Cboe files 19b-4 form for XRP spot ETF from Franklin Templeton

The fund management giant looks to expand its crypto offerings.

The Chicago Board Options BZX Exchange (CBOE) has submitted a 19b-4 form on behalf of Franklin Templeton, proposing a rule change to list and trade shares of the Franklin XRP ETF in the US.

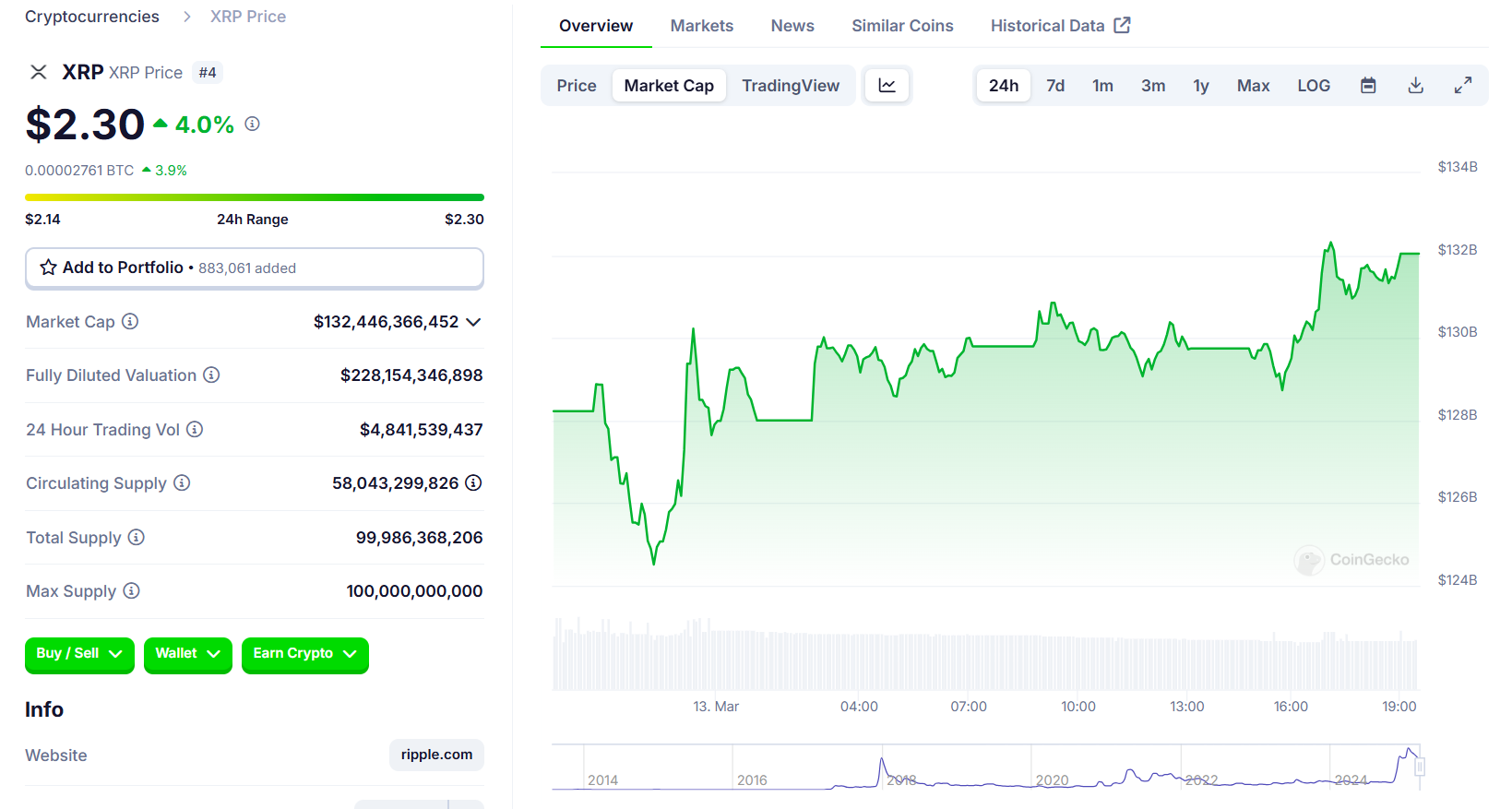

The filing came shortly after Franklin filed an S-1 registration form with the SEC for its proposed investment product focused on XRP, the fourth-largest crypto asset by market capitalization. The digital asset surged 2% to $2.3 after the SEC filing surfaced, according to CoinGecko data.

The Wall Street giant, managing around $1.5 trillion in client assets, has joined a growing lineup of major fund managers seeking approval for ETFs tied to crypto assets beyond Bitcoin and Ethereum.

In addition to XRP, Solana (SOL), Dogecoin (DOGE), Cardano (ADA), Litecoin (LTC), and Hedera (HBAR) are also in the spotlight. Cboe on Wednesday filed a 19b-4 form to list Franklin’s spot Solana ETF.

Diversification as 2025’s theme

Roger Bayston, who leads Franklin’s digital asset strategy, told Blockworks in January that the firm planned to expand its crypto offerings, including more ETFs. The firm’s 2025 strategy centers on diversification, with a focus on assessing various crypto assets beyond Bitcoin and Ethereum for potential ETF products.

The proposed Franklin XRP ETF will trade on the Cboe BZX Exchange with Coinbase Custody serving as the custodian for its XRP holdings. The fund aims to track XRP’s price performance, offering investors exposure to the digital asset without requiring direct custody.

Other asset managers awaiting regulatory approval for XRP ETF proposals include Bitwise, 21Shares, Canary Capital, Grayscale, CoinShares, and WisdomTree. Filings from these firms have already been acknowledged by the SEC.

The securities regulator has extended the decision timeline for several crypto ETF applications.

Despite this, Bloomberg ETF analyst James Seyffart noted that delays are standard procedure. He remained strongly optimistic that these ETFs would eventually get the SEC’s nod.

Earn with Nexo

Earn with Nexo