Shutterstock cover by Gennadiy Naumov

Cardano Looks Poised to Break Out, $2.80 in Target

Cardano could be ready to rally after enduring a month-long consolidation period.

Cardano looks like it’s ready to enter a new uptrend after breaking out of a consolidation pattern, fueled by strong fundamentals and rising buying pressure.

Cardano Ready to Surge

Cardano looks primed to make a run after overcoming a significant resistance barrier.

It appears that Adana’s new partnership with Elrond could have encouraged investors to jump back into the market. Cardano’s decentralized stablecoin hub aims to make EGLD one of the first cross-chain assets to collateralize stablecoins on the platform by bridging both ecosystems. The goal is to enable interoperable token transfers and cross-chain smart contract functionality.

As the utility of the Cardano network expands, ADA appears ready to advance higher. The fourth-largest cryptocurrency by market cap appears to have broken out of a symmetrical triangle on its four-hour chart.

Although Cardano has surged nearly 6% since the breakout occurred, it still has more room to rise. The height of the triangle’s y-axis suggests that ADA could surge by another 19% from the recent high to reach a target of $2.83.

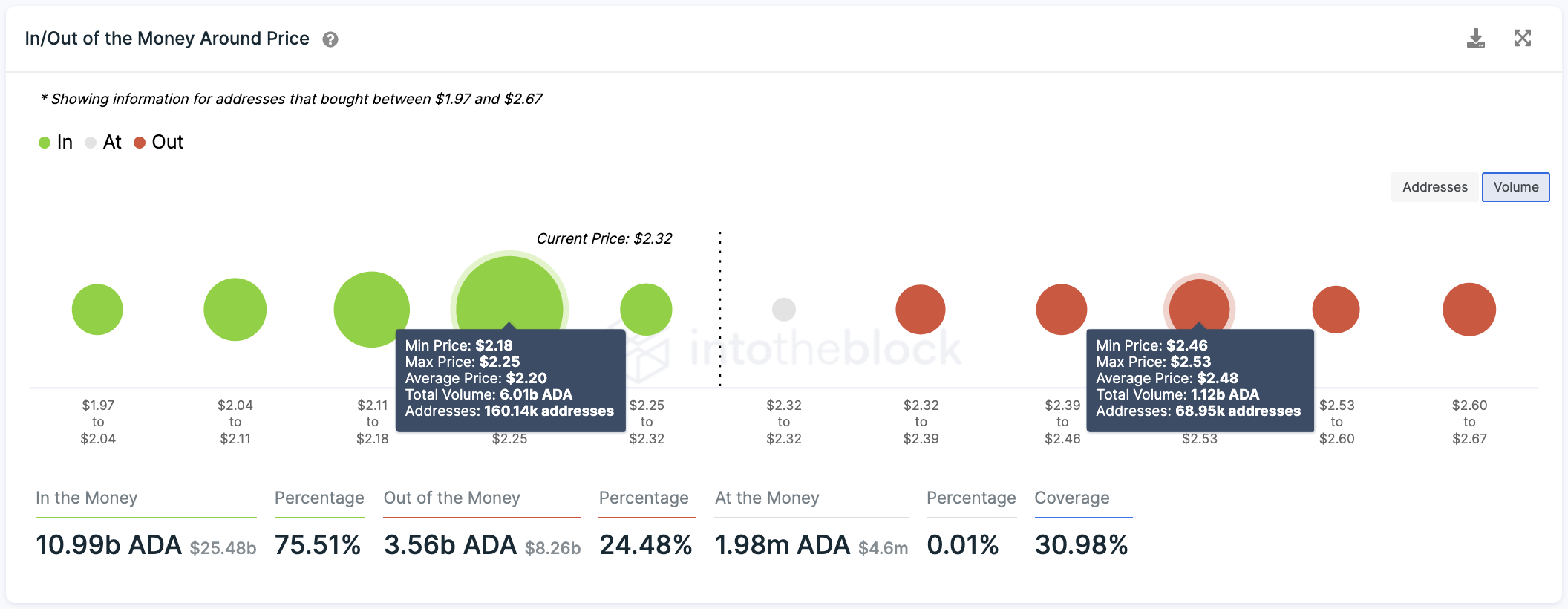

Cardano’s transaction history shows that the asset faces no significant resistance ahead that could prevent it from achieving its upside potential. The only considerable supply zone ahead sits between $2.46 and $2.53, where nearly 70,000 addresses have previously purchased 1.12 billion ADA.

Once this level is cleared, prices could make higher highs.

It is worth noting that Cardano sits on top of stable support as more than 160,000 addresses bought 6 billion ADA at an average price of $2.20. The odds are likely to continue to favor the bulls as long as this demand barrier holds.

Still, a sudden downswing below $2.20 could lead to panic selling, pushing prices to $1.90.

Earn with Nexo

Earn with Nexo