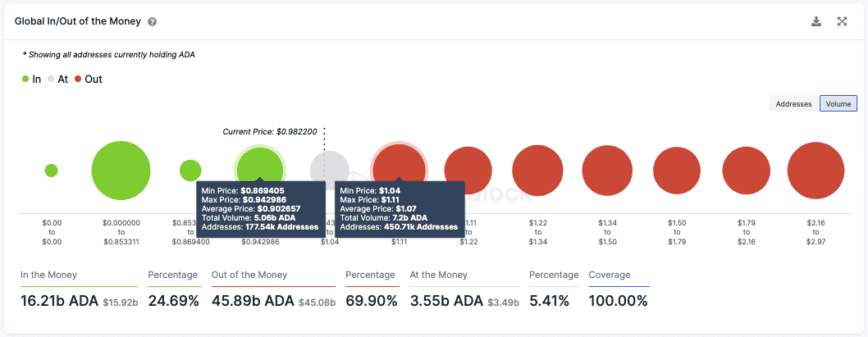

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model estimates that $1.10 plays a crucial role in Cardano’s trend. Transaction history shows that it is one of Cardano’s biggest supply barriers. Here, more than 450,000 addresses have previously purchased over 7.2 billion ADA.

The critical resistance wall could absorb some of the recent buying pressure. That said, if Cardano manages to slice through it, prices could advance toward the next important hurdle at $1.34.

Although Cardano has performed well over the last few days, it must remain trading above $0.90. Failing to hold this level as support could generate panic among investors and potentially trigger a sell-off. In this eventuality, ADA could dive to $0.85 or even $0.50.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Earn with Nexo

Earn with Nexo