Coinbase Wrapped Bitcoin hits $100M market cap

Nansen CEO notes Coinbase holds 36% of cbBTC supply, Wintermute is among top holders.

Coinbase’s new wrapped Bitcoin token, cbBTC, has reached a market capitalization of $100 million following its debut on Ethereum and Base, according to data from Dune Analytics.

Coinbase Wrapped Bitcoin now has a circulating supply of 1,720 tokens, with about 42% on Base and around 58% on Ethereum, data shows.

Launched on Thursday, cbBTC is part of Coinbase’s ongoing efforts to enhance Bitcoin’s utility in DeFi applications. The new token competes directly with BitGo’s WBTC, which is currently the most widely used DeFi-compatible version of Bitcoin.

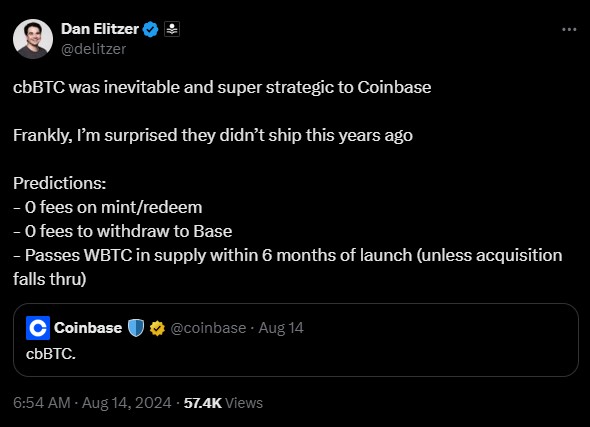

In a statement following Coinbase’s hint at the wrapped Bitcoin launch, Dan Elitzer, co-founder of Nascent, suggested that cbBTC would be a strategic move for Coinbase. Elitzer predicted it could surpass BitGo’s WBTC supply within six months.

At launch, Coinbase’s new token also received positive feedback from industry experts, particularly for its potential to boost DeFi activities on Base, Coinbase’s layer 2 network.

Moonwell’s DeFi contributor Luke Youngblood stated that the fungibility of cbBTC on Coinbase will enable retail and institutional holdings of Bitcoin to seamlessly integrate with its on-chain ecosystem.

Nansen CEO Alex Svanevik noted Coinbase currently holds about 36% of the supply, while market maker Wintermute is among the top holders. Svanevik predicted the token would substantially increase Base’s total assets through its rapid adoption.

“This could explode total assets on [Base] pretty rapidly,” Svanevik stated. “Smart move. Looks like Wintermute is the #1 market maker for it. Will be a solid business for them.”

However, not everyone is convinced. TRON founder Justin Sun expressed skepticism about the token’s lack of Proof of Reserve audits and the potential for government intervention. He argued that cbBTC could pose security risks to DeFi protocols and undermine decentralization.

“…integrating cbbtc will pose major security risks to decentralized finance. A single government subpoena could freeze on-chain Bitcoin instantly, making decentralization a joke,” Sun noted.